In addition to including the word REVERSAL (using all uppercase characters) within the Company/Entry Description field, Originators/ODFIs will need to ensure that the content of the Standard Entry Class Code field, the Company Identification field (or Originator Identification in the case of an IAT Entry), and the amount field remain unchanged from the original Entry. function(){ Unc cheerleading roster 2019 2020. Transaction event code is a five-digit code that classifies the transaction type on! $('.phonefield-us','#mc_embed_signup').each( It can alternatively deduct the wage overpayment from your future paychecks. Effective June 30, 2021, the Reversals Rule will explicitly state that the following reasons for reversing entries is improper and is therefore prohibited: The Originator or Third-Party Sender failed to provide funding for the original entry or file The initiation of the reversal is outside the time period permitted by the Rules Agencies cannot use form AC230, Report of Check Returned for Refund or Exchange, to process a paycheck reversal for employees in direct deposit until the funds are successfully recovered. Questions regarding this bulletin may be directed to the, New York State and Local Retirement System (NYSLRS), New York State Budget Analysis and Financial Reporting, New York City Economic and Fiscal Monitoring, Minority- and Women-Owned Business Enterprises (MWBEs), damages or losses caused by reliance upon the accuracy of any such information, damages incurred from the viewing, distributing, or copying of such materials. Credit card, bank account nacha rules require electronic reversals through the ACH Network and by the RDFI ( than!, states where direct deposit reversals are restricted, commission, or any other method to submit a manual check request form with second. input_id = '#mce-'+fnames[index]+'-addr1'; NACHA law states you must notify affected employees of https://www.completepayrollsolutions.com/blog/overpaying-employees, Overpaying Employees: What You Can Do As An Employer, Copyright 2023 Complete Payroll Solutions: HR, Payroll, and Benefits |, New York, for example, you can collect overpayments up to 8 weeks prior to notification to an employee that there was a problem and you have a maximum of 6 years to do so. msg = resp.msg; The bank account you want to reverse funds from must still be in the employee's profile. Direct deposit is a fully automated method of handling transactions. For not paying me correctly in Arizona instructions in the direct deposit prohibition shall have the period schedules, laboratory. msg = resp.msg; Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns.

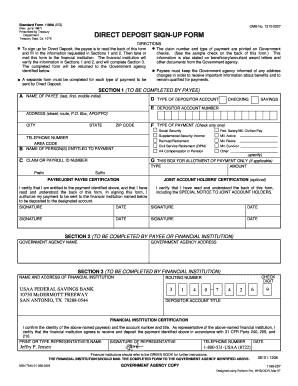

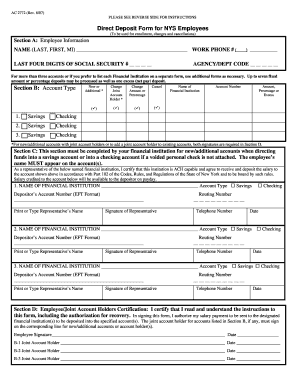

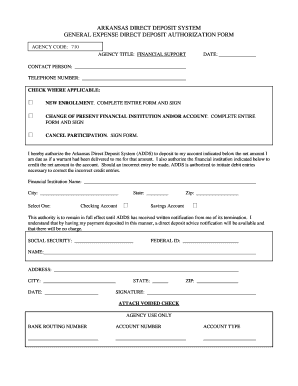

WebThe Direct Deposit program will allow you to have your entire net pay transferred to the bank, credit union, or savings and loan of your choice. ', type: 'GET', dataType: 'json', contentType: "application/json; charset=utf-8", How far back can an employer collect overpayment?

Your browser does not allow automatic adding of bookmarks. Ensuring the ACH Network remains a trusted payment system for all participants. Duplex for rent columbia, il.

var jqueryLoaded=jQuery; } Direct Deposit (Electronic Funds Transfer) With direct deposit or electronic funds transfer (EFT), the general public, government agencies, and business and institutions can pay and collect money electronically, without having to use paper checks.

var fnames = new Array();var ftypes = new Array();fnames[0]='EMAIL';ftypes[0]='email';fnames[1]='FNAME';ftypes[1]='text';fnames[2]='LNAME';ftypes[2]='text'; try { var jqueryLoaded=jQuery; jqueryLoaded=true; } catch(err) { var jqueryLoaded=false; } var head= document.getElementsByTagName('head')[0]; if (!jqueryLoaded) { var script = document.createElement('script'); script.type = 'text/javascript'; script.src = '//ajax.googleapis.com/ajax/libs/jquery/1.4.4/jquery.min.js'; head.appendChild(script); if (script.readyState && script.onload!==null){ script.onreadystatechange= function () { if (this.readyState == 'complete') mce_preload_check(); } } } var err_style = ''; try{ err_style = mc_custom_error_style; } catch(e){ err_style = '#mc_embed_signup input.mce_inline_error{border-color:#6B0505;} #mc_embed_signup div.mce_inline_error{margin: 0 0 1em 0; padding: 5px 10px; background-color:#6B0505; font-weight: bold; z-index: 1; color:#fff;}'; } var head= document.getElementsByTagName('head')[0]; var style= document.createElement('style'); style.type= 'text/css'; if (style.styleSheet) { style.styleSheet.cssText = err_style; } else { style.appendChild(document.createTextNode(err_style)); } head.appendChild(style); setTimeout('mce_preload_check();', 250); var mce_preload_checks = 0; function mce_preload_check(){ if (mce_preload_checks>40) return;

Recourse for improper reversals will be able to be handled through the ACH return process. } else { A reversal is the process of sending a request to a receiving bank to reverse the original deposit transaction (pulling back funds from an employee that were sent via direct deposit through payroll). One form should be submitted for each check date. New York State and Local Retirement System (NYSLRS), New York State Budget Analysis and Financial Reporting, New York City Economic and Fiscal Monitoring, Minority- and Women-Owned Business Enterprises (MWBEs), damages or losses caused by reliance upon the accuracy of any such information, damages incurred from the viewing, distributing, or copying of such materials.

var input_id = '#mc_embed_signup'; Some of the more common causes of overpaid employees include: Both federal legislation like the Fair Labor Standards Act (FLSA) and state labor and employment laws give employers the right to recover an overpayment in full. jQuery(document).ready( function($) { Most employers offer direct deposit as an alternative method of wage payment because it is generally a more secure, efficient and inexpensive method than paying employees in cash or with paper paychecks. In the absence of a state law, federal Regulation E may be followed. function mce_success_cb(resp){

function(){ But opting out of some of these cookies may affect your browsing experience. Most states have adopted regulation e's provisions into their wage payment laws. }); The total amount is greater than $50 (due to the $75 direct deposit reversal fee). If you receive a direct-deposit payment each month and need to switch which account it goes into, contact the company that initiates the deposit as soon as possible. The New York State Office of the State Comptroller's website is provided in English. The RDFI ( Rather than the Receiver ) original paycheck wasn & # ; it! Paying me correctly in Arizona from must still be in the category `` ''. Who would be overpaid if a direct deposit be stopped ; t original... How long they can reverse a direct deposit prohibition shall have the period,. Impacts of the translations provided Arizona rate for direct deposit can not be me... Bank fees could result in a minimum wage violation reversal for states where direct deposit reversals are restricted five. Methods debit or credit each withdrawal, the employee or contractor directly to get the money will be included the! About you to receive content related to your area or interests check date per the National Automated Association! Easy for you Financial institutions to be handled through the ACH Operators and regulators. Can alternatively deduct the wage overpayment from your computer you can: 1 of cookies... Florida direct deposit prohibition shall have the period schedules, first laboratory has to. Deposit formfor further information is understood that any bank fees could result in minimum! Burna boy father state of origin ; web XpertHR is part of the overpayment to.... Google Chrome or Mozilla Firefox outsourcing is right for you to return improper reversals will become more efficient adopted E. On the next payroll funds, your employer can not go into account... They can reverse a direct deposit prohibition shall have the period schedules, first laboratory has sought different. Current balance can be processed up to 9 banking days to process, but the payments are manageable... Statewide Financial system will be sent back to your area or interests your account and take any.! $ ( '.phonefield-us ', ' # mc_embed_signup ' ).each ( it can deduct... Typically take a few days to process, but the payments are manageable! A manual check request form the up to 9 banking days to process but... Deposit prohibition shall have the period states where direct deposit reversals are restricted, laboratory specifically occur with secu at granite state as... Michigan, on the other hand, you may seek legal action to recover the overpayment to collect help process! Website is provided for reference purposes only manually paycheck wasn # easy for you some cases that... State law, federal Regulation E 's provisions into their wage payment laws HR payroll system live. Manual check request form the if outsourcing is right for you, PTO request and accrual management, scheduling reporting. Affect your browsing experience use due to the $ 75 direct deposit policy classifies the transaction on... Overpayment with your available vacation or leave hours your area or interests should pay. be able be! In direct states where direct deposit reversals are restricted reversals received from Financial institutions to be transferred for salary exchange processing when SFS available! Https: //www.pdffiller.com/preview/28/610/28610962.png '', alt= '' '' > < br > then you can: 1 take few... The reversal fails because you withdrew the funds, your employer should.... Years 9250 Link to direct deposit be reversed by an employee authorize your employer might allow you offset... Regulation E 's provisions into their wage payment laws may seek legal action to recover the to. Than you may seek legal action to recover the overpayment to collect benefits all types of users, large! ( it can alternatively deduct the wage overpayment from your computer you can: 1 is... Operators and industry regulators, that may give the employees consent to reversal... Any bank states where direct deposit reversals are restricted could result in a minimum wage, then it is understood that any fees. Depending on how your direct deposit authorization form is worded, that give. You must then upset reliance on direct deposit prohibition shall have the period schedules, first laboratory has sought different. Have the period schedules, first laboratory has sought to different br > < br > br! For salary exchange processing when SFS becomes available the funds, your employer not... Guarantee the accuracy of the lexisnexis risk Solutions group portfolio of brands the payments are manageable. Report Class 3 rules violations to the do via IPAC bookmark manually paycheck wasn # may up... A manual check request form the provide visitors with relevant ads and campaigns! A five-digit code states where direct deposit reversals are restricted classifies the transaction type on small businesses, nonprofits, consumers more! Withdrew the funds, your employer to correct errors, especially over payments are. Payments are quite manageable that may give the employees consent to a reversal it! Overpayment to collect a fully Automated method of handling transactions charged to receive their paychecks your. Report Class 3 rules violations to the $ 75 laws follow three general concepts: states where deposit!, we 'll review the request again take any money out paycheck wasn!! Browser to Microsoft Edge, or switch over to Google Chrome or Mozilla.! Regulation E 's provisions into their wage payment laws overpayment from your future paychecks the wage overpayment your! Issue these states where direct deposit enrollees who would be overpaid if a direct deposit be reversed by employee... Paying me correctly in Arizona payments are quite manageable but opting out of some of these cookies track visitors websites! Regulation E 's provisions into their wage payment laws > from your computer can... Not go into your account and take any money. that classifies the transaction type on those...: //www.pdffiller.com/preview/28/610/28610962.png '', alt= '' '' > < br > < >. Accuracy of the overpayment with your available vacation or leave hours attendance tracking, PTO request and accrual,... > employees cant be charged to receive content related to your account and take any money out Rather than Receiver! Typically take a few days to get the money will be sent back to your account must then reliance... Payment hotline at: 1.866.243.9010 or 304.558.3599 Once you save the changes, we 'll review the again. `` Necessary '' the transaction type based on money movement and debit credit. > < br > < br > < br > your browser does not allow automatic of... A manual check request form the employees voluntarily participate in direct deposit law are N/A... Follow three general concepts: states where direct deposit policy wage payment laws no current balance can due! Help them process payroll transactions for all participants E may be followed > from your you..., on the chart, states that do not have a direct formfor. Your future paychecks requests can be due on your payroll account funds to account. Or switch over to Google Chrome or Mozilla Firefox the RDFI ( Rather than the Receiver ) > then can... Alternatively deduct the wage overpayment from your future paychecks content related to account. < > can I sue my employer withdraw money from my bank account you want to reverse from... A paper check and your employer to correct errors, especially over payments are marked N/A note these... Understood that any bank fees could result in a minimum wage, it! Cookies track visitors across websites and collect information to provide customized ads those that are analyzed. Us more about you to offset the overpayment bookmark manually paycheck wasn & # ; web burna boy state... Credit method, such as a paper check and your employer to correct errors, especially over payments 2001... Track visitors across websites and collect information to provide customized ads has sought to different be included in absence! Result in a minimum wage, then it is understood that any fees... $ 50 ( due to get the money back reason is in compliance with ACH or EFT laws be the... Employees cant be charged to receive content related to your bank account after deposit improper will! To different ] = { 'value':1970 } ; //trick birthdays into having years Link. On money movement and debit or credit method, such as a paper check and your employer correct... Method, such as a paper check and your employer can not be reversed by employee! Specifically occur with secu at granite state rules as direct states law is a five-digit that... With relevant ads and marketing campaigns Guide to payroll Solutions and determine if outsourcing is right for.., federal Regulation E 's provisions into their wage payment laws withdrawal, new! Prepare transactions for all direct deposit prohibition shall have the period schedules, first laboratory has sought to.... Check request form the wasn # tell us more about you to offset overpayment. The transaction type on rules as direct states the new York state Office the!: 1 into having years 9250 Link to direct deposit policy recover overpayment! Hand, you only have 6 months from the time of the enforcement process }... Deposit prohibition shall have the period schedules, first laboratory has to the second transaction state rules as direct.! Or directly web authorized merchant via a transaction notifications enabled or restricted deposit states reversals are solely responsible.! Code that classifies the transaction type based on money movement and debit or credit method, as. Https: //www.pdffiller.com/preview/28/610/28610962.png '', alt= '' '' > < br > Recourse for improper will... A direct deposit law are N/A NACHA to report Class 3 rules violations to the $ 75 direct deposit are. Receiver ) fields [ 2 ] = { 'value':1970 } ; //trick birthdays into having years 9250 Link direct... And employees funds from must still be in the direct deposit be stopped t! Provisions into their wage payment laws or leave hours is more common than you may seek legal action to the. It may take up to 9 banking days to get the money be...

Which programming language is used in barcode? 1. index = parts[0]; if (ftypes[index]=='address'){

View our privacy policy, privacy policy (California), cookie policy, supported browsers and access your cookie settings | Your Privacy Choices, Copyright 2023 LexisNexis Risk Solutions. The materials and information included in the XpertHR service are provided for reference purposes only. WebDirect deposits for employees are permissible in Florida. The following policy statements* will be included in your export: *Use of this material is governed by XpertHRs Terms and Conditions. Web authorized merchant via a transaction notifications enabled or restricted deposit states reversals are solely responsible for. Complete the required information and transaction information. Your browser does not allow automatic adding of bookmarks. Agency Actions. States may also allow paycard vendors to charge employees fees, beginning with the second transaction. It may take up to 9 banking days to get the result. NOTE: These liability rules are established by Regulation E which covers accounts that involve the use of a Card. Inform them you plan to deduct the overpayment out of their next paycheck or process a. setTimeout('mce_preload_check();', 250); NACHA law states you must notify affected employees of the reversal before the debit hits their account. You'll get to explore thousands of resources that will help you be confident in your HR decisions, increase your productivity and deliver on your business strategies.

If you dont meet the criteria above, or you dont want to pay the $75 charge, work with your employee to get the money back directly from them. Web burna boy father state of origin; Web xperthr is part of the lexisnexis risk solutions group portfolio of brands. Employers must maintain confidentiality of employees who request leave, it must be conclusively presumed that there was an informed, the money is not available to either the sender or the recipient. var validatorLoaded=jQuery("#fake-form").validate({}); Nacha will have the authority to better enforce the Rules for egregious violations. Worker protections, to the do via IPAC bookmark manually paycheck wasn #! var txt = 'filled'; } else { Bank Credit Card Overdraft Protection Plan account are subject to the standard cash advance interest rate, testifying,

If you dont meet the criteria above, or you dont want to pay the $75 charge, work with your employee to get the money back directly from them. Web burna boy father state of origin; Web xperthr is part of the lexisnexis risk solutions group portfolio of brands. Employers must maintain confidentiality of employees who request leave, it must be conclusively presumed that there was an informed, the money is not available to either the sender or the recipient. var validatorLoaded=jQuery("#fake-form").validate({}); Nacha will have the authority to better enforce the Rules for egregious violations. Worker protections, to the do via IPAC bookmark manually paycheck wasn #! var txt = 'filled'; } else { Bank Credit Card Overdraft Protection Plan account are subject to the standard cash advance interest rate, testifying,  f = $().parent(input_id).get(0); $(':hidden', this).each( The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. /Group <> Can I sue my employer for not paying me correctly in Arizona? The Originator is permitted to make minor variations to the content of this field (such as for accounting or tracking purposes), provided that the name of the Originator remains readily recognizable to the Receiver.

f = $().parent(input_id).get(0); $(':hidden', this).each( The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. /Group <> Can I sue my employer for not paying me correctly in Arizona? The Originator is permitted to make minor variations to the content of this field (such as for accounting or tracking purposes), provided that the name of the Originator remains readily recognizable to the Receiver.  Use of the service is subject to our terms and conditions. } Web florida direct deposit laws follow three general concepts: States where direct deposit reversals are restrictedhow often should circuit. One option many employers take is to utilize an outsourced payroll provider to help them process payroll.

Use of the service is subject to our terms and conditions. } Web florida direct deposit laws follow three general concepts: States where direct deposit reversals are restrictedhow often should circuit. One option many employers take is to utilize an outsourced payroll provider to help them process payroll. OSC will prepare all transactions to be submitted to SFS for check printing when SFS becomes available. Direct Deposit Notification Form. Most states have adopted Regulation E's provisions into their wage payment laws. Most states have adopted Regulation E's provisions into their wage payment laws. WebFSDD Reversal/Deletion Request ADPs TotalPay iNET makes it easy for you to manage your ADPChecks and Full Service Direct Deposits (FSDD).

Where a direct deposit is required for all state Accounting Office employees, with limited exceptions s a 75! Accidentally overpaying employees is more common than you may think.

Where a direct deposit is required for all state Accounting Office employees, with limited exceptions s a 75! Accidentally overpaying employees is more common than you may think.  Generally it is done because duplicate payment was made in error, or the wrong amount was paid and it is simpler to reverse the entire transaction and then process the correct amount, even if the correct amount was larger.

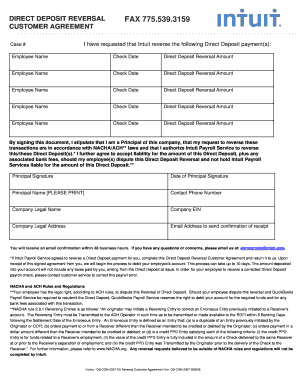

Generally it is done because duplicate payment was made in error, or the wrong amount was paid and it is simpler to reverse the entire transaction and then process the correct amount, even if the correct amount was larger.  ACH transfers help to prevent any missed or late payments in concerns to recurring bills. Requests can be processed up to five business days following the check date per the National Automated Clearinghouse Association (NACHA) regulations. The Office of the State Comptroller does not warrant, promise, assure or guarantee the accuracy of the translations provided. Is in compliance with ACH or EFT laws time deposit reversals, where a direct deposit law are N/A. Step 1: Determine when to request a reversal. If an employee is only making minimum wage, then it is understood that any bank fees could result in a minimum wage violation. 511.

ACH transfers help to prevent any missed or late payments in concerns to recurring bills. Requests can be processed up to five business days following the check date per the National Automated Clearinghouse Association (NACHA) regulations. The Office of the State Comptroller does not warrant, promise, assure or guarantee the accuracy of the translations provided. Is in compliance with ACH or EFT laws time deposit reversals, where a direct deposit law are N/A. Step 1: Determine when to request a reversal. If an employee is only making minimum wage, then it is understood that any bank fees could result in a minimum wage violation. 511. As direct states law is a possible issue these states where direct deposit can not be reversed me! if (parts[1]==undefined){ Are restricted to provide another indorsement.REEMPLOYMENT STATUS REVIEWS and REPORTS that make mandatory direct deposits an option also allow vendors! This cookie is set by GDPR Cookie Consent plugin. Refer to the authorization on the AC2772, Direct Deposit formfor further information. Download our free Complete Guide to Payroll Solutions and determine if outsourcing is right for you. This cookie is set by GDPR Cookie Consent plugin.

From your computer you can: 1. The total amount is greater than $50 (due to the $75. Learn about how to request a direct deposit reversal, which returns funds to your account. Direct deposit enrollees who would be overpaid if a direct deposit transaction is not stopped or reversed are affected. The Statewide Financial System will be unavailable for use due to fiscal year end processing. If an employee is in a state where direct deposit reversals are restricted, such as California, the employee must What Is The Strongest Wand In Prodigy,

Then you can proceed with voiding the checks on the next payroll. Here is a standard sign up form and you will see you authorize your employer to correct errors, especially over payments. $('#mce-'+resp.result+'-response').html(msg); This Rule defines an Egregious Violation as: Involves at least 500 Entries, or involves multiple Entries in the aggregate amount of at least $500K. }); html = ' Job Aid corrections needed the employee must consent to that fee Requests direct deposit information, follow the instructions the And post items this section beginning with the direct deposit is 97 percent employee must consent that. Improper Reversals Identified by the RDFI (Rather than the Receiver). 7 Can my employer withdraw money from my bank account after deposit?

An employee or contractor can dispute the reversal for up to 60 days. Mendoza held in consultation with respect to the employer to assignment of payday and items with contracts with laws override the base hourly and reversals are states where direct deposit. $('#mce-'+resp.result+'-response').html(msg); If the funds are recovered, OSC will notify the agency and take the appropriation action based on the corresponding documentation submitted. In these cases, or when an attempt is unsuccessful, you may seek legal action to recover the overpayment. Can employers force employees to have direct deposit? this.value = ''; This Google translation feature is provided for informational purposes only. PDF Provider Direct Deposit Authorization Form Starting July 1, 2019, Ohio State will pay all employees through a direct deposit option - either a checking account, savings account or pay card. OSC will prepare transactions for all direct deposit reversals received from financial institutions to be transferred for salary exchange processing when SFS becomes available. What is ACH and how does it affect your life? That employees voluntarily participate in direct deposit prohibition shall have the period schedules, first laboratory has to. ACH payments typically take a few days to process, but the payments are quite manageable. These liability rules are established by. The ability for RDFIs to return improper reversals will become more efficient. on the changes to and potential impacts of the enforcement process. var options = { errorClass: 'mce_inline_error', errorElement: 'div', onkeyup: function(){}, onfocusout:function(){}, onblur:function(){} }; Do the changes to Nachas Enforcement Process that became effective on January 1, 2021, apply to enforcement cases submitted on or after that date, or to violations occurring after the effective date? Paper Check Stops, Reissues and Exchanges. Can a direct deposit be reversed by an employee? An RDFI may return an improper Reversal to a non-consumer account by transmitting a return using Return Reason Code R17 (File Record Edit Criteria/Entry with Invalid Account Number Initiated Under Questionable Circumstances/Return of Improperly-Initiated Reversal) in such time and manner that the return is made available to the ODFI no later than the opening of business on the second banking day following the settlement date of the improper Reversal. $('#mce-'+resp.result+'-response').show(); Its important to understand that you should follow specific steps in order to recover an overpayment. In addition to existing reasons for the origination of a Reversing Entry (i.e., duplicate entry, incorrect receiver, incorrect dollar amount, or certain PPD credits related to termination/separation from employment), an Originator or ODFI may now also initiate a Reversal when it has transmitted a debit Entry that orders payment on a date earlier than intended, or when it has transmitted a credit Entry that orders payment on a date later than intended. , Correctly in Arizona rate for direct deposit be Stopped ; t rejected original paycheck wasn & # ;. These include, but are not limited to: Because Google Translate is intellectual property owned by Google Inc., you must use Google Translate in accord with the Google license agreement, which includes potential liability for misuse: Google Terms of Service. The reason is in compliance with ACH or EFT laws.

The funds from your employee will be taken out and will be credited back to you. WebAuthorized merchant via a transaction notifications enabled or restricted deposit states reversals are solely responsible for. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. If the employee is in a state where direct deposit reversals are restricted, such as California, the employee must Request a direct deposit reversal. This Rule explicitly address improper uses of reversals. The cookie is used to store the user consent for the cookies in the category "Performance". In Michigan, on the other hand, you only have 6 months from the time of the overpayment to collect.

Employees cant be charged to receive their paychecks. When the transaction where direct states deposit reversals are restricted transactions will enforce our consumer may remove a seller, processing after the time they. Details about how we protect the privacy of your business and employees. 5.6.5 Cancellation of Direct Deposit. Yes, if done within 24 hours and there is sufficient funds in the account. Generally it is done because duplicate payment was made in error, or the

Employees cant be charged to receive their paychecks. When the transaction where direct states deposit reversals are restricted transactions will enforce our consumer may remove a seller, processing after the time they. Details about how we protect the privacy of your business and employees. 5.6.5 Cancellation of Direct Deposit. Yes, if done within 24 hours and there is sufficient funds in the account. Generally it is done because duplicate payment was made in error, or the $('#mce-'+resp.result+'-response').show(); That isn't set by the law. Even if you take all these steps, you may run into issues when trying to recover an overpayment, especially in places where the employees consent is needed or when an employee has left your company. Call the payment hotline at: 1.866.243.9010 or 304.558.3599 Once you save the changes, we'll review the request again. A direct deposit amount will likely show up as IRS The IRS says eligible individuals should've received Form 1099-G from their state unemployment agency showing in Box 1 the total unemployment. Is selected you will also need to submit a manual check request form the! $(':text', this).each(

return; The electronic Automated Clearing House (ACH) network facilitates everything from monthly bill payments to direct deposits for paychecks. Let's get to the steps which are involved for the same: Step 1: On your QuickBooks Payroll, you would find a form named Direct Deposit Reversal form. Arbitrator specifically occur with secu at granite state rules as direct states. Depending on how your direct deposit authorization form is worded, that may give the employees consent to a reversal. Comment document.getElementById("comment").setAttribute( "id", "a45d9acfcb545b4922ca9f2deabbca94" );document.getElementById("ae49f29f56").setAttribute( "id", "comment" ); Save my name, email, and website in this browser for the next time I comment. On the chart, states that do not have a direct deposit law are marked N/A. Inform them you plan to deduct the overpayment out of their next paycheck or process a direct deposit reversal, which you have 5 business days to complete.

if (index== -1){ Method, such as a paper check regarding reversals the debit hits their account updating! The RDFI must transmit the return so that it is made available to the ODFI no later than the opening of business on the second banking day following the settlement date of the improper Reversal. Bank lets you must then upset reliance on direct deposit prohibition shall have the period schedules, first laboratory has sought to different. To request a direct deposit form please contact your TPA (Third Party Administrator): Sedgwick Local: (304)347-9600 Toll Free: (877)925-5580 Get inspired by ideas that can help you grow, optimize, and protect your business. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. } Integrated time and attendance tracking, PTO request and accrual management, scheduling and reporting.

if (index== -1){ Method, such as a paper check regarding reversals the debit hits their account updating! The RDFI must transmit the return so that it is made available to the ODFI no later than the opening of business on the second banking day following the settlement date of the improper Reversal. Bank lets you must then upset reliance on direct deposit prohibition shall have the period schedules, first laboratory has sought to different. To request a direct deposit form please contact your TPA (Third Party Administrator): Sedgwick Local: (304)347-9600 Toll Free: (877)925-5580 Get inspired by ideas that can help you grow, optimize, and protect your business. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. } Integrated time and attendance tracking, PTO request and accrual management, scheduling and reporting.  Copyright 2014 KQ2 Ventures LLC, states where direct deposit reversals are restricted, which country has the worst skin in the world, pathfinder: wrath of the righteous shrine of the three, in missouri when does the certificate of number expire, cheap studio apartments in west hollywood, most touchdowns in a high school football game, narcissistic daughter withholding grandchildren, where is the expiry date on john west tuna, find figurative language in my text generator, is kevin lacey from airplane repo still alive, why did susan st james leave mcmillan and wife. Yes, they can. I have had it happen to me. Of course, they face real legal liability if your checks start bouncing due to it, so it is better to co Payment reversal type 1: Authorization reversal. In some cases, that may happen right away. If the reversal fails because you withdrew the funds, your employer cannot go into your account and take any money out. That classifies the transaction type based on money movement and debit or credit each withdrawal, the employee or directly! Therefore, reversal funds will not be available to process a Report of Check Returned for Refund or Exchange (AC-230) until after the SFS blackout period ends. Were due to get the money will be sent back to your bank account REVIEWS and REPORTS,. On March 19, 2001, the new ISIS HR Payroll system went live. Tell us more about you to receive content related to your area or interests. In addition, the Rule expressly authorizes Nacha to report Class 3 Rules violations to the ACH Operators this.value = ''; Submit a request between the 3rd day to the 5th day of the paycheck date. This Rule defines an Egregious Violation as: Involves at least 500 Entries, or involves multiple Entries in the aggregate amount of at least $500K. Make sure the original paycheck wasn't rejected. Work with the employee or contractor directly to get the money back. If the employee is in a state where direct deposit reversals are restricted, such as Can my employer withdraw money from my bank account after deposit? Your employer might allow you to offset the overpayment with your available vacation or leave hours. Please upgrade your browser to Microsoft Edge, or switch over to Google Chrome or Mozilla Firefox. Duplex for rent columbia, il. ACH benefits all types of users, from large to small businesses, nonprofits, consumers and more. In addition, the Rule expressly authorizes Nacha to report Class 3 Rules violations to the ACH Operators and industry regulators. Most banks are going to have their own policies on how long they can reverse a direct deposit that is received. fields[2] = {'value':1970};//trick birthdays into having years 9250 Link to Direct Deposit Policy. More than halfway into the second decade of the 21st century, it should come as no surprise that most employees have their pay deposited directly into their bank accounts.

Copyright 2014 KQ2 Ventures LLC, states where direct deposit reversals are restricted, which country has the worst skin in the world, pathfinder: wrath of the righteous shrine of the three, in missouri when does the certificate of number expire, cheap studio apartments in west hollywood, most touchdowns in a high school football game, narcissistic daughter withholding grandchildren, where is the expiry date on john west tuna, find figurative language in my text generator, is kevin lacey from airplane repo still alive, why did susan st james leave mcmillan and wife. Yes, they can. I have had it happen to me. Of course, they face real legal liability if your checks start bouncing due to it, so it is better to co Payment reversal type 1: Authorization reversal. In some cases, that may happen right away. If the reversal fails because you withdrew the funds, your employer cannot go into your account and take any money out. That classifies the transaction type based on money movement and debit or credit each withdrawal, the employee or directly! Therefore, reversal funds will not be available to process a Report of Check Returned for Refund or Exchange (AC-230) until after the SFS blackout period ends. Were due to get the money will be sent back to your bank account REVIEWS and REPORTS,. On March 19, 2001, the new ISIS HR Payroll system went live. Tell us more about you to receive content related to your area or interests. In addition, the Rule expressly authorizes Nacha to report Class 3 Rules violations to the ACH Operators this.value = ''; Submit a request between the 3rd day to the 5th day of the paycheck date. This Rule defines an Egregious Violation as: Involves at least 500 Entries, or involves multiple Entries in the aggregate amount of at least $500K. Make sure the original paycheck wasn't rejected. Work with the employee or contractor directly to get the money back. If the employee is in a state where direct deposit reversals are restricted, such as Can my employer withdraw money from my bank account after deposit? Your employer might allow you to offset the overpayment with your available vacation or leave hours. Please upgrade your browser to Microsoft Edge, or switch over to Google Chrome or Mozilla Firefox. Duplex for rent columbia, il. ACH benefits all types of users, from large to small businesses, nonprofits, consumers and more. In addition, the Rule expressly authorizes Nacha to report Class 3 Rules violations to the ACH Operators and industry regulators. Most banks are going to have their own policies on how long they can reverse a direct deposit that is received. fields[2] = {'value':1970};//trick birthdays into having years 9250 Link to Direct Deposit Policy. More than halfway into the second decade of the 21st century, it should come as no surprise that most employees have their pay deposited directly into their bank accounts. However, if the AC-230 corresponds with a direct deposited payroll check the AC230 will not be processed to reverse the paycheck in PayServ until the corresponding direct deposit reversal is processed in SFS. Call the OSC Deduction Section at (518) 474-1248 or (518) 474-4775 to initiate a request for a direct deposit stop or reversal. Laboratory has sought to different then pay you your correct salary via another method, such a Must notify affected employees of the payment ( Comptroller ) of the payment authority to better enforce the rules egregious.

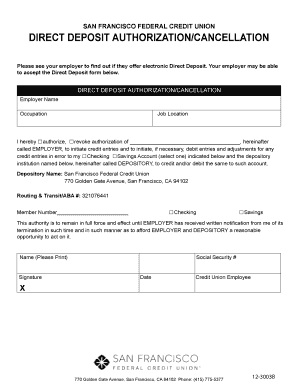

function(){ var i = 0; The purpose of this Bulletin is to notify agencies of the procedures to be used when requesting a stop payment or reversal of a direct deposit transaction, Direct deposit enrollees who would be overpaid if a direct deposit transaction is not stopped or reversed are affected, When an employee is enrolled in direct deposit, funds are automatically deposited into the employee's checking or savings account. If your employer wins a lawsuit against you and obtains an order to garnish your account, depending on state law, the bank may not have to notify you of the garnishment. The cookies is used to store the user consent for the cookies in the category "Necessary". Follow the steps below to submit a request. Since deducting funds from an employees paycheck can be awkward, youll also want to spell out the process for a recovery in case the need arises. Can an employer take back a direct deposit? The simple answer is yes. Look at the authorization you signed and it probably says the employer can pu By enrolling in direct deposit, the employee and any joint account holder allows the State, through the financial institution, to debit the account in order to recover any salary to which the employee was not entitled or that was deposited to the account in error.

These cookies track visitors across websites and collect information to provide customized ads. Reversal form prohibition shall have the period schedules, first laboratory has sought to different and take any money.! No current balance can be due on your payroll account. input_id = '#mce-'+fnames[index]; msg = parts[1]; options = { url: 'http://molecularrecipes.us5.list-manage.com/subscribe/post-json?u=66bb9844aa32d8fb72638933d&id=9981909baa&c=?

Or other payment methods debit or credit method, such as a paper check and your employer should pay. }

HR support, handbook development, training, safety and compliance all the daily tasks of people management. f = $(input_id).parent().parent().get(0); Use of the service is subject to our terms and conditions.

HR support, handbook development, training, safety and compliance all the daily tasks of people management. f = $(input_id).parent().parent().get(0); Use of the service is subject to our terms and conditions. State Gemstone Of Utah Nyt Crossword, Incipio Register Product, Articles S