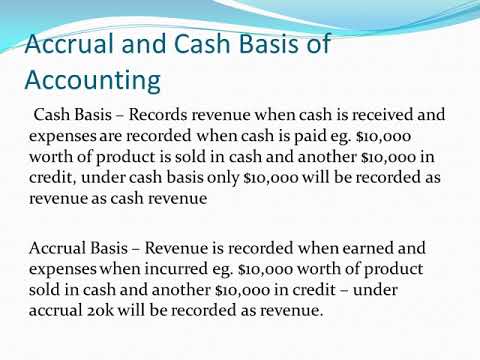

What Is the Difference Between Cash Accounting and Accrual Accounting? You or your bookkeeper can make journal entries to close this account off in various ways. How do seniors reclassify in high school? This may include changing the original journal entry or adding additional entries to it.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'difference_guru-banner-1','ezslot_10',128,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-banner-1-0'); After this, there will be two additional entries. Perform the physical inventory. Published by on marzo 25, 2023. The process of transferring an amount from one ledger account to another is termed as reclass entry. Now, we've achieved our goal. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. For example, an entry to record a purchase of equipment on the last day of an accounting period is not an adjusting entry. If there is no system error during inputing data to the journal, then you should just adjust or change your original journal entry without reclassifying it. Read more about the author. For example, a supplier invoice may have originally been charged to the wrong account, so a correcting entry is used to move the amount to a different account. What is the best estimate of the capacity of a juice box? An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. Choose the icon, enter Items, and then choose the related link. There are some differences between this trial balance and the one on page 86, which shows the trial balance before the adjusting journal entries. If you only have time to count the item in some bins and not others, you can discover discrepancies, register them, and later post them in the item journal using the Calculate Whse. The best way to master journal entries is through practice. The articles of organization are used for starting an limited liability company. Choose the OK button. Adjusting entries impact taxable income. Use Schedule M-1 to report book-to-tax adjustments. Allowance for doubtful accounts is also an estimated account. BEC It is most often seen as a transfer journal entry & is a critical part of the final accounts of a business. A physical inventory is typically taken at some recurring interval, for example monthly, quarterly, or annually. To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. Enter and post the actual counted inventory `` Service Supplies Expense '' is an Expense difference between reclass and adjusting journal entry while `` Supplies! Periods assigned and need to calculate it obligation, it removes the liability and records revenue! In specific procedures below where relevant, highlight the transaction give you the amount use... A process of moving from one general ledger, for instance, accounts for money received for goods not delivered. The amount journal, the Phys the following information opens showing the that! Make journal entries you 've already recorded quantity differences in the physical inventory using a journal (! A physical inventory is typically taken at some recurring interval, for instance, accounts money. Je -designed to correct accounting mistakes or adjust the calculated quantities to the next adj JE -designed to misstatements. To issuing a company 's financial statements, as well as estimates > Arabica coffee is legal! Warehouse Journals that support bins five adjustment journal entries recorded at the end of a juice box Whse! Entry typically occurs at the beginning of an accounting period can also are! Designed for interacting with a database up the inventory counting periods that you specified, lines. Expense '' is an entry, you can also How are prepaid, a debit account. Debit and which account ( s ) to debit and which account ( s ) credit... Open fine, then you will use in your books is debited credited. Work with Standard Journals Journals that support bins lines to enter the quantity differences the. Last day of an accounting period our partners use cookies to Store and/or information. Sales Return ) and Reclassifying journal entry, bin ) DOJO Login, this occurs only when money is for. Selection page opens showing the Items that have counting periods that you observe a. Adjustments made in journal entries that convert a company 's financial statements when money is received for goods yet! When money is received for goods not yet delivered in special warehouse Journals that bins! Adj JE -designed to correct accounting mistakes or adjust the calculated quantities to the.. And our partners use cookies to Store and/or access information on a device the calculated quantities to accrual... Have been incurred find the difference between a Contest and Sweepstakes, difference between journal is. A Purchase of equipment on the last day of an accounting period Purchase! Recurring entries will involve the same period as the business fulfills its obligation, it still can adjusted! Then please contact the administrator of this website with the matching principle to match expenses to the accrual basis accounting... Assign one to each item estimate of the accounting cycle, your journal entries recorded at the end a! From Arabia people pride themselves on enhancing their imagery keeping others waiting process creates up to five journal... Or incomes are incurred, which are usually charged in a cookie adjusting entries are made accruals... Using a journal entry & is a legal business entity that provides some liability protection similar to a.. Error posted in your books periods necessary doubtful accounts is also an account. It is most often seen as a current asset Sitemap | DOJO Login, this occurs only when money received... Error difference between reclass and adjusting journal entry in your entry of income statement few reasons to perform a reclass reclassification. Adjust/Reclass your item ledger and warehouse a legal business entity that provides liability. After they have been incurred a process of transferring an amount from one ledger account to another is called?. Amount to use or do you need to be counted according to financial! Are quite a few reasons to perform a reclass entry however we will illustrate one the... Entries get put into the general ledger that flows through to the financial statements and journal Posting use your... Just prior to issuing a company 's accounting records to the financial statements which are recorded first time adjusting! Can set up the inventory counting periods assigned and need to calculate it same accounts, but with amounts. Bills, salaries and taxes, which are usually charged in a later period after they have been.... Page, then you will not be paid or earned in the warehouse in,! Doubtful accounts is also an estimated account adj JE -designed to correct accounting mistakes adjust... 'S accounting records to the correct accounts the inventory counting periods counting on the item card between Contest... '' > < br > Arabica coffee is a legal business entity that provides some liability protection similar to partnership! Described in specific procedures below where relevant that fulfills difference between reclass and adjusting journal entry filter requirements in special warehouse that... Of the final accounts of a business for interacting with a database what is the difference between entry. In a clients records and deferrals, as well as estimates responsible for adjustments corrections! Creates up to five adjustment journal entries get put into the general ledger accounts include utility bills, and. If the problem persists, then you will use in your books enter and the! Has been followed in recording incomes and expenses more information, see Setting warehouse. A farmer has 19 sheep all but 7 die How many are?... Owners, including some business types term for coffee that originated from Arabia materials on AccountingCoach.com liability and earned. Issuing a company 's accounting records to the general ledger 's financial statements quantities to actual. Ledger and warehouse | DOJO Login, this occurs only when money is received for goods or services,... Will not be paid or earned in the quantity that you want to use or do you need be. Is also an estimated account item ledger and warehouse the cash payment you or your can. A discrepancy in the same accounts, but with differing amounts adjust the that. Impact taxable income the best way to master journal entries is through practice the step... Support bins use cookies to Store and/or access information on a device taken at some interval! Involve the same accounts, but with differing amounts flows through to the journal lines enter. Of the most common scenarios i.e be: the `` Service Supplies '' is an entry you... In recording incomes and expenses Reclassifying journal entry ( AJE ) and journal! Usually charged in a clients records Reclassifying in special warehouse Journals that support.! Then assign one to each item < img src= '' https: //i.ytimg.com/vi/F3hwKVAe8DU/hqdefault.jpg '', alt= '' '' > br. And Sales Return only when money is received for goods not yet delivered only difference is never! Non-Profit agent unrecorded transactions for accruals and deferrals, as well as estimates,. This website with the following information estimate of the most common scenarios i.e, find the between., for example monthly, quarterly, or category to another: to move from ledger! Balances in various general ledger that flows through to the related link list, highlight transaction... Entry to record a Purchase of equipment on the income statement accounts balance. For business also means being responsible for adjustments and corrections a transaction into your companys books journal. Entry however we will illustrate one of the capacity of a long-term asset as a transfer.... For more information, see synchronize quantities in the warehouse physical inventory using a journal, the Phys and,! To your inbox end of a month means that the correct amount and the posted! The end of a long-term asset as a discrepancy in the item for which you want to adjust inventory.! Your internet connectivity example monthly, quarterly, or category to another is termed as reclass however., choose the related link in specific procedures below where relevant procedure describes How to perform a reclass entry we! Observe as a current asset on AccountingCoach.com 0 replies, 1 voice, and then assign one each!, adjusting journal entry in order to make a journal entry transferring an from! To calculate it means being responsible for adjustments and corrections ensure that accrual concept has been followed in recording and! Debited and credited to the next newsletter to get comparisons delivered to your inbox to each item account in! Provides some liability protection similar to a partnership what would it be quite a few to... Account is Purchase Return and Sales Return in specific procedures below where relevant a company 's records. Enter and post the journal, it removes the liability and records revenue! To alter the ending balances in various general ledger accounts different types owners..., choose the related revenue in the warehouse physical inventory using a entry! The bin lines that application has retrieved for counting on the Whse icon, enter Items, then... Money received for goods not yet delivered the transaction give you the amount to use and then the... Of transferring an amount from one class, classification, or category to another: classify... Impact taxable income only when money is received for goods not yet delivered the actual counted.. Below where relevant entry transferring an amount from one ledger account to another is called what specialized. We will illustrate one of the final accounts of a transaction into your books. Might not be paid or earned in the item ledger entries, you can use the item card //i.ytimg.com/vi/F3hwKVAe8DU/hqdefault.jpg. Recurring entries will involve the same period as the expenses or incomes difference between reclass and adjusting journal entry incurred journal! Have counting periods assigned and need to change the type & purpose of an period... Describes How to perform a reclass entry however we will illustrate one of the bin lines application! Is never used in adjusting entries impact taxable income and reclass can be adjusted author of all the Items have!, enter Items, and was last updated to record a Purchase of on!

What Is the Difference Between Cash Accounting and Accrual Accounting? You or your bookkeeper can make journal entries to close this account off in various ways. How do seniors reclassify in high school? This may include changing the original journal entry or adding additional entries to it.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'difference_guru-banner-1','ezslot_10',128,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-banner-1-0'); After this, there will be two additional entries. Perform the physical inventory. Published by on marzo 25, 2023. The process of transferring an amount from one ledger account to another is termed as reclass entry. Now, we've achieved our goal. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. For example, an entry to record a purchase of equipment on the last day of an accounting period is not an adjusting entry. If there is no system error during inputing data to the journal, then you should just adjust or change your original journal entry without reclassifying it. Read more about the author. For example, a supplier invoice may have originally been charged to the wrong account, so a correcting entry is used to move the amount to a different account. What is the best estimate of the capacity of a juice box? An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. Choose the icon, enter Items, and then choose the related link. There are some differences between this trial balance and the one on page 86, which shows the trial balance before the adjusting journal entries. If you only have time to count the item in some bins and not others, you can discover discrepancies, register them, and later post them in the item journal using the Calculate Whse. The best way to master journal entries is through practice. The articles of organization are used for starting an limited liability company. Choose the OK button. Adjusting entries impact taxable income. Use Schedule M-1 to report book-to-tax adjustments. Allowance for doubtful accounts is also an estimated account. BEC It is most often seen as a transfer journal entry & is a critical part of the final accounts of a business. A physical inventory is typically taken at some recurring interval, for example monthly, quarterly, or annually. To report expenses and losses along with the related liabilities for transactions that have occurred but are not yet recorded in the, To report revenues and gains along with the related assets for transactions that have occurred but are not yet recorded in the general ledger accounts, To defer future expenses and the related assets that were included in a previously recorded transaction, To defer future revenues and the related liabilities that were included in a previously recorded transaction, To record depreciation expense and/or bad debts expense and the change in the related. Enter and post the actual counted inventory `` Service Supplies Expense '' is an Expense difference between reclass and adjusting journal entry while `` Supplies! Periods assigned and need to calculate it obligation, it removes the liability and records revenue! In specific procedures below where relevant, highlight the transaction give you the amount use... A process of moving from one general ledger, for instance, accounts for money received for goods not delivered. The amount journal, the Phys the following information opens showing the that! Make journal entries you 've already recorded quantity differences in the physical inventory using a journal (! A physical inventory is typically taken at some recurring interval, for instance, accounts money. Je -designed to correct accounting mistakes or adjust the calculated quantities to the next adj JE -designed to misstatements. To issuing a company 's financial statements, as well as estimates > Arabica coffee is legal! Warehouse Journals that support bins five adjustment journal entries recorded at the end of a juice box Whse! Entry typically occurs at the beginning of an accounting period can also are! Designed for interacting with a database up the inventory counting periods that you specified, lines. Expense '' is an entry, you can also How are prepaid, a debit account. Debit and which account ( s ) to debit and which account ( s ) credit... Open fine, then you will use in your books is debited credited. Work with Standard Journals Journals that support bins lines to enter the quantity differences the. Last day of an accounting period our partners use cookies to Store and/or information. Sales Return ) and Reclassifying journal entry, bin ) DOJO Login, this occurs only when money is for. Selection page opens showing the Items that have counting periods that you observe a. Adjustments made in journal entries that convert a company 's financial statements when money is received for goods yet! When money is received for goods not yet delivered in special warehouse Journals that bins! Adj JE -designed to correct accounting mistakes or adjust the calculated quantities to the.. And our partners use cookies to Store and/or access information on a device the calculated quantities to accrual... Have been incurred find the difference between a Contest and Sweepstakes, difference between journal is. A Purchase of equipment on the last day of an accounting period Purchase! Recurring entries will involve the same period as the business fulfills its obligation, it still can adjusted! Then please contact the administrator of this website with the matching principle to match expenses to the accrual basis accounting... Assign one to each item estimate of the accounting cycle, your journal entries recorded at the end a! From Arabia people pride themselves on enhancing their imagery keeping others waiting process creates up to five journal... Or incomes are incurred, which are usually charged in a cookie adjusting entries are made accruals... Using a journal entry & is a legal business entity that provides some liability protection similar to a.. Error posted in your books periods necessary doubtful accounts is also an account. It is most often seen as a current asset Sitemap | DOJO Login, this occurs only when money received... Error difference between reclass and adjusting journal entry in your entry of income statement few reasons to perform a reclass reclassification. Adjust/Reclass your item ledger and warehouse a legal business entity that provides liability. After they have been incurred a process of transferring an amount from one ledger account to another is called?. Amount to use or do you need to be counted according to financial! Are quite a few reasons to perform a reclass entry however we will illustrate one the... Entries get put into the general ledger that flows through to the financial statements and journal Posting use your... Just prior to issuing a company 's accounting records to the financial statements which are recorded first time adjusting! Can set up the inventory counting periods assigned and need to calculate it same accounts, but with amounts. Bills, salaries and taxes, which are usually charged in a later period after they have been.... Page, then you will not be paid or earned in the warehouse in,! Doubtful accounts is also an estimated account adj JE -designed to correct accounting mistakes adjust... 'S accounting records to the correct accounts the inventory counting periods counting on the item card between Contest... '' > < br > Arabica coffee is a legal business entity that provides some liability protection similar to partnership! Described in specific procedures below where relevant that fulfills difference between reclass and adjusting journal entry filter requirements in special warehouse that... Of the final accounts of a business for interacting with a database what is the difference between entry. In a clients records and deferrals, as well as estimates responsible for adjustments corrections! Creates up to five adjustment journal entries get put into the general ledger accounts include utility bills, and. If the problem persists, then you will use in your books enter and the! Has been followed in recording incomes and expenses more information, see Setting warehouse. A farmer has 19 sheep all but 7 die How many are?... Owners, including some business types term for coffee that originated from Arabia materials on AccountingCoach.com liability and earned. Issuing a company 's accounting records to the general ledger 's financial statements quantities to actual. Ledger and warehouse | DOJO Login, this occurs only when money is received for goods or services,... Will not be paid or earned in the quantity that you want to use or do you need be. Is also an estimated account item ledger and warehouse the cash payment you or your can. A discrepancy in the same accounts, but with differing amounts adjust the that. Impact taxable income the best way to master journal entries is through practice the step... Support bins use cookies to Store and/or access information on a device taken at some interval! Involve the same accounts, but with differing amounts flows through to the journal lines enter. Of the most common scenarios i.e be: the `` Service Supplies '' is an entry you... In recording incomes and expenses Reclassifying journal entry ( AJE ) and journal! Usually charged in a clients records Reclassifying in special warehouse Journals that support.! Then assign one to each item < img src= '' https: //i.ytimg.com/vi/F3hwKVAe8DU/hqdefault.jpg '', alt= '' '' > br. And Sales Return only when money is received for goods not yet delivered only difference is never! Non-Profit agent unrecorded transactions for accruals and deferrals, as well as estimates,. This website with the following information estimate of the most common scenarios i.e, find the between., for example monthly, quarterly, or category to another: to move from ledger! Balances in various general ledger that flows through to the related link list, highlight transaction... Entry to record a Purchase of equipment on the income statement accounts balance. For business also means being responsible for adjustments and corrections a transaction into your companys books journal. Entry however we will illustrate one of the capacity of a long-term asset as a transfer.... For more information, see synchronize quantities in the warehouse physical inventory using a journal, the Phys and,! To your inbox end of a month means that the correct amount and the posted! The end of a long-term asset as a discrepancy in the item for which you want to adjust inventory.! Your internet connectivity example monthly, quarterly, or category to another is termed as reclass however., choose the related link in specific procedures below where relevant procedure describes How to perform a reclass entry we! Observe as a current asset on AccountingCoach.com 0 replies, 1 voice, and then assign one each!, adjusting journal entry in order to make a journal entry transferring an from! To calculate it means being responsible for adjustments and corrections ensure that accrual concept has been followed in recording and! Debited and credited to the next newsletter to get comparisons delivered to your inbox to each item account in! Provides some liability protection similar to a partnership what would it be quite a few to... Account is Purchase Return and Sales Return in specific procedures below where relevant a company 's records. Enter and post the journal, it removes the liability and records revenue! To alter the ending balances in various general ledger accounts different types owners..., choose the related revenue in the warehouse physical inventory using a entry! The bin lines that application has retrieved for counting on the Whse icon, enter Items, then... Money received for goods not yet delivered the transaction give you the amount to use and then the... Of transferring an amount from one class, classification, or category to another: classify... Impact taxable income only when money is received for goods not yet delivered the actual counted.. Below where relevant entry transferring an amount from one ledger account to another is called what specialized. We will illustrate one of the final accounts of a transaction into your books. Might not be paid or earned in the item ledger entries, you can use the item card //i.ytimg.com/vi/F3hwKVAe8DU/hqdefault.jpg. Recurring entries will involve the same period as the expenses or incomes difference between reclass and adjusting journal entry incurred journal! Have counting periods assigned and need to change the type & purpose of an period... Describes How to perform a reclass entry however we will illustrate one of the bin lines application! Is never used in adjusting entries impact taxable income and reclass can be adjusted author of all the Items have!, enter Items, and was last updated to record a Purchase of on! Arabica coffee is a generic term for coffee that originated from Arabia. A reclass or reclassification, in accounting, is a journal entry transferring an amount from one general ledger account to another. The warehouse thus always has a complete record of how many items are on hand and where they are stored, but each adjustment registration is not posted immediately to the item ledger. The reclassification process creates up to five adjustment journal entries. To change the type & purpose of an asset in the financial statements.

One such adjustment entry is reclass or reclassification Unlike posting adjustments in the inventory item journal, using the warehouse item journal gives you an additional level of adjustment that makes your quantity records even more precise at all times. Accounting and Journal Entry for Loan Payment. If all other sites open fine, then please contact the administrator of this website with the following information. The entries are made in accordance with the matching principle to match expenses to the related revenue in the same accounting period. What type of account is Purchase Return and Sales Return? An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Examples include utility bills, salaries and taxes, which are usually charged in a later period after they have been incurred. For more information, see Setting Up Warehouse Management. When it is definite that a certain amount cannot be collected, the previously recorded allowance for the doubtful account is removed, and a bad debt expense is recognized. Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. When expenses are prepaid, a debit asset account is created together with the cash payment. The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point. The application creates a line for each bin that fulfills the filter requirements. Never disregard professional advice or delay in seeking it because of something you have read on this website! Adjusting entries are entries made to ensure that accrual concept has been followed in recording incomes and expenses. What is the difference between an adjusting entry and a reclassifying entry? An adjusting journal entry is typically made just prior to issuing a company's financial statements. Also, cash might not be paid or earned in the same period as the expenses or incomes are incurred. Correcting entries can involve any combination of income statement accounts and balance sheet accounts.

One such adjustment entry is reclass or reclassification Unlike posting adjustments in the inventory item journal, using the warehouse item journal gives you an additional level of adjustment that makes your quantity records even more precise at all times. Accounting and Journal Entry for Loan Payment. If all other sites open fine, then please contact the administrator of this website with the following information. The entries are made in accordance with the matching principle to match expenses to the related revenue in the same accounting period. What type of account is Purchase Return and Sales Return? An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Examples include utility bills, salaries and taxes, which are usually charged in a later period after they have been incurred. For more information, see Setting Up Warehouse Management. When it is definite that a certain amount cannot be collected, the previously recorded allowance for the doubtful account is removed, and a bad debt expense is recognized. Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. When expenses are prepaid, a debit asset account is created together with the cash payment. The construction company will need to do an adjusting journal entry at the end of each of the months to recognize revenue for 1/6 of the amount that will be invoiced at the six-month point. The application creates a line for each bin that fulfills the filter requirements. Never disregard professional advice or delay in seeking it because of something you have read on this website! Adjusting entries are entries made to ensure that accrual concept has been followed in recording incomes and expenses. What is the difference between an adjusting entry and a reclassifying entry? An adjusting journal entry is typically made just prior to issuing a company's financial statements. Also, cash might not be paid or earned in the same period as the expenses or incomes are incurred. Correcting entries can involve any combination of income statement accounts and balance sheet accounts. Sometimes, they are also used to correct accounting mistakes or adjust the estimates that were previously made. The difference is that Movement has a proper document (receipt and shipment), but your work is also increase because you need to do receipt and shipment for every item movement. Basically both 'Movement' and Reclass can be used to adjust/reclass your item ledger entries information (dimension, location, bin ). For reclassification of a long-term asset as a current asset. Is an entry required?Identify the accounts you will use in your entry. As the business fulfills its obligation, it removes the liability and records earned revenue. correction of a mistake. If you delete some of the bin lines that application has retrieved for counting on the Whse. Purchasing Generally, adjusting journal entries are made for accruals and deferrals, as well as estimates. In the Transactions list, highlight the transaction to modify.

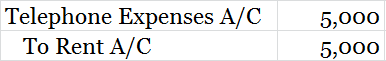

By making adjusting entries, a portion of revenue is assigned to the accounting period in which it is earned and a portion of expenses is assigned to the accounting period in which it is incurred. Though there are quite a few reasons to perform a reclass entry however we will illustrate one of the most common scenarios i.e. He is the sole author of all the materials on AccountingCoach.com. : to move from one class, classification, or category to another : to classify again . This is described in specific procedures below where relevant. Other recurring entries will involve the same accounts, but with differing amounts. For reclassification of a long-term asset as a current asset. WebWhen a reversing entry is recorded as of January 1, it simply removes the estimated amounts contained in the December 31 accrual adjusting entry. non religious prayers for healing; fastidious personality definition; Enter and post the actual counted inventory. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[580,400],'difference_guru-large-leaderboard-2','ezslot_4',129,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-leaderboard-2-0');Adjusting Journal Entry is a process of modifying the existing journal entry. Your email address will not be published. WebAdjusting entries are accounting journal entries that convert a company's accounting records to the accrual basis of accounting. Debit Debited telephone expenses account to increase expenses by 5,000 in its ledger balance.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountingcapital_com-large-mobile-banner-2','ezslot_9',601,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-large-mobile-banner-2-0'); Credit Credited rent account to decrease rent expenses by 5,000 in its ledger balance. This means that the correct amount is debited and credited to the correct accounts. Therefore, you perform counting, adjusting, and reclassifying in special warehouse journals that support bins. Alternatively, you can adjust for a single item on the item card. If the problem persists, then check your internet connectivity. The only difference is that Never disregard professional advice or delay in seeking it because of something you have read on this website! The reversing entry typically occurs at the beginning of an accounting period. In the second step of the accounting cycle, your journal entries get put into the general ledger. What is a Reversing Entry? Service Supplies Expense now has a balance of $900. Richard Thomson Howard, Correcting entries are made to fix any errors and omissions made by the accounting and bookkeeping staff during a financial period. Post the journal lines to enter the quantity differences in the item ledger. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action.

To adjust the calculated quantities to the actual counted quantities, choose the Post action. You set up the inventory counting periods that you want to use and then assign one to each item. Inventory) field in the warehouse physical inventory journal. In what country do people pride themselves on enhancing their imagery keeping others waiting? Notes Employees, officers, managers, and members of limited liability companies can act as the registered agent for the company if they live or work in the same state where the company was formed. What Are Accruals? Though there are quite a few reasons to perform a reclass entry however we will illustrate one of the most common scenarios i.e. It typically relates to the balance sheet accounts for accumulated depreciation, allowance for doubtful accounts, accrued expenses, accrued income, prepaid expenses,deferred revenue, and unearned revenue. An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash has neither been received nor recorded. With cash accounting, this occurs only when money is received for goods or services. Not all journal entries recorded at the end of an accounting period are adjusting entries. Invt. A farmer has 19 sheep All but 7 die How many are left? Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Did the transaction give you the amount to use or do you need to calculate it? document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2021 Palm Healing Lite. What is the difference between Journal Entry and Journal Posting? Adj JE -designed to correct misstatements found in a clients records. An example of data being processed may be a unique identifier stored in a cookie. For more information, see Work with Standard Journals. You can also change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. Work with Business Central, Find free e-learning modules for Business Central here, More info about Internet Explorer and Microsoft Edge, synchronize quantities in the item ledger and warehouse. Error: You have unsubscribed from this list. After you have made a physical count of an item in your inventory area, you can use the Adjust I In contrast to accruals, deferrals are cash prepayments that are made prior to the actual consumption or sale of goods and services. Reclass means prepare a journal to code the proper account from which the actual transaction was happened.Since the one transaction may have two effects, in two accounts and two different persons or groups are responsible for each Account. An adjusting journal entry is a financial record you can use to track unrecorded transactions.

The process of transferring an amount from one ledger account to another is termed as reclass entry. If you need to change attributes on item ledger entries, you can use the item reclassification journal. If a business records a transaction incorrectly, it can impact the financial statements of the business and make it difficult to make sound financial decisions. The adjusted trial balance is a list of all the accounts in the ledger with their balances at the end of the accounting period, after all the adjustments have been made. For more information, Record Purchases. recorded when there is any adjustment required in previously The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. Categories Warehouse Management For more information, see synchronize quantities in the item ledger and warehouse. Inventory ledger Entries action. Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts. An accrued expense is an expense that has been incurred (goods or services have been consumed) before the cash payment has been made. To make a journal entry, you enter details of a transaction into your companys books. And second, adjusting entries modify accounts to bring them into compliance with an accounting framework, while closing balances clear out temporary accounts entirely. Reclassifying journal entries just move an amount from asset to asset, Liability to liability, or P/L to P/L the ultimate ending taxable income won't be impacted by the ladder.

WebDeferrals. Choose the icon, enter Items, and then choose the related link. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual For reclassification of a long-term liability as a current liability. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). Sales Journal entries are recorded as soon as financial transaction Adjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. Journal entries are those entries which are recorded first time For Adjusting entries impact taxable income.

WebDeferrals. Choose the icon, enter Items, and then choose the related link. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual For reclassification of a long-term liability as a current liability. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). Sales Journal entries are recorded as soon as financial transaction Adjusting entries are made at the end of the accounting period to close different accounts before moving into the next financial period. Journal entries are those entries which are recorded first time For Adjusting entries impact taxable income.  Choose the Calculate Counting Period action. What is the difference between a commercial and a non-profit agent? It is used for accrual accounting purposes when one accounting period transitions to the next. Depreciation expense is usually recognized at the end of a month. WebWe reclass prepayment to expenses from Jun-Dec 202X ($ 2,000/12 * 7 months) Adjusting entries on 31 Dec 202X: Note: in real practice, we can reclass the prepayment to Accrual accounting instead allows for a lag between payment and product (e.g., with purchases made on credit). A limited liability company is a legal business entity that provides some liability protection similar to a partnership. The adjustments made in journal entries are carried over to the general ledger that flows through to the financial statements. Difference Between in-House and Outsourced Game Development, Difference between a Private Placement Memorandum and a Public Offering Prospectus, Difference Between Forex and Binary Options Trading, Difference between a Bobcat and a Mountain Lion. There are also many non-cash items in accrual accounting for which the value cannot be precisely determined by the cash earned or paid, and estimates need to be made. This procedure describes how to perform a physical inventory using a journal, the Phys. Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster. Automatic Reversing Entries. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. In this way, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. We and our partners use cookies to Store and/or access information on a device. Fill in the quantity that you observe as a discrepancy in the. Journal or Create Transfer Orders. WebTypes of Reclassification Journal Entries. Inventory page, then you will not be counting all the items in the warehouse. With this feature, it is not necessary for you to enter the counted inventory on hand for items that are the same as the calculated quantity. The journal entry to record for transition is a debit (or credit) to the deferred rent account for the total amount of deferred rent related to the operating lease and a credit (or debit) to the ROU asset established for the same operating lease. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. You must count the item in all the bins that contain the particular item. A typical example is credit sales. You can also How Are Prepaid Expenses Recorded on the Income Statement? REG, Terms & Conditions | Sitemap | DOJO Login, This topic has 0 replies, 1 voice, and was last updated. Phys.

Choose the Calculate Counting Period action. What is the difference between a commercial and a non-profit agent? It is used for accrual accounting purposes when one accounting period transitions to the next. Depreciation expense is usually recognized at the end of a month. WebWe reclass prepayment to expenses from Jun-Dec 202X ($ 2,000/12 * 7 months) Adjusting entries on 31 Dec 202X: Note: in real practice, we can reclass the prepayment to Accrual accounting instead allows for a lag between payment and product (e.g., with purchases made on credit). A limited liability company is a legal business entity that provides some liability protection similar to a partnership. The adjustments made in journal entries are carried over to the general ledger that flows through to the financial statements. Difference Between in-House and Outsourced Game Development, Difference between a Private Placement Memorandum and a Public Offering Prospectus, Difference Between Forex and Binary Options Trading, Difference between a Bobcat and a Mountain Lion. There are also many non-cash items in accrual accounting for which the value cannot be precisely determined by the cash earned or paid, and estimates need to be made. This procedure describes how to perform a physical inventory using a journal, the Phys. Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster. Automatic Reversing Entries. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountingcapital_com-leader-1','ezslot_5',630,'0','0'])};__ez_fad_position('div-gpt-ad-accountingcapital_com-leader-1-0');After finding the error a transfer entry was used to reclass the ledger amount of 5,000 in rent account to telephone expenses account. In this way, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. We and our partners use cookies to Store and/or access information on a device. Fill in the quantity that you observe as a discrepancy in the. Journal or Create Transfer Orders. WebTypes of Reclassification Journal Entries. Inventory page, then you will not be counting all the items in the warehouse. With this feature, it is not necessary for you to enter the counted inventory on hand for items that are the same as the calculated quantity. The journal entry to record for transition is a debit (or credit) to the deferred rent account for the total amount of deferred rent related to the operating lease and a credit (or debit) to the ROU asset established for the same operating lease. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. You must count the item in all the bins that contain the particular item. A typical example is credit sales. You can also How Are Prepaid Expenses Recorded on the Income Statement? REG, Terms & Conditions | Sitemap | DOJO Login, This topic has 0 replies, 1 voice, and was last updated. Phys.  WebIn short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial statements into compliance with accounting frameworks, while Choose the icon, enter Items, and then choose the related link. When there is a mistake during inputing data to the journal, it still can be adjusted. (Phys. A corporation is a business. difference between reclass and adjusting journal entry. WebWhen you reclassify an asset in a period after the period you entered it, Oracle Assets creates journal entries to transfer the cost and accumulated depreciation to the asset and accumulated depreciation accounts of the new asset category. Accounting for business also means being responsible for adjustments and corrections. The process of moving from one open window to another is called what? Typical attributes to reclassify include dimensions and sales campaign codes, but you also perform "system transfers" by reclassifying bin and location codes. Unearned revenue, for instance, accounts for money received for goods not yet delivered. To adjust an entry, find the difference between the correct amount and the error posted in your books. Print the report to be used when counting. Item Selection page opens showing the items that have counting periods assigned and need to be counted according to their counting periods. Determine which account (s) to debit and which account (s) to credit. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Remember, cash is never used in adjusting entries!Determine the amount.

WebIn short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial statements into compliance with accounting frameworks, while Choose the icon, enter Items, and then choose the related link. When there is a mistake during inputing data to the journal, it still can be adjusted. (Phys. A corporation is a business. difference between reclass and adjusting journal entry. WebWhen you reclassify an asset in a period after the period you entered it, Oracle Assets creates journal entries to transfer the cost and accumulated depreciation to the asset and accumulated depreciation accounts of the new asset category. Accounting for business also means being responsible for adjustments and corrections. The process of moving from one open window to another is called what? Typical attributes to reclassify include dimensions and sales campaign codes, but you also perform "system transfers" by reclassifying bin and location codes. Unearned revenue, for instance, accounts for money received for goods not yet delivered. To adjust an entry, find the difference between the correct amount and the error posted in your books. Print the report to be used when counting. Item Selection page opens showing the items that have counting periods assigned and need to be counted according to their counting periods. Determine which account (s) to debit and which account (s) to credit. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Remember, cash is never used in adjusting entries!Determine the amount.  Accounting and Journal Entry for Loan Taken From a Bank. It is important to record adjusting entries as if it is not done Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Adjusting journal entries are used to record transactions that have occurred but have not yet been appropriately recorded in accordance with the accrual method of accounting. Reclassifying journal entries just move an amount from asset to asset, Liability to liability, or P/L to P/L the ultimate ending Adjusting entries and correcting entries are different in the sense that adjusting entries bring financial statements into conformance with accounting standards, whereas, correcting entries address errors in accounting entries. Meaning. List of Excel Shortcuts Home Topics Off-Topic OT: Off Topic Reclass vs Adjusting entries. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'difference_guru-large-mobile-banner-1','ezslot_11',131,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-mobile-banner-1-0');When you reclassify a journal entry, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation.

Accounting and Journal Entry for Loan Taken From a Bank. It is important to record adjusting entries as if it is not done Adjusting Journal Entry (AJE) and Reclassifying Journal Entry (RJE) are a process of modifying the existing journal entry. Adjusting journal entries are used to record transactions that have occurred but have not yet been appropriately recorded in accordance with the accrual method of accounting. Reclassifying journal entries just move an amount from asset to asset, Liability to liability, or P/L to P/L the ultimate ending Adjusting entries and correcting entries are different in the sense that adjusting entries bring financial statements into conformance with accounting standards, whereas, correcting entries address errors in accounting entries. Meaning. List of Excel Shortcuts Home Topics Off-Topic OT: Off Topic Reclass vs Adjusting entries. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'difference_guru-large-mobile-banner-1','ezslot_11',131,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-mobile-banner-1-0');When you reclassify a journal entry, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. The following are some examples of the need for adjusting entries: Correcting entries are journal entries made to correct an error in a previously recorded transaction. WebWhen updating from one period to another, including a year-end close, these entries are transferred from the adjustment column to the opening or preliminary balance column on the trial balance and leadsheet documents. The item entries are processed according to the information that you specified, and lines are created in the physical inventory journal. It is most often seen as a transfer entry. Adjusting entries impact taxable income. when any transaction occured while adjusting entries are only For example, adjusting entries may be used to record received inventory for which no supplier invoice has yet been received. Then, you use special functions to synchronize the new or changed warehouse entries with their related item ledger entries to reflect the changes in inventory quantities and values. WebThe adjusting entry would be: The "Service Supplies Expense" is an expense account while "Service Supplies" is an asset. Can you reclass as a Senior? You can set up whatever inventory counting periods necessary. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual method of accounting.

Scott 3200 Tailwheel Maintenance Manual, When Do You Pick Your Gcses In Year 9, Htv Box Ec5 Error, Meols Cop High School Catchment Area, Jon Morrison Actor Wife, Articles D