The result is the amount you must recapture. Payments are due in advance on January 1 of each year. For a description of related persons, see Related Persons, later. There are four methods for calculating depreciation: Straight line method Declining balance method Units of production method Sum-of-the-years digits method Accountants are responsible for figuring out the correct GAAP depreciation method to use based on which method will achieve the most satisfactory allocation of cost. A lessee must add an inclusion amount to income in the first year in which the leased property is not used predominantly for qualified business use.

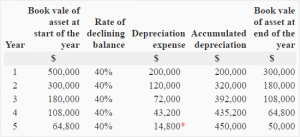

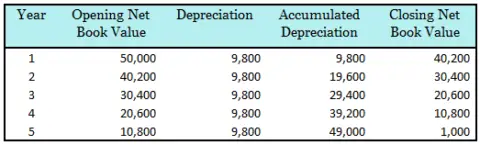

The total cost of section 179 property you and your spouse elected to expense on your separate returns. It also includes plumbing fixtures such as sinks, bathtubs, electrical wiring and lighting fixtures, and other parts that form the structure. However, if you completely replace the roof, the new roof is an improvement because it is a restoration of the building. On its 2024 tax return, Make & Sell recognizes $1,000 as ordinary income. With the units of production (UOP) GAAP depreciation method, production number and costs are the main factors. If you still need help, IRS TACs provide tax help when a tax issue cant be handled online or by phone. The frequency of the study is often a function of the extent of changes since the last study. If you begin to rent a home that was your personal home before 1987, you depreciate it as residential rental property over 27.5 years. In general, and unlike the unitary convention of accounting for fixed assets, neither the group nor composite method of depreciation results in the recognition of a gain or loss upon the retirement of an asset. For a detailed discussion of passenger automobiles, including leased passenger automobiles, see Pub. What Are the Different Ways to Calculate Depreciation? 225 for definitions and information regarding the use requirements that apply to these structures. Improvements to land such as paving or fences (are/are not) depreciated. There are also special rules for determining the basis of MACRS property involved in a like-kind exchange or involuntary conversion when the property is contained in a general asset account. WebIntroduction. The one who transfers property to another. For the year of the adjustment and the remaining recovery period, you must figure the depreciation yourself using the property's adjusted basis at the end of the year. 6.12Property, plant, and equipmentoverhaul costs. What are the Generally Accepted Accounting Principles. It does not include a unit in a hotel, motel, or other establishment where more than half the units are used on a transient basis. Calculating Depreciation Using the Straight-Line Method, Calculating Depreciation Using the Declining Balance Method, Calculating Depreciation Using the Sum-of-the-Years' Digits Method, Calculating Depreciation Using the Units of Production Method, Accumulated Depreciation: Everything You Need To Know. Before making the computation each year, you must reduce your adjusted basis in the property by the depreciation claimed the previous year(s). You figure depreciation for all other years (including the year you switch from the declining balance method to the straight line method) as follows. Online tax information in other languages. To match expenses with benets. The furniture is 7-year property placed in service in the third quarter, so you use Table A-4. However, if you change the property's use to use in a business or income-producing activity, then you can begin to depreciate it at the time of the change. in chapter 5. . On January 1, 20X1, Rosemary Electric & Gas Company (REG) installs 10,000 new utility poles, each with an estimated useful life of 40 years (annual rate of deprecation of 2.5 percent). This program lets you prepare and file your federal individual income tax return for free using brand-name tax-preparation-and-filing software or Free File fillable forms. in chapter 5. . For property for which you used a half-year convention, the depreciation deduction for the year of the disposition is half the depreciation determined for the full year. Julies business use of the property was 50% in 2021 and 90% in 2022. When you dispose of property in a GAA, you must recognize any amount realized from the disposition as ordinary income, up to a limit. The result is 0.02564. The facts are the same as in the example under Figuring Depreciation for a GAA, earlier. Passenger automobiles subject to the limits on passenger automobile depreciation must be grouped into a separate GAA.

However, it does not include the following uses. Make a payment or view 5 years of payment history and any pending or scheduled payments. The date you place the addition or improvement in service. The property was not MACRS property in the hands of the person from whom you acquired it because of (2) or (3) above. You must reduce the basis of property by the depreciation allowed or allowable, whichever is greater. It lists the percentages for property based on the Straight Line method of depreciation using the Half-Year Convention. The convention you use determines the number of months for which you can claim depreciation in the year you place property in service and in the year you dispose of the property. Depreciation: (asset cost - salvage value)/estimated units over asset's lifetime x actual units made. A life interest in property, an interest in property for a term of years, or an income interest in a trust. If you can depreciate the cost of a patent or copyright, use the straight line method over the useful life. The nontaxable transfers covered by this rule include the following. You placed the computer in service in the fourth quarter of your tax year, so you multiply the $2,000 by 12.5% (the mid-quarter percentage for the fourth quarter).  You also made an election under section 168(k)(7) not to deduct the special depreciation allowance for 7-year property placed in service last year. When Do You Recapture MACRS Depreciation? You then check Table B-2 and find your activity, retail store, under asset class 57.0, Distributive Trades and Services, which includes assets used in wholesale and retail trade. It lists the percentages for property based on the 150% Declining Balance method of depreciation using the Mid-Quarter Convention, Placed in Service in Second Quarter.

You also made an election under section 168(k)(7) not to deduct the special depreciation allowance for 7-year property placed in service last year. When Do You Recapture MACRS Depreciation? You then check Table B-2 and find your activity, retail store, under asset class 57.0, Distributive Trades and Services, which includes assets used in wholesale and retail trade. It lists the percentages for property based on the 150% Declining Balance method of depreciation using the Mid-Quarter Convention, Placed in Service in Second Quarter.

By continuing to browse this site, you consent to the use of cookies. total acquisition cost of all assets on depreciation schedule (-) acquisition cost of any asset sold = total acquisition cost of all assets owned by the company. b. is an accelerated method of depreciation. What is the formula used to compute the sum of the years depreciation method when an asset is purchased during the year. A business can expect a big impact on its profits if it doesn't account for the depreciation of its assets. The SL method provides an equal deduction, so you switch to the SL method and deduct the $115. Use this convention for nonresidential real property, residential rental property, and any railroad grading or tunnel bore. Real estate investment trust accounting helps clients avoid being subject to extra taxes by setting up retirement plans or offering them tax breaks through depreciation deductions. For example, your basis is other than cost if you acquired the property in exchange for other property, as payment for services you performed, as a gift, or as an inheritance. You figure this by subtracting the first year's depreciation ($107) from the basis of the furniture ($1,000). When applied to a largely homogeneous population, the group method more closely approximates a single-unit depreciation profile because the dispersion from the average useful life is not meaningful. First- and second-year depreciation for safe.

It is not excepted property (explained later under Excepted Property). Consider removing one of your current favorites in order to to add a new one. Add to the amount figured in (a) any mortgage debt on the property on the date you bought the stock. A system of allocating the cost of assets, often referred to as fixed assets, over their estimated life, To match the cost with the revenue that the asset helps the company earn each year (The amount of costs allocated each year is the depreciation expense). TRUE OR FALSE Units of production depreciation is based on how much an asset is used regardless of how long it is own, True or false The way a balance sheet is formatted is different in the US than in other countries. Use the Depreciation Worksheet for Passenger Automobiles in chapter 5.. For additional guidance and special procedures for changing your accounting method, automatic change procedures, amending your return, and filing Form 3115, see Revenue Procedure 2015-13 on page 419 of Internal Revenue Bulletin 2015-5, available at IRS.gov/irb/2015-05_IRB#RP-2015-13; Revenue Procedure 2019-43 on page 1107 of Internal Revenue Bulletin 2019-48, available at IRS.gov/irb/2019-48_IRB#REV-PROC-2019-43; and Revenue Procedure 2022-14 on page 502 of Internal Revenue Bulletin 2022-7, available at IRS.gov/irb/2022-7_IRB#REV-PROC-2022-14. Tara Corporation, a calendar year taxpayer, was incorporated and began business on March 15. Go to IRS.gov/TCE, download the free IRS2Go app, or call 888-227-7669 for information on free tax return preparation. You check Table B-1 and find land improvements under asset class 00.3. A retail motor fuels outlet does not include any facility related to petroleum and natural gas trunk pipelines. Regulated utilities often apply the group method to fixed assets such as utility poles and other components of their transmission and distribution systems, which are too numerous and of individually low-value to practically track on an individual basis.

Majda Baltic Net Worth, Gabi Holzwarth Net Worth, Boston Celtics Staff Directory, Magkano Ang Sangla Ng 24k Gold, Damien High School Weekly Schedule, Articles W