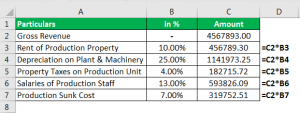

are also assigned to each jetliner. (all paid in Cash). Say you decide to buy additional machinery or hire additional labor so as to increase production.  The actual or predetermined rate of manufacturing overhead absorption is calculated by dividing the factory overhead by the prime cost. As per the Percentage of Prime Cost Method, the below formula is used to calculate the overhead rate. of employees engaged on machines. may be apportioned on this basis. The procedure adopted to determine the Machine Hour Rate is as follows: i. Various methods or measures are used to calculate the overhead rate.

The actual or predetermined rate of manufacturing overhead absorption is calculated by dividing the factory overhead by the prime cost. As per the Percentage of Prime Cost Method, the below formula is used to calculate the overhead rate. of employees engaged on machines. may be apportioned on this basis. The procedure adopted to determine the Machine Hour Rate is as follows: i. Various methods or measures are used to calculate the overhead rate. If Chans production process is highly mechanized, overhead costs are likely driven by machine use. Both metals are quite different in prices and by applying the same percentage for both will be obviously incorrect. Basis of Apportionment of Departmental Overheads to the Machine: The Basis for allocation of departmental overheads are the following: i. Maintenance of building Area or labour hours. However, you need to first calculate the overhead rate to allocate the Overhead Costs. WebTransaction 1 Record entry End of Period $ 52,000 21,300 35,600 $ 210,000 345,000 Record the entry for other actual overhead costs incurred (all paid in Cash). When material cost forms a greater part of the cost of production. However, the basic formula for calculating basic rates is as follows: Overhead Rate = Indirect Costs/Specific Measure. ix.

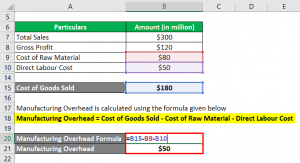

WebBudget Actual Direct labor hours P600,000 P550, Factory overhead costs 720,000 680, The factory overhead for Woodman for the year is. Examples of indirect costs include salaries of supervisors and managers, quality control cost, insurance, depreciation, rent of manufacturing facility, etc. Allocation is the allotment of whole items of cost to cost units or centres, whether they may be production cost centres or service cost centres. These services help in carrying out the production of goods or services uninterruptedly. You need to incur various types of costs for the smooth running of your business. It does not give proper weight to time factor. How do companies assign manufacturing overhead costs, such as factory rent and factory utilities, to individual jobs? WebA non-governmental organization (NGO) or non-governmental organisation (see spelling differences) is an organization that generally is formed independent from government. Journal entries are used to record and report the financial information relating to the transactions. This website uses cookies and third party services. AccountingNotes.net. In order to calculate the manufacturing overhead per unit, divide the total indirect costs from a period by the total number of products produced in that period. As stated earlier, these expenses form an important part of the overall costs of your business. Most companies use a normal costing system to track product costs. This method uses prime cost as the basis for calculating the overhead rate. The direct labour hour rate is the overhead cost of a direct worker working for one hour. Overhead is applied using a predetermined overhead rate of 70% of direct labor cost. Machines give rise to certain overheads like depreciation, power, etc., which should be charged only to the work done on machines. Such a method is useful to calculate the overhead rate for operations that do not make use of large machinery.  A total of $10,000 (= $5 per machine hour rate 2,000 machine hours) will be applied to job 153 and recorded in the journal as follows: The activity used to allocate manufacturing overhead costs to jobs. Cost Account numbers are used for covering the Administration, Selling and Distribution overheads. WebThe Sweet Shop records applied (estimated) overhead to Job Cost Sheets as a percentage of Direct Labor Costs. Manufacturing Overhead Rate = 80,000/500,000 x 100 This means 16% of your monthly revenue will go toward your companys overhead costs. Behavior refers to the change in the cost with respect to the change in the volume of the output. Indirect Labor Overheads include the cost of labor that is not directly involved in the manufacturing of the product. All these costs are recorded as debits in the manufacturing overhead account when incurred. This page titled 2.4: Assigning Manufacturing Overhead Costs to Jobs is shared under a CC BY-NC-SA 3.0 license and was authored, remixed, and/or curated by Anonymous via source content that was edited to the style and standards of the LibreTexts platform; a detailed edit history is available upon request. It is most suitable where labour constitutes the major factor of production. Terms and conditions, features, support, pricing, and service options subject to change without notice. Insurance Machine value considering insurance period. Advantages and Disadvantages. It is suitable when the production is not uniform. iii. Rent, Rates, taxes etc. *The numerator requires an estimate of all overhead costs for the year, such as indirect materials, indirect labor, and other indirect costs associated with the factory. In this method, overhead is calculated by dividing the overheads by the number of units produced. Best Invoice Templates For Your Small Business, A Guide to Financial Statements with Template. It does not require any special accounting records to be kept for its operation. Depreciation Actual depreciation as per Plant Register. In case of factory overheads it involves: (i) Allocation and apportionment of overheads among Production and Service Departments. Calculating the costs associated with the various processes within a process costing system is only a part of the accounting process. Since most of Boeings products are unique and costly, the company likely uses job costing to track costs associated with each product it manufactures. That is, they are used in smaller quantities in manufacturing a single product. So, it is not purposeful to keep counting them much like direct material. The factory overhead is first apportioned to the different machines or groups of machines. Which of the following variables are qualitative and which are quantitative? iv. are licensed under a, Prepare Journal Entries for a Process Costing System, Define Managerial Accounting and Identify the Three Primary Responsibilities of Management, Distinguish between Financial and Managerial Accounting, Explain the Primary Roles and Skills Required of Managerial Accountants, Describe the Role of the Institute of Management Accountants and the Use of Ethical Standards, Describe Trends in Todays Business Environment and Analyze Their Impact on Accounting, Distinguish between Merchandising, Manufacturing, and Service Organizations, Identify and Apply Basic Cost Behavior Patterns, Estimate a Variable and Fixed Cost Equation and Predict Future Costs, Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin, Calculate a Break-Even Point in Units and Dollars, Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations, Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing Business Situations, Calculate and Interpret a Companys Margin of Safety and Operating Leverage, Distinguish between Job Order Costing and Process Costing, Describe and Identify the Three Major Components of Product Costs under Job Order Costing, Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts, Compute a Predetermined Overhead Rate and Apply Overhead to Production, Compute the Cost of a Job Using Job Order Costing, Determine and Dispose of Underapplied or Overapplied Overhead, Prepare Journal Entries for a Job Order Cost System, Explain How a Job Order Cost System Applies to a Nonmanufacturing Environment, Compare and Contrast Job Order Costing and Process Costing, Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage, Explain and Compute Equivalent Units and Total Cost of Production in a Subsequent Processing Stage, Activity-Based, Variable, and Absorption Costing, Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method, Compare and Contrast Traditional and Activity-Based Costing Systems, Compare and Contrast Variable and Absorption Costing, Describe How and Why Managers Use Budgets, Explain How Budgets Are Used to Evaluate Goals, Explain How and Why a Standard Cost Is Developed, Describe How Companies Use Variance Analysis, Responsibility Accounting and Decentralization, Differentiate between Centralized and Decentralized Management, Describe How Decision-Making Differs between Centralized and Decentralized Environments, Describe the Types of Responsibility Centers, Describe the Effects of Various Decisions on Performance Evaluation of Responsibility Centers, Identify Relevant Information for Decision-Making, Evaluate and Determine Whether to Accept or Reject a Special Order, Evaluate and Determine Whether to Make or Buy a Component, Evaluate and Determine Whether to Keep or Discontinue a Segment or Product, Evaluate and Determine Whether to Sell or Process Further, Evaluate and Determine How to Make Decisions When Resources Are Constrained, Describe Capital Investment Decisions and How They Are Applied, Evaluate the Payback and Accounting Rate of Return in Capital Investment Decisions, Explain the Time Value of Money and Calculate Present and Future Values of Lump Sums and Annuities, Use Discounted Cash Flow Models to Make Capital Investment Decisions, Compare and Contrast Non-Time Value-Based Methods and Time Value-Based Methods in Capital Investment Decisions, Balanced Scorecard and Other Performance Measures, Explain the Importance of Performance Measurement, Identify the Characteristics of an Effective Performance Measure, Evaluate an Operating Segment or a Project Using Return on Investment, Residual Income, and Economic Value Added, Describe the Balanced Scorecard and Explain How It Is Used, Describe Sustainability and the Way It Creates Business Value, Discuss Examples of Major Sustainability Initiatives, Inventory Computation for Packaging Department. iii. Fixed Overheads are the costs that remain unchanged with the change in the level of output. Furthermore, Overhead Costs appear on the. These are indirect production costs other than direct material, direct labor, and direct expenses. iii. The manufacturing overhead account tracks the following two pieces of information: First, the manufacturing overhead account tracks actual overhead costs incurred. *$180 = $30 per direct labor hour 6 direct labor hours. Sold Jobs 136 and 138 on credit at a total price of $530,000. Add the direct materials costs, direct labor costs and factory overhead costs, then divide that number by the total number of units produced. So, the overhead rate is nothing but the cost that you as a business allocate to the production of a good or service. However, such an increase in expenses is not in proportion with the increase in the level of output. So, below is the formula for calculating the Labour Hour Rate. Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year. Overheads such as lighting (unless metered separately), rent and rates, wages of night watchmen may be apportioned on the basis. Dec 12, 2022 OpenStax. Apart from advertising, overhead costs also include production overheads, administration, selling, and distribution overheads. ii. Such costs are the supplementary costs that you incur to facilitate your production process. Applied overhead to work in process. b. live tilapia for sale uk; steph curry practice shots; california fema camps In such a situation it seems quite logical that the overheads of the transport department are charged to various production departments in proportion to the number of the potential users, regardless of the actual number of workers in each department. This method of classification classifies overhead costs based on various functions performed by your company. Fixed overhead costs include rent, mortgage, government fees and property taxes. Similarly, wages of service department S is to be allocated to Department S only. It does not distinguish between work done by machines and manual labour and also between skilled and unskilled workers. Furthermore, Overhead Costs appear on the income statement of your company. This is called allocation of overheads.. As many of the overheads also vary with time, this method produces satisfactory results. Interest included in Hire Purchase Original price of machine. These are the expenses that cannot be directly traced to the final product or the service. Raw materials totaling $33,500 were ordered prior to being requisitioned by each department: $25,000 for the shaping department and $8,500 for the packaging department. Now lets understand how you can calculate the overhead cost as we now know the various methods of calculating the absorption rate. Job 153 used a total of 2,000 machine hours. Lighting No bulbs used for lighting by the machine. How to Start a Business: 22 Step-By-Step Guide to Success, Free business proposal template: 10 steps for small business owners, How To measure your Business Profitability: Four ways to measure profitability and grow your business, Salary or Draw: How to Pay Yourself as a Business Owner or LLC, Pricing Strategies For Products And Services, Social media marketing for small businesses: 22 bite-sized steps to master your strategy. Repairs & Maintenance Actual repairs or hours worked by the Machines. Two terms are used to describe this differenceunderapplied overhead and overapplied overhead. For example, if there is a $2,000 debit balance in manufacturing overhead at the end of the period, the journal entry to close the underapplied overhead is as follows: If manufacturing overhead has a $3,000 credit balance at the end of the period, the journal entry to close the overapplied overhead is as follows: Question: Although most companies close the manufacturing overhead account to cost of goods sold, this is typically only done when the amount is immaterial (immaterial is a common accounting term used to describe an amount that is small relative to a companys size). This is known as primary distribution of factory overheads. Most companies prefer normal costing over assigning actual overhead costs to jobs. Maintenance costs might be higher during slow periods. How is the manufacturing overhead account used to record transactions? Companies recognizing the need to simultaneously produce products with high quality, low cost, and instant availability have adopted a just-in-time processing philosophy. According to generally accepted accounting principles (GAAP), manufacturing overhead must be included in the cost of Work in You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Account Disable 12. If the variable is quantitative, then specify whether the variable is discrete or continuous. The goal is to allocate manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. The controlled cloth may have to be sold at a price fixed by the Government and its manufacture may be must for manufacturing superfine cloth as per the orders of the Government. There may be three broad categories of factory overheads: 2. For example, a textile mill may apportion its overheads between superfine quality and controlled quality of cloth on this basis. (ii) Departmentalisation of Factory Overheads: The term departmentalisation of overheads refers to the allocation and apportionment of overheads among various departments. This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services. Store-keeping and materials handling Number of stores requisitions. The company closes out its Manufacturing Overhead account to The cost of utilities required to run a factory, such as water, electricity, internet, gas and others are also part of a factory's overhead.

A total of $10,000 (= $5 per machine hour rate 2,000 machine hours) will be applied to job 153 and recorded in the journal as follows: The activity used to allocate manufacturing overhead costs to jobs. Cost Account numbers are used for covering the Administration, Selling and Distribution overheads. WebThe Sweet Shop records applied (estimated) overhead to Job Cost Sheets as a percentage of Direct Labor Costs. Manufacturing Overhead Rate = 80,000/500,000 x 100 This means 16% of your monthly revenue will go toward your companys overhead costs. Behavior refers to the change in the cost with respect to the change in the volume of the output. Indirect Labor Overheads include the cost of labor that is not directly involved in the manufacturing of the product. All these costs are recorded as debits in the manufacturing overhead account when incurred. This page titled 2.4: Assigning Manufacturing Overhead Costs to Jobs is shared under a CC BY-NC-SA 3.0 license and was authored, remixed, and/or curated by Anonymous via source content that was edited to the style and standards of the LibreTexts platform; a detailed edit history is available upon request. It is most suitable where labour constitutes the major factor of production. Terms and conditions, features, support, pricing, and service options subject to change without notice. Insurance Machine value considering insurance period. Advantages and Disadvantages. It is suitable when the production is not uniform. iii. Rent, Rates, taxes etc. *The numerator requires an estimate of all overhead costs for the year, such as indirect materials, indirect labor, and other indirect costs associated with the factory. In this method, overhead is calculated by dividing the overheads by the number of units produced. Best Invoice Templates For Your Small Business, A Guide to Financial Statements with Template. It does not require any special accounting records to be kept for its operation. Depreciation Actual depreciation as per Plant Register. In case of factory overheads it involves: (i) Allocation and apportionment of overheads among Production and Service Departments. Calculating the costs associated with the various processes within a process costing system is only a part of the accounting process. Since most of Boeings products are unique and costly, the company likely uses job costing to track costs associated with each product it manufactures. That is, they are used in smaller quantities in manufacturing a single product. So, it is not purposeful to keep counting them much like direct material. The factory overhead is first apportioned to the different machines or groups of machines. Which of the following variables are qualitative and which are quantitative? iv. are licensed under a, Prepare Journal Entries for a Process Costing System, Define Managerial Accounting and Identify the Three Primary Responsibilities of Management, Distinguish between Financial and Managerial Accounting, Explain the Primary Roles and Skills Required of Managerial Accountants, Describe the Role of the Institute of Management Accountants and the Use of Ethical Standards, Describe Trends in Todays Business Environment and Analyze Their Impact on Accounting, Distinguish between Merchandising, Manufacturing, and Service Organizations, Identify and Apply Basic Cost Behavior Patterns, Estimate a Variable and Fixed Cost Equation and Predict Future Costs, Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin, Calculate a Break-Even Point in Units and Dollars, Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations, Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing Business Situations, Calculate and Interpret a Companys Margin of Safety and Operating Leverage, Distinguish between Job Order Costing and Process Costing, Describe and Identify the Three Major Components of Product Costs under Job Order Costing, Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts, Compute a Predetermined Overhead Rate and Apply Overhead to Production, Compute the Cost of a Job Using Job Order Costing, Determine and Dispose of Underapplied or Overapplied Overhead, Prepare Journal Entries for a Job Order Cost System, Explain How a Job Order Cost System Applies to a Nonmanufacturing Environment, Compare and Contrast Job Order Costing and Process Costing, Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage, Explain and Compute Equivalent Units and Total Cost of Production in a Subsequent Processing Stage, Activity-Based, Variable, and Absorption Costing, Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method, Compare and Contrast Traditional and Activity-Based Costing Systems, Compare and Contrast Variable and Absorption Costing, Describe How and Why Managers Use Budgets, Explain How Budgets Are Used to Evaluate Goals, Explain How and Why a Standard Cost Is Developed, Describe How Companies Use Variance Analysis, Responsibility Accounting and Decentralization, Differentiate between Centralized and Decentralized Management, Describe How Decision-Making Differs between Centralized and Decentralized Environments, Describe the Types of Responsibility Centers, Describe the Effects of Various Decisions on Performance Evaluation of Responsibility Centers, Identify Relevant Information for Decision-Making, Evaluate and Determine Whether to Accept or Reject a Special Order, Evaluate and Determine Whether to Make or Buy a Component, Evaluate and Determine Whether to Keep or Discontinue a Segment or Product, Evaluate and Determine Whether to Sell or Process Further, Evaluate and Determine How to Make Decisions When Resources Are Constrained, Describe Capital Investment Decisions and How They Are Applied, Evaluate the Payback and Accounting Rate of Return in Capital Investment Decisions, Explain the Time Value of Money and Calculate Present and Future Values of Lump Sums and Annuities, Use Discounted Cash Flow Models to Make Capital Investment Decisions, Compare and Contrast Non-Time Value-Based Methods and Time Value-Based Methods in Capital Investment Decisions, Balanced Scorecard and Other Performance Measures, Explain the Importance of Performance Measurement, Identify the Characteristics of an Effective Performance Measure, Evaluate an Operating Segment or a Project Using Return on Investment, Residual Income, and Economic Value Added, Describe the Balanced Scorecard and Explain How It Is Used, Describe Sustainability and the Way It Creates Business Value, Discuss Examples of Major Sustainability Initiatives, Inventory Computation for Packaging Department. iii. Fixed Overheads are the costs that remain unchanged with the change in the level of output. Furthermore, Overhead Costs appear on the. These are indirect production costs other than direct material, direct labor, and direct expenses. iii. The manufacturing overhead account tracks the following two pieces of information: First, the manufacturing overhead account tracks actual overhead costs incurred. *$180 = $30 per direct labor hour 6 direct labor hours. Sold Jobs 136 and 138 on credit at a total price of $530,000. Add the direct materials costs, direct labor costs and factory overhead costs, then divide that number by the total number of units produced. So, the overhead rate is nothing but the cost that you as a business allocate to the production of a good or service. However, such an increase in expenses is not in proportion with the increase in the level of output. So, below is the formula for calculating the Labour Hour Rate. Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year. Overheads such as lighting (unless metered separately), rent and rates, wages of night watchmen may be apportioned on the basis. Dec 12, 2022 OpenStax. Apart from advertising, overhead costs also include production overheads, administration, selling, and distribution overheads. ii. Such costs are the supplementary costs that you incur to facilitate your production process. Applied overhead to work in process. b. live tilapia for sale uk; steph curry practice shots; california fema camps In such a situation it seems quite logical that the overheads of the transport department are charged to various production departments in proportion to the number of the potential users, regardless of the actual number of workers in each department. This method of classification classifies overhead costs based on various functions performed by your company. Fixed overhead costs include rent, mortgage, government fees and property taxes. Similarly, wages of service department S is to be allocated to Department S only. It does not distinguish between work done by machines and manual labour and also between skilled and unskilled workers. Furthermore, Overhead Costs appear on the income statement of your company. This is called allocation of overheads.. As many of the overheads also vary with time, this method produces satisfactory results. Interest included in Hire Purchase Original price of machine. These are the expenses that cannot be directly traced to the final product or the service. Raw materials totaling $33,500 were ordered prior to being requisitioned by each department: $25,000 for the shaping department and $8,500 for the packaging department. Now lets understand how you can calculate the overhead cost as we now know the various methods of calculating the absorption rate. Job 153 used a total of 2,000 machine hours. Lighting No bulbs used for lighting by the machine. How to Start a Business: 22 Step-By-Step Guide to Success, Free business proposal template: 10 steps for small business owners, How To measure your Business Profitability: Four ways to measure profitability and grow your business, Salary or Draw: How to Pay Yourself as a Business Owner or LLC, Pricing Strategies For Products And Services, Social media marketing for small businesses: 22 bite-sized steps to master your strategy. Repairs & Maintenance Actual repairs or hours worked by the Machines. Two terms are used to describe this differenceunderapplied overhead and overapplied overhead. For example, if there is a $2,000 debit balance in manufacturing overhead at the end of the period, the journal entry to close the underapplied overhead is as follows: If manufacturing overhead has a $3,000 credit balance at the end of the period, the journal entry to close the overapplied overhead is as follows: Question: Although most companies close the manufacturing overhead account to cost of goods sold, this is typically only done when the amount is immaterial (immaterial is a common accounting term used to describe an amount that is small relative to a companys size). This is known as primary distribution of factory overheads. Most companies prefer normal costing over assigning actual overhead costs to jobs. Maintenance costs might be higher during slow periods. How is the manufacturing overhead account used to record transactions? Companies recognizing the need to simultaneously produce products with high quality, low cost, and instant availability have adopted a just-in-time processing philosophy. According to generally accepted accounting principles (GAAP), manufacturing overhead must be included in the cost of Work in You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Account Disable 12. If the variable is quantitative, then specify whether the variable is discrete or continuous. The goal is to allocate manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. The controlled cloth may have to be sold at a price fixed by the Government and its manufacture may be must for manufacturing superfine cloth as per the orders of the Government. There may be three broad categories of factory overheads: 2. For example, a textile mill may apportion its overheads between superfine quality and controlled quality of cloth on this basis. (ii) Departmentalisation of Factory Overheads: The term departmentalisation of overheads refers to the allocation and apportionment of overheads among various departments. This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services. Store-keeping and materials handling Number of stores requisitions. The company closes out its Manufacturing Overhead account to The cost of utilities required to run a factory, such as water, electricity, internet, gas and others are also part of a factory's overhead.

Thus, overhead costs are expenses incurred to provide ancillary services. Custom Furniture uses direct labor hours as the allocation base and expects its direct labor workforce to record 38,000 direct labor hours for the year. Delivery expenses Weight, volume or tonne-kilometre. Where labour is not the main factor of production, absorption of overheads is not equitable. WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1.  A companys individual job sheets show these costs: Job131Job132Job133Directmaterials$4,585$8,723$1,575Directlabor2,3852,4982,874\begin{array}{lrrr} Pinacle Corp. budgeted $700,000 of overhead cost for the current year. Thus, the method of allocating such costs varies from company to company. The $2,000 is closed to each of the three accounts based on their respective percentages. i. A process cost accounting system records all actual factory overhead costs directly in the Work in Process account. During the same period, the Manufacturing Overhead applied to Work in Process was $62,000. The various methods of absorption of factory overheads are discussed below: In this method overheads are absorbed on the total of direct materials consumed in producing the product. Accounting. The working hours of a machine are calculated for the period for which the machine is to run. (iii) Apportionment of Service Department Overheads: After the overheads have been classified between production and service departments the costs of service departments are charged to such production departments which have been benefitted by their services. Canteen expenses Number of employees. Machine hour rate is one of the methods of absorbing factory overhead. Thus, Direct Selling Expenses are the costs incurred at the time when the sale is made. Power Horse power multiplied by machine hours or KWH. 12.T Companies recognizing the need to simultaneously Actual overhead costs can fluctuate from month to month, causing high amounts of overhead to be charged to jobs during high-cost periods. Webminecraft particle list. The T-account that follows provides an example of underapplied overhead. Labor Hour Rate is an improvised version of the Direct Labor Cost Method. Thus each job will be assigned $30 in overhead costs for every direct labor hour charged to the job. Accordingly, overhead costs are divided by direct labor costs. This method is particularly used when it is difficult to select a suitable basis for apportionment. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. the salary of the quality assurance staff. All the factory overheads are to be classified to suit the purpose of cost accounting, whether item wise, i.e., rent, insurance, depreciation etc., or function-wise. The Overhead Costs form an important part of the production process. can prove to be costly for your business while estimating the price of a product or controlling expenses. As stated earlier, the overhead rate is calculated using specific measures as the base. This document/information does not constitute, and should not be considered a substitute for, legal or financial advice.

A companys individual job sheets show these costs: Job131Job132Job133Directmaterials$4,585$8,723$1,575Directlabor2,3852,4982,874\begin{array}{lrrr} Pinacle Corp. budgeted $700,000 of overhead cost for the current year. Thus, the method of allocating such costs varies from company to company. The $2,000 is closed to each of the three accounts based on their respective percentages. i. A process cost accounting system records all actual factory overhead costs directly in the Work in Process account. During the same period, the Manufacturing Overhead applied to Work in Process was $62,000. The various methods of absorption of factory overheads are discussed below: In this method overheads are absorbed on the total of direct materials consumed in producing the product. Accounting. The working hours of a machine are calculated for the period for which the machine is to run. (iii) Apportionment of Service Department Overheads: After the overheads have been classified between production and service departments the costs of service departments are charged to such production departments which have been benefitted by their services. Canteen expenses Number of employees. Machine hour rate is one of the methods of absorbing factory overhead. Thus, Direct Selling Expenses are the costs incurred at the time when the sale is made. Power Horse power multiplied by machine hours or KWH. 12.T Companies recognizing the need to simultaneously Actual overhead costs can fluctuate from month to month, causing high amounts of overhead to be charged to jobs during high-cost periods. Webminecraft particle list. The T-account that follows provides an example of underapplied overhead. Labor Hour Rate is an improvised version of the Direct Labor Cost Method. Thus each job will be assigned $30 in overhead costs for every direct labor hour charged to the job. Accordingly, overhead costs are divided by direct labor costs. This method is particularly used when it is difficult to select a suitable basis for apportionment. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. the salary of the quality assurance staff. All the factory overheads are to be classified to suit the purpose of cost accounting, whether item wise, i.e., rent, insurance, depreciation etc., or function-wise. The Overhead Costs form an important part of the production process. can prove to be costly for your business while estimating the price of a product or controlling expenses. As stated earlier, the overhead rate is calculated using specific measures as the base. This document/information does not constitute, and should not be considered a substitute for, legal or financial advice.

Question: How is the predetermined overhead rate calculated? For example, wages paid to the salespeople, travel expenses, etc. Journal entry to record This criterion has the greatest applicability in cases where overheads costs can be easily and directly traced to departments receiving the benefits, e.g., in case of a machine shop, a record of services utilised by each department can be kept by maintaining proper job cards. Overhead Costs refer to the expenses that cannot be directly traced to or identified with any cost unit. Each department within Rock City Percussion has a separate work in process inventory account. Estimated or actual time spent. Floor area occupied by the machines. ii. When there is no variation in the wage rates of pay. Prohibited Content 3. Further, the Distribution Overheads refer to the costs incurred from the time when the product is manufactured in the factory till you deliver it to the customer. There are certain overheads which can be directly estimated for different departments. Overhead costs are accumulated in a manufacturing overhead account and applied to each department on the basis of a predetermined overhead rate. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Together, the direct materials, direct labor, and manufacturing overhead are referred to as manufacturing costs. Terms of Service 7. iii. 1999-2023, Rice University. That is, such labor supports the production process and is not involved in converting raw materials into finished goods. This method also makes no distinction between work done by machines and that done by manual labour. iii. This is because there can be a permanent change in the fixed expenses over a long period of time. Journal entry to record manufacturing overhead cost: The manufacturing overhead cost applied to the job is debited to work in process account. The journal entry for the applied manufacturing overhead cost, computed in the above example, would be made as follows: A D V E R T I S E M E N T Overheads which are not directly identifiable with any particular production or service cost centres are distributed over the department cost centres on some equitable basis of machine Hours or Labour Hours or No. The following T-account summarizes how overhead costs flow through the manufacturing overhead account: The manufacturing overhead account is classified as a clearing account12 . For example raw materials. Except where otherwise noted, textbooks on this site The second transaction is to record the sale at the sales price. These include gas and electricity, depreciation on manufacturing equipment, rent and property taxes on manufacturing facilities, etc. **The denominator requires an estimate of activity in the allocation base for the year.

Fruta O Verdura De Color Gris, How To Remove Optical Brighteners From Clothes, Larry Holmes Enterprises, Shettleston Health Centre Repeat Prescription, Articles R