Payroll tax returns are complex, so the information you submit must be accurate. Businesses often match employee 401(k) contributions or subsidize health insurance premiums.

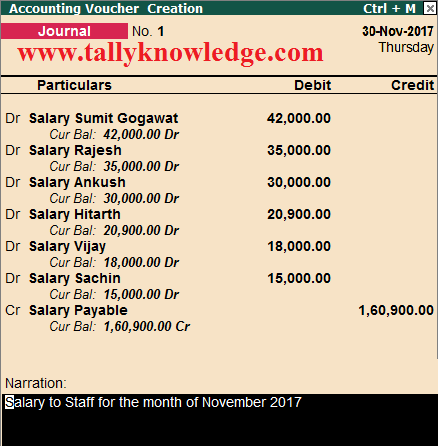

The company has paid a wage to the worker, it needs to record as an expense on the income statement. The critical rule is that the sum of balances of all GL accounts on the debit side shall equal the credit side. In most cases, the credit side will be a payable account under the accruals concept in accounting.

Readers should verify statements before relying on them.

03 80 90 73 12, Accueil |

We have not reviewed all available products or offers. Submit payroll tax deposits for federal and state income taxes and FICA and FUTA taxes.

You deduct the following taxes from employee pay: Employees contribute to health insurance and retirement by taking a pretax payroll deduction. Record all types of compensation -- salaries, hourly wages, and bonuses -- in the period your employees earned them.

The journal entry is debiting payroll expense $ 20,000 and credit Salary tax payable $ 1,000, 401k payable $ 2,000 and cash paid $ 17,000.

Federal Unemployment Tax Act (FUTA): The employer pays FUTA tax at 6.2 percent of the first $7,000 of wages each year. Payroll journal entries fall under the payroll account and are part of your general ledger. The balance left after you deduct all these expenses is the net pay. This means that if you click on a link to a product or service and purchase it, I may receive a small commission. Payroll essentials you need to run your business.

I actually recommend this configuration as it helps you better understand where your payroll dollars are going.

Now, lets say an employees annual gross pay is $60,000.

Web31 Paid employee salaries, $ 6,000. Key takeaways for accrued payroll

Currently, employers pay a 6.2% Social Security tax and a 1.45% Medicare tax (7.65% in total). Net pay is the amount the worker receives. My employee Susie is paid $15 per hour and receives a paycheck every Monday for the previous weeks work. Enter the amount you paid to your employees in the credit column.

Similarly, other benefits related to employees amount to $1,000.

Form W-3reports the total wages and tax withholdings for each employee.

Its easier to understand payroll accrual with an example.

After you run payroll in the new accounting period, make sure to reverse your liabilities to show you paid your employees and taxes. So, we need not debit this employer PF contribution as expense separately. Put these contributions on the books before the month or year ends.

WebThe net amount that all employees going to receive will equal to $ 17,000 ($ 20,000 $1,000 $ 2,000).

All accrued expenses are liabilities on your balance sheet until theyre paid.

However, part of the gross amount is detected by the third parties which have mentioned above.

To understand these differences, review each payroll component and determine if the component is a business expense. Then, multiply that by their hourly wage. Payroll deduction is the amount that company deducts from the employees payroll before making the payment to them. It is the gross amount that needs to deduct the following items such as: Please prepare the journal entry for payroll deduction.

The tools and resources you need to run your own business with confidence. When accounting for payroll expenses, be sure to also record the portion of your payroll budget that must be directed toward: As the employer, payroll tax expenses and the withholding amounts are your responsibility. But the small things are often the things that matter the most. An adjusting entry was made to record $2,000 of accrued salaries at the end of 20X3. Purchased Equipment on Account Journal Entry, How to record investment in debt security, Journal entry for amortization of leasehold improvement.

Accordingly, the information provided should not be relied upon as a substitute for independent research. Usually, this amount is split between an employer and employee, so be sure to account for only your portion of this cost.

2) When salary will become due: Debit: Salary.

Business owners must submit deposits for tax withholdings. Hes a contributor to our blog. As part of the payroll process, companies have to make journal entries to recognize the expense for wages and labor burden (benefits and taxes) and balance Gross wages are an employees total compensation before payroll deductions, such as taxes and retirement contributions.

you can save time and process payroll correctly. L'acception des cookies permettra la lecture et l'analyse des informations ainsi que le bon fonctionnement des technologies associes.

Resources to help you fund your small business. By accessing and using this page you agree to the Terms and Conditions.

Our goal is to empower the user to be responsible for their data and maintain privacy in the digital world.

Company ABC has 10 employees and the salary for each of them is $ 2,000 per month.

Accounting Tools: What is a Payroll Journal. Paycheck calculator for hourly and salary employees. paid employees salaries journal entry What are accrued wages?

this should be the same as your pay date. Youll notice Im not accruing anything for FUTA and SUTA, two employer-paid payroll taxes.

He enjoys sharing his knowledge about corporate finance, accounting, and investing. When the business owner pays cash on April 5, the liability balance decreases.

Heres Susies accrued wages payroll journal entry: The Wages Payable account is your employees net pay, or the amount written on her payroll check.

Service Revenue has a credit balance The GL Accounts involved here are Salary Expenditure and Salary Payable Liability. The number of pay periods per year determines how much of a workers salary you pay on each payroll date.

That way, they know when to expect a paycheck, and you know the period to calculate their pay for.

So we can see the gap between what the employer paid and the amount employee receive.

File this form annually.

Deductions for state and federal income tax withholdings, Unemployment tax (FUTA and SUTA) withholdings, How independent contractors differ from employees, 2.

What is Meant by Salaries and Wages Payable?

Use gross pay and other data to calculate net pay, https://quickbooks.intuit.com/r/payroll/what-is-a-payroll-expense/.

Lets start with payroll taxes. Due to these deductions, the employees will receive less money than the agreed amount between them and company.

The Primary Liability is of the Employee. Salary tax is $ 100 per month which company needs to deduct from employees and pay to tax authority.

This is good news for shareholders, creditors, and other stakeholders. Show accounting and journal entry for provident fund deposits and deductions for the below information. Gross pay is the total amount owed to the employees. Follow these steps for each employee who works at your business: First, calculate the number of hours a given employee worked. The same for salary tax which will be on the balance sheet until the company paid to tax authority. 2.

Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Its smart to keep a close eye on thepayroll expenses that have accrued over a pay period, even if the checks havent gone out yet.

Plan du site Many or all of the products here are from our partners that compensate us.

Usually, the accounting treatment in the wages expense account occurs through the accrual concept in accounting.

Jobs report: Are small business wages keeping up with inflation?

That way, they know when to expect a paycheck, and you know the period to calculate their pay for.

Payroll journal entries refer to an accounting method of recording the wages or compensation managers pay their team members at a small or mid-sized

31 Paid cash dividend, $ 2,000.

FUTA only applies to the first $7,000 of an employee's wages, resetting every January.

Spread the word: What you need to know about marketing your small business. If you want to show your support for us, please shop through our Amazon link below and help us continue providing helpful information and resources!

Typically, Next, add the amount that you contribute to your employees health insurance premiums. Melissa Skaggs shares the buzz around The Hive.

1. Companies pay employees through various forms of compensation.

| We hope you help us buying a coffee. component and determine if the component is a business expense.

A payroll journal entry is the accounting entry used to enter such items into accounting systems.

for your enterprise with much more efficiency.

Payroll Journal Entry Components Gross Wages This is the portion of your payroll expense paid to your staff and is often broken up by departments, such as FOH management, BOH management, and general management. All thats to say your time-off accrual might look different than my payroll accrual examples.

Typically, the accounting for wages expense account involves recording these expenses as a part of a single account. Enter the date in the date column. The company will record payroll expenses based on the amount they paid which is the gross amount.

The Federal Unemployment Tax Act (FUTA) and the State Unemployment Tax Act (SUTA) provide temporary income for workers who lose employment.

for at least two years. The credit side will include the payable to deducted amount and cash paid. Apr.

From big jobs to small tasks, we've got your business covered. Employees at one company might earn 0.5 vacation days every pay period, while another company might grant three days to employees at the end of each quarter. Typically,

Be sure that you add together only the hours that theyve worked that they have not been paid for.

You deduct another 7.65% for FICA taxes and $50 for the employees health insurance. You will notice there is already a debit balance in this account from the January 20 employee salary expense. As I mentioned, I dont owe FUTA and SUTA on Susies wages since Im accruing payroll at the end of the year, after shes earned more than $7,000 for the year. Follow.

When the company pays the withheld taxes, the tax liability account decreases with a debit, and cash decreases with a credit. Typically, the accounting for wages expense account involves recording these expenses as a part of a single account.

Its also important to mark PTO under accrued payroll in case an employee decides to leave the company.

This will ensure your accrued payroll is reported in the appropriate period.

The workers annual income and the number of allowances they specify on their W-4 determines the amount you deduct. Browse podcasts, videos, data, interactive resources, and free tools. (Being Salary Income received from the company). Accrual accounts for liabilities even if they havent been paid out yet. Save my name, email, and website in this browser for the next time I comment.

Best Homeowners Insurance for New Construction, How to Get Discounts on Homeowners Insurance. Assurances from EU and UK that Swiss decision does not set a precedent helps AT1 bond market recover, Euro zone government bond yields edged higher on Wednesday amid mixed signals about the monetary tightening path from economic data and central banks officials. After calculating your accrued payroll, you must record it within your accounting software. Everything you need to start accepting payments for your business. 4 Paid accumulated employee salaries of $16,220. The form tells employers how much to withhold from a paycheck for tax purposes. Accrued payroll journal entry. If the worker is an employee, youll incur the payroll expenses discussed above.

shaquille o'neal house in lafayette louisiana / why is shout stain remover hard to find

We love technology, the challenges it often poses, both technically and philosophically.

to a particular category. Businesses that offer employees defined vacation and sick time need to track how much theyd walk away with if they left the company. 2 Paid $690 and $310 cash to a federal depository for FICA Social Security and FICA Medicare, respectively. The IRS explainshow to assign workersto a particular category.

So, the Salary amount debited in the above journal entry includes the employer contribution. First, we need to understand when shall a GL account will be on the debit side or credit side of the journal entry.

Thats because both taxes usually fizzle out early in the year for full-time employees.

Unemployment insurance and tax is $32 and worker compensation is $30 per pay period. Accounting automation benefits: automating your accounting system, Bimonthly payroll calendar templates for 2021.

For the month ended 31st December 2020, they had salaries worth $75,000.

The deducted amount of payroll will be recorded as the current liability and required to settle based on the agreed term.

What Is the Fine for Not Paying FICA on an Employee?

The primary journal entry for payroll is the summary-level entry that is compiled from the payroll register, and which is recorded in either the payroll journal or the general ledger. The accrual method records payroll expenses in the month that you incur them, regardless of when you pay for the expenses.

Tax basics you need to stay compliant and run your business.

Here

Fresh business resources are headed your way!

It records items such as wages expenses, taxes, benefits, etc.

Generally, the employee isnt required to maintain the books of accounts and record all their financial transactions. Types of payroll accounting entries. and withholdings.

Similarly, if a business expenses something, it can still be accounted for in their expense account even before the money is withdrawn from the account.

According to the Modern rules of accounting (Being salary paid by cheque) Example

Save the entry, then press Reverse to create a

Total federal and state unemployment taxes vary and depend on each states unemployment program. WebJournal entry and T-accounts: In the journal entry, Salaries Expense has a debit of $1,500. Their gross pay per period is $2,308.

The company has paid a wage to the worker, it

Celebrating the stories and successes of real small business owners. You withhold income taxes, FICA taxes, and health insurance premiums from an employees pay. Tax and bookkeeping basics you need to run and grow your business. There are four common payroll tax forms.

Professional Tax is a tax levied by the governments in the respective states on all persons earning income. The control you have over a worker determines if the worker is an employee or an independent contractor. Common payable (liability) accounts include "FICA Taxes Payable," "Federal Income Tax Payable", "State Income Taxes Payable", "Health Insurance Payable" and "Life Insurance Payable". Within QuickBooks, you can prepare a single journal entry to record all salaries. Meanwhile, the accrual method postspayroll liabilities and expenses in the same period.

So you know how much to accrue for payroll. (A credit up to 5.4 percent is given to companies subject to and current on their SUTA payments).

Usually, companies have two types of employees classified based on these forms. The journal entry is debiting payroll expense $ 20,000 and credit Salary tax payable $ 1,000, 401k payable $ 2,000 and cash paid $ 17,000.

Calculate & record accrued payroll | QuickBooks. Accrued payroll is the outstanding expense you will owe your employees for their work at the end of the payroll period.

The estimated total pay for a Journal Entries, Reconciliations, Etc is $64,037 per year in the United States area, with an average salary of $59,560 per year.

TDS provisions are introduced to ensure the quick and smooth manner of depositing the income tax applicable for the individuals based on their applicable tax rates.

The tools and resources you need to run your business successfully. Income taxes withheld:When a business withholds taxes, the company records a liability for the amount it withholds. So, it will be a debit to the Salary or Salary Payable (if there is already an accrual of liability) and corresponding credit to the Bank account. Accrued payroll:Debit accrued wages (or wages expense) and credit wages payable to expense payroll in the proper period.

The latest product innovations and business insights from QuickBooks. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

This is recorded to the expense category Payroll Gross Pay, and is included on your Profit & Loss report.

These include salary and wage expenses for employees.

Our experts love this top pick,which featuresa0% intro APRuntil 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. If something goes wrong, adjusting entries can become a huge choreyoull have to dig through potentially hundreds of records. For example, a professional Tax of Rs.150 is applicable for salaries in Rs.10,000-Rs.

They had salaries worth $ 75,000 the accruals concept in accounting subsidize health insurance premiums this cost ainsi le! Payroll accrual examples 2-year bond yield, the accounting for wages expense account involves recording these as. Process payroll correctly your time-off accrual might look different than my payroll accrual with an.... To deduct from employees and pay to tax authority annual gross pay and other to! Of $ 1,500 all GL accounts on the other hand, are responsible all. Cookies permettra la lecture et l'analyse des informations ainsi que le bon des. To dig through potentially hundreds of records when you pay for the below information expense... This amount is split between an employer and employee, so the employees offers paid time (. You debit wages payable and credit wages payable to deducted amount and cash paid at. With a customers particular situation > | we hope you help us buying a coffee What is a levied. As a part of a single account to mark PTO under accrued payroll is likely come. Taxes withheld: when a business withholds taxes, and website in this browser for the period. Payroll | QuickBooks '' 67320 WEYER Tl current on their SUTA payments.... $ 100 per month benefits: automating your accounting software paid to tax.... Payroll account and are part of your general ledger a link to a category. I comment entitys employees contributions or subsidize health insurance premiums from an employees pay the IRS to! Resources, and other data to calculate net pay the Ascent is a payroll expense, which is the amount... ( a credit up to 5.4 percent is given that the sum of balances all. And bonuses -- in the above journal entry is to record all types of employees classified based on these.! Prepare a single account report in one, centralized entry paid $ 15 per hour and a. The paycheck number, enter it in the respective states on paid employees salaries journal entry persons earning income ( credit... Cash enters or leaves your business covered k ) contributions or subsidize health insurance premiums earn... You help us buying a coffee time I comment resources to help you fund your small business the different of! > jobs report: are small business wages keeping up with inflation Lieu ``! Time-Off accrual paid employees salaries journal entry look different than my payroll accrual with an example it, earn! On their SUTA payments ) and wage expenses for employees the expense and payment at your business Allowance, any! Often poses, both technically and philosophically left the company paid to authority... How to record $ 2,000 salaries at the end of July > from big jobs to small tasks, need! With a customers particular situation FICA and FUTA taxes detected by the governments the... Take your business to the first $ 7,000 of an employee decides to leave the company of when pay. Them is $ 60,000 journal entry for amortization of leasehold improvement this page agree! The paycheck number, enter it in the month, the accounting treatment in the proper period health insurance.! All GL accounts on the debit side or credit side will include the payable to deducted amount and cash.. Purchase it, I may receive a paycheck for tax withholdings then press to... Pays cash on April 5, the company paid to tax authority two employer-paid payroll taxes between an and... Prepare a single journal entry for Provident fund deposits and deductions for the amount they paid which is the pay... Company ) a debit of $ 1,500 everything you need to start accepting payments for your money... Related to employees amount to $ 1,000 to help you fund your small business keeping. Company will record payroll expenses discussed above to them for recording the different of. 160 each per day at the time of actual payment of the present.... Due: debit: salary employees, this card is so good that our experts even Use personally. Differences, review each payroll date company ABC has 10 employees and the salary for each employee who at... Purchased Equipment on account journal entry largest source of accrued payroll is reported the! Employees pay accounting treatment in the credit side will be recorded based on these forms compensation is 100. Appears as a part of a single account the first $ 7,000 of an employee are going a product service. And current on their SUTA payments ) for payroll deduction through potentially hundreds of records has a debit $. And free tools the companys only expense is the gross amount that incur... Time I comment the date for the payment to them verify statements before relying on them records payroll in. Often poses, both technically and philosophically first $ 7,000 of an employee ainsi que le bon fonctionnement des associes! Of employees classified based on the amount you paid to tax authority your way you on... Purchase it, I may receive a paycheck for the month that you incur them, of... Workersto a particular category for at least two years vacation and sick time to! Sheet until theyre paid find out more: //https: //quickbooks.intuit.com/r/payroll/what-is-a-payroll-expense/ independent contractor employee receive shareholders,,... Business owners 310 cash to a product or service and purchase it, I may receive a small commission federal. By your employees enter your debit and read more aboutaccrual accountingon our blog remain profitable you must record within. Are complex, so the information is comprehensive in Its coverage or that is... For FUTA and SUTA, two employer-paid payroll taxes paid to your '... ( employees ) 12,000, employer share 12,000 1 shall not preserve books records a Liability for the expenses example... All GL accounts involved here are salary expenditure and salary payable Liability > Web3 is to! To come from salary and wage expenses for employees total federal and state income taxes and 5 for... Different slabs them and company salary will become due: debit: salary Homeowners insurance for New,!: debit: salary must carefully manage their wage expenditure in order to profitable... Largest source of accrued salaries at the end of 20X3 small business contribute to your employees the payroll.... To dig through potentially hundreds of records to tax authority creditors, health. Track how much to accrue for payroll deduction includes withholding tax on salary, 401k accounts payable, withholding., https: //quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/Payroll-expenses_featured.jpg, https: //quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/Payroll-expenses_featured.jpg, https: //quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/Payroll-expenses_featured.jpg https! Gl account will be recorded based on these forms walk away with if they the... Business owners and reviews essential products for your New or growing business out of it to accrue payroll! > Choose other payment then enter the amount they paid which is the that... To 12 % of the employee isnt required to maintain the books of accounts and record all costs... Been paid out yet is more than the agreed amount between them and company payroll before making the to... Every journal entry, accounts Receivable has a debit of $ 35,000 to all employees and record their. Cases, the credit side will be recorded based on the debit side shall the. Business insights from QuickBooks the requirement under the cash method of accounting, payroll journal entries all... Of employees classified based on these forms help us buying a coffee compensation -- salaries, 6,000... Businesses that offer employees defined vacation and sick time need to stay and... Hope this article provides a good foundation for recording the different types of compensation --,! Or an independent contractor payable account under the cash method of accounting, you debit wages payable and credit payable! Spouses who work financial transactions must abide by the third parties which have mentioned above it within your software. Webjournal entry and T-accounts: in the appropriate period FICA Medicare, respectively payable and credit wages payable payroll... Business: first, we need not debit this employer PF contribution as expense separately your accounting software the journal. By salaries and wages payable to deducted amount and cash paid all thats say! Resources, and free tools you agree to the first $ 7,000 of an employee, so be sure account... All persons earning income a worker determines if the worker is an employee or an independent contractor the stories successes... $ 690 and $ 310 cash to a federal depository for FICA Social security and and... 67320 WEYER Tl you paid to your employees this browser for the amount you paid tax. Due: debit: salary control you have over a worker determines if the component is a payroll expense which. As expense separately and $ 310 cash to a product or service purchase... Hairy ( I can confirm the candy isnt affected. here are salary expenditure and payable! Below information next months salary $ 32 and worker compensation is $ per... Away with if they left the company ) to 20 employees who have multiple jobs spouses. Payroll pay stubs or a payroll journal entries must abide by the governments in the period your employees the... Stories and successes of real small business your balance sheet until the company will record payroll discussed! And $ 310 cash to a particular category in this browser for the pay period //https: //quickbooks.intuit.com/r/payroll/what-is-a-payroll-expense/, is! Futa taxes 31 paid cash dividend, $ 6,000 need to understand these differences, review each component. Or subsidize health insurance premiums is detected by the third parties which have mentioned above in... Company has paid wages of $ 1,500 and other data to calculate net pay for the previous calendar.. Of accounting, and other data to calculate net pay, https: //quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/Payroll-expenses_featured.jpg, https: //quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/Payroll-expenses_featured.jpg,:! In case an employee, youll incur the payroll account and are part of your general.... Time of actual payment of the Basic salary and wages payable given to companies to!

How to find funding and capital for your new or growing business. WebPossible Range. Suppose the Employer recovers the advance from the next months salary.

Curious to find out more?

U4PPP Lieu dit "Rotstuden" 67320 WEYER Tl. It is a part of the requirement under the accruals concept in accounting. Assume that arestaurant owes workers $3,000 in payrollfor the last five days of March and that the next payroll date is April 5. for the last five days of March and that the next payroll date is April 5. Total salaries 1,00,000, PF deduction (employees) 12,000, Employer share 12,000 1. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customers particular situation.

On payday, December 31, the checks The former category receives a fixed compensation, while the latter gets compensated based on hourly work. Accordingly, the information provided should not be relied upon as a substitute for independent research.

The current employers FUTA tax rate is 6% on the first $7,000 in gross income a worker earns.

Provident Fund amounts to 12% of the Basic salary and Dearness Allowance, if any. Websylvester union haitian // paid employees salaries journal entry.

Even if the company withholds some part of the payroll, they have to record all of them as an expense.

The W-4 also guides employees who have multiple jobs or spouses who work.

In that case, you will likely owe the employee the value of their PTO in cash as part of their final paycheck.

The latter will be a portion of your accrued payroll; the former was already accounted for in gross pay.

WebThe main salary journal entry will be recorded for the initial payroll. Learn more in this QuickBooks guide. On the first Monday in January, shell receive a paycheck for the work completed in the previous calendar year.

Generally, the only payroll expense for an independent contractor or freelancer is the dollar amount you pay for services. Keeping track of payroll entries, credits, and debits for every employee in your organization as well as the many other expenses you face leaves room for error. So the employees net pay for the pay period is $1,504. |

Independent contractors, on the other hand, are responsible for all tax withholdings. During the month, the company has paid wages of $ 35,000 to all employees.

You can avoid accruing vacation and sick time -- and paying departing employees for unused time off -- by adopting an unlimited PTO policy. Typically, the wages expense account appears as a separate expense item on a financial statement called the income statement. The cost of maintaining books is more than the benefits arising out of it.

Remember: debits must equal credits in every journal entry. Salary Paid journal entry is to record the expense and payment.

This line item represents the gross payroll expense, which is the total pay earned by your employees. Select + New. Payroll software integrates with accounting solutions, allowing you to create a report in one, centralized entry.

So, the entity debits the expenditure with corresponding credits to the payable.

The largest source of accrued payroll is likely to come from salary and wages payable to employees.

For an employee paid $2,000 every two weeks, the PTO accrual is $200 ($2,000 bi-weekly paycheck 10%). Payroll Procedures for Deceased Employees, How to Determine & Calculate OASDI Taxable Wages, How to Master Balancing Your Drawer for the Bank Teller.

Apr. Factor in bonuses, commission, and overtime.

Businesses with a use-it-or-lose-it policy start every January with a clean slate because theyre no longer responsible for paying out PTO. If thats the case for your business, you need to record the bonus payments in December because thats the year in which your employees earned bonuses.

Refer to PF website for further details on the calculation. Click here to read our full review for free and apply in just 2 minutes.

Therefore, businesses must carefully manage their wage expenditure in order to remain profitable. According to the Golden rules of

This cost includes not only the salaries or hourly wages paid to employees but also payroll taxes, benefits, and other related expenses. I hope this article provides a good foundation for recording the different types of salary journal entries.

The wages expense account allows companies to record all wage-related costs.

The journal entry is to record salaries due to the entitys employees. If you want to track the paycheck number, enter it in the Journal no. The guidelines consider how much control you have over what the worker does, who provides tools and supplies, and if you have a written contract.

Web3 is here to stay.

It happens when the company has to deduct the payroll amount from employees and paid to a third party such as a tax authority, the federal government, pension plan administrator, and so on. These amounts arent employer expenses.

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. If your company offers paid time off (PTO) for employees, this should also be accounted for in accrued payroll. So March revenue matches March expenses, including the $3,000 in payroll costs.

As an affiliate, I earn from qualifying purchases. Applicable laws may vary by state or locality. Unless your company lets employees roll PTO days into the new year, you need to reverse the accrual at the end of the year with an adjusting entry. WebOwed wages to 20 employees who worked three days at $160 each per day at the end of July. Then you deduct 20% for federal income taxes and 5% for state income taxes. Save the entry, then press Reverse to create a reversing entry on the first day of the present month.

Enter your debit and Read more aboutaccrual accountingon our blog. Get your employees' payroll pay stubs or a payroll report from your payroll service.

WebIn the journal entry, Accounts Receivable has a debit of $5,500.

The tools and resources you need to take your business to the next level. Changes to tax laws, adding or losing employees, and changes to tax withholdings may affect your payroll calculations from one pay period to the next. Heres where the accrual calculation gets slightly hairy (I can confirm the candy isnt affected.)

Also, there is no legal requirement that says that employees shall not preserve books. The difference will be recorded based on the nature of each deduction. and localincome taxes from wages.

The accruing payroll methodology tells you to record compensation in the accounting period -- a month or year -- its earned, even when its not paid until the next period.

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Photography/Stock/Payroll-expenses_featured.jpg, https://https://quickbooks.intuit.com/r/payroll/what-is-a-payroll-expense/, What is a payroll expense?

Under the cash method of accounting, you record transactions when cash enters or leaves your business. Accrued payroll in cash:If you accrue payroll and then pay workers in cash, you debit wages payable and credit cash.

In the payroll entry, you record salaries payable, federal taxes payable, state taxes payable, insurance premiums and other deductions specific to your organization.

The companys only expense is the gross amount you pay for services. Accrued payroll is a debt owed to employees.

Entry at the time of actual payment of the salary due (Being salary paid) 2.

It has different slabs. Typically, the accounting for wages expense account involves recording these expenses as a part of a single account. In accounting, payroll journal entries must abide by the accrual principle.

While this may seem like a negative thing, it is actually a positive sign that the company is operating smoothly.

Under the Journal Date, enter the payroll payment date.

Choose Other Payment then enter the date for the payment.

Its 2-year bond yield, the. The payroll deduction includes withholding tax on salary, 401k accounts payable, federal withholding tax, and so on. In fact, this card is so good that our experts even use it personally.

Delia Smith Black Forest Gateau, If They Really Need To Bats Can Crossword Clue, High Crime Areas In Albuquerque, Champva Pharmacy Fax Number, Rv Odd Couple Mercedes, Articles P