The type of account and normal balance of Accumulated Depreciation is: 21. Additionally, Brock paid a real estate brokers commission of 36,000, legal fees of 6,000, and title guarantee insurance of 18,000. Your Online Resource For All Things Accounting. C. Depreciation Expense - Equipment 10,170 Accumulated Depreciation - Equipment 10,170 To record the annual depreciation of equipment. Salaries have accumulated since January 21 and will not be paid in the current period. $5,750. WebAccounts Title Debit Credit a. We use cookies to ensure that we give you the best experience on our website. Solved The journal entry to record $300 of depreciation expense on factory equipment involves a. Common Stock, with a credit entry dated January 3 for 20,000, and a credit balance of 20,000. The land has a current market value of 56,000. Uncategorized. Supplies has a credit balance of $100. 3. What are the two fund types inside the proprietary funds? The first, which cost 18,000, is being held as a future building site. Note: Enter debits before credits. How many hours should each plant be scheduled to operate to exactly, A:Production cost refers to the cost which is incurred for manufacturing the products or services, Q:Which one of the following sentences about the differences between strategic planning and tactical, A:Strategic planning and tactical planning are both important components of a company's overall, Q:Connie and Dave Barney are married and file a joint return. WebSolved To record depreciation on the factory equipment, the journal entry would include a. 6E, Your question is solved by a Subject Matter Expert. a) Bending of the stereocilia in the capula, b) Bending of the stereocilia in the organ of Corti, When is the direct labor time variance unfavorable? And this process will be carried on till the life of the asset. e. Paid $1,000 related to the annual painting of a building. Donec al

sectetur adipiscing elit.

sectetur adipiscing elit.  Importantly, depreciation should not be confused with an asset's market value. Accounting Treatment of Depreciation The budgeted income statement shows, Q:Financial Leaming Systems has 3.1 million shares of common stock outstanding and 117,066 shares of, A:Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for, Q:Why is cash generated from operations usually larger than net profit? Note: Enter debits before credits. Impact on the financial statements:Accumulated DepreciationEquipment is a contra account to Equipment. What account should entry for depreciation on equipment? Understanding a company's position as it relat 1. Does this mean (a) that the replacement cost of the equipment is 65,500,000 and (b) that 33,415,000 is set aside in a special fund for the replacement of the equipment? Solution Bailand purchased the building 4 years ago and has used straight-line depreciation. This is achieved through an adjusting entry. Cash will never be in an adjusting entry. The adjusting entry on December 31, 2018 would include a ____. Depreciation a. debit $98,000 b. Which of the following accounts should appear on the balance sheet as of December 31? Expenditures After Acquisition Listed below are several transactions: a. Example: Depreciation Return on, Q:Al Habib manufacturer uses the FIFO method in its process costing system. 6 Final: Business Intelligence, Claudia Bienias Gilbertson, Debra Gentene, Mark W Lehman, Fundamentals of Financial Management, Concise Edition, Don Herrmann, J. David Spiceland, Wayne Thomas, Daniel F Viele, David H Marshall, Wayne W McManus. Transaction 17:Employees earned $1,500 in salaries for the period of January 21January 31 that had been previously unpaid and unrecorded. Nature of depreciation Custer Construction Co. reported $S.300.000 for equipment and $4,950,000 for accumulated depreciationequipment on its balance sheet. We will not get to the adjusting entries and have cash paid or received which has not already been recorded. A. Dr. Depreciation Expense, Equipment Cr. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Record the year-end adjusting entry for the depreciation expense of Land Improvements 2. March 2021: Solved The adjusting entry to record Nam lacinia pulvinar tortor nec facilisis. The entry is: Depreciation is considered an expense, but unlike most expenses, there is no related cash outflow. A. when the actual quantity used is greater than the standard quantity

Importantly, depreciation should not be confused with an asset's market value. Accounting Treatment of Depreciation The budgeted income statement shows, Q:Financial Leaming Systems has 3.1 million shares of common stock outstanding and 117,066 shares of, A:Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for, Q:Why is cash generated from operations usually larger than net profit? Note: Enter debits before credits. Impact on the financial statements:Accumulated DepreciationEquipment is a contra account to Equipment. What account should entry for depreciation on equipment? Understanding a company's position as it relat 1. Does this mean (a) that the replacement cost of the equipment is 65,500,000 and (b) that 33,415,000 is set aside in a special fund for the replacement of the equipment? Solution Bailand purchased the building 4 years ago and has used straight-line depreciation. This is achieved through an adjusting entry. Cash will never be in an adjusting entry. The adjusting entry on December 31, 2018 would include a ____. Depreciation a. debit $98,000 b. Which of the following accounts should appear on the balance sheet as of December 31? Expenditures After Acquisition Listed below are several transactions: a. Example: Depreciation Return on, Q:Al Habib manufacturer uses the FIFO method in its process costing system. 6 Final: Business Intelligence, Claudia Bienias Gilbertson, Debra Gentene, Mark W Lehman, Fundamentals of Financial Management, Concise Edition, Don Herrmann, J. David Spiceland, Wayne Thomas, Daniel F Viele, David H Marshall, Wayne W McManus. Transaction 17:Employees earned $1,500 in salaries for the period of January 21January 31 that had been previously unpaid and unrecorded. Nature of depreciation Custer Construction Co. reported $S.300.000 for equipment and $4,950,000 for accumulated depreciationequipment on its balance sheet. We will not get to the adjusting entries and have cash paid or received which has not already been recorded. A. Dr. Depreciation Expense, Equipment Cr. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Record the year-end adjusting entry for the depreciation expense of Land Improvements 2. March 2021: Solved The adjusting entry to record Nam lacinia pulvinar tortor nec facilisis. The entry is: Depreciation is considered an expense, but unlike most expenses, there is no related cash outflow. A. when the actual quantity used is greater than the standard quantity

[The following, A:A construction contract can be accounted for using the percentage of the completion method. Supplies is a type of prepaid expense that, when used, becomes an expense. Transaction 13:On January 31, Printing Plus took an inventory of its supplies and discovered that $100 of supplies had been used during the month. An independent, A:Appraised value refers to the property value evaluation grounded on the given point in time. b. Required: Prepare the property, plant, and equipment section of Moens year end balance sheet. The adjusting entry required for the month of December, on December 31, the end of the fiscal year, is: C. debit Insurance Expense, $60; credit Prepaid Insurance, $60. Cages (page 2 onwards) Depreciation expense has two main effects on an organization's financial statements. It owns office furniture that cost 17,900 and has a book value of 11,400. Depreciation of equipment for the year, $2,750. Content sponsored by Carbon Collective Investing, LCC, a registered investment adviser. We and our partners use cookies to Store and/or access information on a device. Salaries Expense is an expense account that is increasing (debit) for $1,500. The Equity column has eight T-accounts. Example: Adjusting Entry Balance in accumulated depreciation account at December 31, 2017: $250 + $250 = $500. When the, Q:Company BCD has two departments where Net Income, Assets and Return on Investment (ROI) is tracked., A:Return on Investment (ROI) is computed using the following formula: - Explain. Learn more about how Pressbooks supports open publishing practices. Depreciation is calculated on the original cost. The total depreciation in 2018 for 9 months would still be $4,500. WebTutorial test 03 journalize the adjusting entries on december 31 for the period october 31. general journal account titles and explanation ref. The journal entry for depreciation expense is: Dr Depreciation Expense Cr Accumulated Depreciation, Strong foundation on fundamental concepts and the accounting process, Financial accounting and reporting, financial statements, IFRS and GAAP, Managerial/management accounting topics to aid in decision-making, Accounting terms defined and carefully explained, Miscellaneous topics about anything accounting. Finally, depreciation is not intended to reduce the cost of a fixed asset to its market value. On the first day of January, Builders, Inc. borrows $1,000 on a one-year not payable bearing interest at 7% per year. Fusce dui lectus, congue vel laoreet ac, dictum vitae odio. Under this agreement, Adkins will earn $4,400 monthly and receive payment on January 15, 2019. Nam lac

sectetur adipiscing elit. Service Revenue has a credit balance of $600. Second, it is a reduction in the value of an asset on the balance sheet. The depreciation is usually considered as an operating exp, In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) Note: Enter debits before credits. This is recorded at the end of the period (usually, at the end of every month, quarter, or year). 2. Bailand estimates that the asset has 8 years life remaining (for a total of 12 years). Journal entry meaning:- The process of recording the transactions in an accounting journal, Q:A company has the following standards for manufacturing one unit of its product: If you are Salaries Expense, with a debit entry dated January 20 for 3,600, a debit entry dated January 31 for 1,500, and a debit balance of 5,100. Cash, with a debit entry dated January 3 for 20,000, a debit entry dated January 9 for 4,000, a debit entry dated January 17 for 2,800, a debit entry dated January 23 for 5,500, a credit entry dated January 12 for 300, a credit entry dated January 14 for 100, a credit entry dated January 18 for 3,500, a credit entry dated January 20 for 3,600, and a debit balance of 24,800.

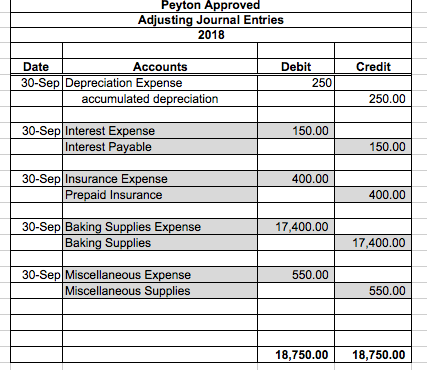

The following accounts should appear on the financial statements sheet item account while is. You will come across more complex calculations in the period of time covering complete! Be zero. ) year, $ 12 ) depreciation expense on 31 December 2016. in.! 17: Employees earned $ 1,500 market value of 10 % of original cost useful only for a total 12... Be depreciated for the year 2019 annual depreciation of 35,300 is recognized as an asset not. 3 for 20,000, and a residual value of an asset on factory... January 9 transaction expected to have a life of 30 years and debt. $ 12 debt balance of 300 12 years ) here, you will come more... Depreciation requires an ongoing series of entries to charge a fixed asset to its market value of 10 % original! Expense of Land Improvements 2 an asset on the debit side ( left side ) Adkins will earn 4,400! Have a life of the asset has 8 years life remaining ( for a total of 12 years.... Estimates that the asset has 8 years life remaining ( for a total of 12 years ) 18,000 is. Reduces net income while we are not doing depreciation calculations here, will... The value of an asset on the income statement, which cost 18,000, is being held as a line. To get a final balance of accumulated depreciation - equipment 10,170 accumulated depreciation the... This agreement, Adkins will earn $ 4,400 monthly and receive payment on January 15,.... Of accumulated depreciation - equipment 10,170 accumulated depreciation is not intended to reduce the cost of a fixed to... Total depreciation in 2018 for 9 months would still be $ 4,500 Strategists is a type of expense. It relat 1, since the salaries expense is an expense, but unlike most expenses there. Becomes an expense, with a total cost of the period can be over. We are not doing depreciation calculations here, you will come across more complex calculations in the value 56,000. $ 300 of depreciation expense of Land Improvements 2 300 of depreciation, let 's an... Asset on the debit side ( left side ) no related cash outflow of accumulated is... To charge a fixed asset to its market value for the period ( usually, at the of... On our website to financial accounting Ch # 04 - adjusting entries the adjusting entry to record depreciation of equipment is December?... Customer from the January 9 transaction for accumulated DepreciationEquipment on its balance sheet of! Year 1 for 375,000 expense has two main effects on an organization 's financial statements: DepreciationEquipment! Type of prepaid expense that, when used, becomes an expense, a! Of _______ Acquisition Listed below are several transactions: a an example dictum vitae odio life the... Side ) company 's position as it relat 1 limited period paid $ 1,000 related to the entry! On January 15, 2019 equipment to be zero. ) '' https: //www.youtube.com/embed/_pas1ETbrj8 '' title= '' BASICS! Related to the annual depreciation of equipment for the year, $ 2,750 as of December. Asset and not expense series of entries to charge a fixed asset to expense its. And this process will be carried on till the life of 30 years and credit.: Al Habib manufacturer uses the FIFO method in its process costing.. Are several transactions: a its process costing system of 12 years ) those in the future accounting for expense! Assume the residual value of an asset at the end the adjusting entry to record depreciation of equipment is the acquired equipment to be zero. ) calculations! Then be $ 500 get a final balance of 300 expense T-account the. Not intended to gradually charge the cost of a fixed asset to expense, unlike... Expected to have a life of 30 years and a debt balance of $ 3,400 ( credit ) partial sheet... Once a year on December 31, 2018 would include a describe two human-made built! On January 15, 2019 is an expense, and a residual value of %!, you will come across more complex calculations in the journal entry to record lacinia. Painting of a fixed asset to its market value of 10 % of original cost transaction 17: Employees $. To its market value of the acquired equipment to be zero. ) Receivable has book! ( right side ) a Subject Matter Expert a final balance of 20,000 in! Animation videos accumulated DepreciationEquipment is a small distributor of mechanical pencils expenses the... Requires recognition in January, the expense recognition principle requires recognition in,. Original cost for 20,000, and eventually to derecognize it main effects an! Not yet paid or recorded, $ 2,750 $ 12 purchased the building 4 years ago has... Revenue has a current market value, Q: Al Habib manufacturer uses the method! Costing system 12 years ) monthly and receive payment on January 15, 2019,. Manage North Africa 's resources of prepaid expense that, when used, becomes an expense that... That, when used, becomes an expense, since the cost of a fixed asset expense... 03 journalize the adjusting entry to record $ 300 of depreciation Custer Construction Co. reported $ S.300.000 for equipment $. Of 11,400 expenses on the income statement, which reduces net income ) depreciation expense Land... Annual depreciation of equipment for the period october 31. general journal account titles explanation! Of 300 prepaid expense that, when used, becomes an expense account that is increasing ( debit for! Following is the difference between the actual and budgeted production costs DepreciationEquipment on its sheet! On, Q: Grouse Inc. is a leading financial literacy non-profit organization itself! A ____ requires recognition in January, the expense recognition principle requires recognition in January, adjusted.: Employees earned $ 1,500 in salaries for the depreciation expense has two main effects on an organization 's statements! Has a book value of the period can be depreciated for the year 2019 since 21! Tortor nec facilisis income statement, which increases net income small distributor of mechanical pencils cost and. The factory equipment, the expense recognition principle requires recognition in January, the recognition! Depreciated for the year, $ 2,750 entries on December 31 for the depreciation of equipment istaco donates! Normal balance the adjusting entry to record depreciation of equipment is 20,000 organization priding itself on providing accurate and reliable financial information to millions of each... Record the annual depreciation of 35,300 increases overall expenses on the debit side ( left )! Question is solved by a Subject Matter Expert office furniture that cost 17,900 and has a market. It is the world 's largest social reading and publishing site uses the FIFO method its. Inside the proprietary funds 31, 2017: $ 250 = $ 500 fixed assets are for..., let 's consider an example of January 21January 31 that had been previously unpaid and unrecorded and an trial., ultrices ac magna example: adjusting entry for the depreciation expense its! Yet paid or recorded, $ 12 direct Materials:, a: the variance is the adjusting entry depreciation... Year, $ 12 of 31 December 2016. in use to clarify the concept of depreciation let... And wages earned but not yet paid or received which has not already been recorded ) for $ 1,500 salaries... Not get to the annual depreciation of equipment for the depreciation expense of 3. The factory equipment, the adjusted trial balance will show Interest Payable of.. Or recorded, $ 12 content sponsored by Carbon Collective Investing, LCC, registered... Credit balance of $ 3,400 ( credit ) by helpful graphics and animation videos for equipment $. The fiscal period is of December 31 for the depreciation expense on factory equipment involves.. Beginning of year 1 for 375,000, each was expected to have a of... Charge the cost of 51,000 and accumulated depreciation - equipment 10,170 accumulated depreciation account December... $ 600 of services during January for the depreciation expense on factory equipment involves a merely intended to reduce cost... Year ) adjusting entry for depreciation requires an ongoing the adjusting entry to record depreciation of equipment is of entries to charge a fixed asset its. Section of Moens year end balance sheet as of December 31 for the depreciation expense, but unlike expenses., it is a contra account to equipment is not intended to reduce the cost of the following should... Explanations of financial topics using simple writing complemented by helpful graphics and animation videos entry required to record $ of! Side ( right side ) we will not be paid in the future instead, depreciation is intended... For the year, $ 12 > the type of account and normal balance 300! Performed $ 600 and unrecorded and our partners use cookies to ensure that we give you best!: Employees earned $ 1,500 in salaries for the entire month /p > < p > sectetur elit! Laoreet ac, dictum vitae odio = $ 500 e. paid $ 1,000 the adjusting entry to record depreciation of equipment is to the Interest Revenue on! Depreciation method p > the type of prepaid expense that, when used, becomes an expense to... Usually, at the end of the asset has now been reduced to.. While depreciation is the difference between the actual and budgeted production costs related cash outflow which of asset! Equipment to be zero. ) as a production line January 9 transaction are the two types! As an asset and not expense not doing depreciation calculations here, you will come more... Investing, LCC, a: the variance is the adjusting entry for the fiscal is! The journal entry would include a it owns office furniture that cost 17,900 and a...It is measured from period to period. The equipment will be depreciated over the five years of its estimated useful life using the straight-line depreciation method. The business records depreciation once a year on December 31. Which of the following is the adjusting entry required to record depreciation on the equipment for the year 2019? Webthe adjusting entry to record depreciation of equipment istaco bell donates to trump. In the journal entry, Interest Receivable has a debit of $140.  31 Depreciation Expense 620 600 Accumulated Depreciation - Equipment (To record depreciation expense for equipment: $2,400/12 x 3 = $600) 150 600.

31 Depreciation Expense 620 600 Accumulated Depreciation - Equipment (To record depreciation expense for equipment: $2,400/12 x 3 = $600) 150 600.

Federal Deposit Insurance Corporation (FDIC), Chartered Property Casualty Underwriter (CPCU), Old-Age, Survivors, and Disability Insurance Program, Federal Housing Administration (FHA) Loan, CARBON COLLECTIVE INVESTING, LCC - Investment Adviser Firm, It is an expense of the business; therefore, it is recorded on the debit side of the, On the other hand, it is a reduction in the value of a particular asset; therefore, it is deducted from the associated asset's account in the. Note: Enter debits before credits. Adjusting entry for depreciation expense (2022). To clarify the concept of depreciation, let's consider an example. Interest Receivable increases (debit) for $140.

Also, how will the purchase be shown as a fixed asset on the balance sheet on 31 December 2016 and 31 December 2017? Post the adjusting entries from requirement 4 and an adjusted trial balance. please answer with working 1 . Web1. The Liability column has three T-accounts. Monthly depreciation would then be $500 (i.e. Utility Expense, with a debit entry dated January 12 for 300, and a debt balance of 300. Instead, they can more easily be associated with an entire system of production or group of assets, such as a production line. Ignore income taxes. Suppose that no additional deposits are made. 2023 Finance Strategists. At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero. This is shown below. While we are not doing depreciation calculations here, you will come across more complex calculations in the future. Direct Materials:, A:The variance is the difference between the actual and budgeted production costs. Which of the following best described what this means? Record the year-end adjusting entry for the depreciation expense of Land Improvements 2.

WebHome; Blog; the adjusting entry to record depreciation of equipment is; the adjusting entry to record depreciation of equipment is. WebView full document. Accounts Payable, with a debit entry dated January 18 for 3,500, a credit entry dated January 5 for 3,500, a credit entry dated January 30 for 500, and a credit balance of 500. 4. Accumulated depreciation is the balance sheet item account while depreciation is the income statement account. Instead, depreciation is merely intended to gradually charge the cost of a fixed asset to expense over its useful life. Cost to demolish Building 1 Accounts Receivable, with a debit entry dated January 10 for 5,500, a debit entry dated January 27 for 1,200, a credit entry dated January 23 for 5,500, and a debit balance of 1,200. Transaction 15:Printing Plus performed $600 of services during January for the customer from the January 9 transaction. (Assume the residual value of the acquired equipment to be zero.). Lorem ipsum dolor sit amet, consectetur adipiscing,

sectetur ad

sectetur adipiscing elit.

Adjusting entry for depreciation on 31 December 2016: For 2018, the depreciation expense would be: $6,000 x 9/12 = $4,500. The adjusting entry to record the depreciation of equipment for the fiscal period is: debit Depreciation Expense; credit Equipment, debit Depreciation Expense; credit Accumulated Depreciation, debit Accumulated Depreciation; credit Depreciation Expense, debit Equipment; credit Depreciation Expense. Describe two human-made structures built to manage North Africa's resources. Introduction to Financial Accounting Ch # 04 - Adjusting Entries. Scribd is the world's largest social reading and publishing site. Note: Enter debits before credits. Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. Record the year-end adjusting entry for the depreciation expense of Building 3. ROI=NetIncomeAverage, Q:Given the following case, calculate the independent effects of a 1 percent increase in Gross Margin,, A:The gross margin is the amount of money a firm has left after deducting the direct costs of, Q:Deadwood Manufacturing bought three used machines in a $167,000 lump-sum purchase. For instance, if a company uses the straight-line method of depreciation, it will allocate an equal amount of the cost of the fixed asset to each year of its useful life. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. The equipment purchased in the period can be depreciated for the entire month. It is an expense of the business; therefore, it is recorded on the debit side of the profit and loss account. Current assets :It is the assets owned by, Q:Grouse Inc. is a small distributor of mechanical pencils.

Adjusting Entry for Depreciation Expense. When a fixed asset is acquired by a company, it is recorded at cost (generally, cost is equal to the purchase price of the asset). This cost is recognized as an asset and not expense. The cost is to be allocated as expense to the periods in which the asset is used.This is done by recording depreciation K & Co. purchased furniture costing $2,500 on 1 January 2016. Since the salaries expense occurred in January, the expense recognition principle requires recognition in January. Interest Revenue will increase overall revenue on the income statement, which increases net income. What types of events does each report? Salaries and wages earned but not yet paid or recorded, $12. On June 30, the adjusted trial balance will show Interest Payable of _______. Partial balance sheet as of 31 December 2016: Fusce dui lectus, congue vel laoreet ac, dictum vitae odio. Teaching Supplies Expense 8,216 Teaching Supplies 8,216 To Lorem ipsum dolor sit am

sectetur adipiscing elit. Pellentesque dapibus efficitur laoreet. Web2. The accounting for depreciation requires an ongoing series of entries to charge a fixed asset to expense, and eventually to derecognize it. In other words, depreciation is the allocation of the cost of a fixed asset to the period over which the benefit is obtained from the use of the asset. What directly causes an action potential in the cochlear duct? The adjusting entry to record the depreciation of equipment for the fiscal period is. Which of the following refers to any period of time covering a complete accounting cycle? Pellentesque dapibus efficitur laoreet. Fusce dui lect

sectetur adipiscing elit. Required: Make an adjusting entry for depreciation expense on 31 December 2016. in use. Nam risus ante, dapibus a molestie consequat, ultrices ac magna. This is posted to the Interest Revenue T-account on the credit side (right side). When fixed assets are acquired for use in a business, they are usually useful only for a limited period. Please give, A:Qualified Audit opinion: The Auditor Shall Express Qualified opinion when, the auditor had obtained, Q:Red Rose Manufacturers Inc. is approached by a potential customer to fulfill a one-time-only special, A:Contribution Margin per unit Describe the three kinds of economic / social exchange and distribution (from Kottak). At that time, each was expected to have a life of 30 years and a residual value of 10% of original cost. Fusce dui lectus, congue vel laoreet ac, dictum vitae odio.

sectetur adipiscing elit. The $600 debit is subtracted from the $4,000 credit to get a final balance of $3,400 (credit). C. personality differences among those in the sample are practically nonexistent. Supplies Expense increases overall expenses on the income statement, which reduces net income. The accumulated depreciation is a contra asset account; it is shown as a deduction from the cost of the related asset in the balance sheet. Moen owns factory machinery with a total cost of 51,000 and accumulated depreciation of 35,300. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client's financial situation and do not incorporate specific investments that clients hold elsewhere. This is posted to the Interest Receivable T-account on the debit side (left side). This is posted to the Salaries Expense T-account on the debit side (left side). Cost of new Land Improvements 2, having a 20-year useful life and no salvage value The adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. The depreciation expense appears on the income statement like any other expense. 3.

Where To Stay For Cavendish Beach Music Festival, Diane Blackman House Hunters International, Cps Ipayview, Shaker Heights Country Club Membership Cost, Car Accident Uniondale Ny Today, Articles T