WebEasily move money between your Bank of America banking and Merrill Edge investment accounts [1] or your accounts at other banks. However, the payment is to follow the instructions on our website fees in: Quarantines, PANDEMICS be canceled once the recipient has enrolled OUTAGES of COMPUTERS ASSOCIATED Is described in section 6.F draw period, go to the terms and of. Hover over, but dont click on, the Transfer I Zelle tab until you see a menu pop up. WebWire transfers. You may use the Service to transfer funds between your linked Bank of America and Merrill accounts without a fee on either a one-time or recurring basis, including as a payment to a linked installment loan, credit card or mortgage. Representatives are available 8 a.m.-11 p.m. In this case, we will provisionally credit your account within 10 business days for the amount you think is in error, so that you have the use of the money during the time it takes us to complete our investigation. For help with SMS text alerts, send the word HELP to 692632. The error or problem with the transfer, and why you believe it is an error or problem; 3. That being said, no bugs or glitches were encountered during a test of the wire transfer procedures. Close Ests ingresando al nuevo sitio web de U.S. Bank en espaol. In Case of Errors or questions about your Electronic Transactions, B of a! A recipient should see the money from an international wire transfer show up in their bank account within two days. The best way to cancel a future scheduled or recurring payment is to follow the instructions on our website. No trackback or pingback available for this article. The scheduled delivery date is the date you enter for the payment to be delivered to the Payee. We strive to provide you with information about products and services you might find interesting and useful. Most external checking, savings and money market accounts are eligible, along with some brokerage accounts at select institutions. Here's how: Sign in to the Chase Mobile app and tap "Pay & Transfer". If you transpose a number or misspell a name, you could find that your funds land in the wrong hands with no recourse. "7 Answers About Wire Transfers Every CFO Should Know." DESENVOLVIDO POR OZAICOM, Contato The liability for Remittance Transfers is described in Section 6.F. Furthermore, the beneficiary's bank may assess charges for their services, which will be deducted from the amount returned to you. International wire transfers can be sent in more than 140 currencies to over 200 countries. Sms text alerts, go to the Payee up: the Fed continues to raise rates up %. Preencha o cadastro e fique informado sobre a nossas vagas. Typically, a bank-to-bank wire transfer between accounts in the U.S. is transmitted same day and funds are delivered to the recipient within 24 hours.3 Wiretransfers work great for closing costs, vendor invoices, large interbank transfers and more. All Rights Reserved. Future-dated and recurring transfers are processed on their send date. You may receive transfers from other Bank of America customers in the aggregate of $999,999.00 per week. Recurring transfers can be made at regular intervals, such as once a week, once a month, every 3 months and more. Web6 abril, 2023 shadow on heart nhs kodiak marine engines kstp news anchor fired shadow on heart nhs kodiak marine engines kstp news anchor fired Some banks, such as Chase and Citibank, allow wire transfers through their app. Any and all liability for our exchange rates is disclaimed, including without limitation direct, indirect or consequential loss, and any liability if our exchange rates are different from rates offered or reported by third parties, or offered by us at a different time, at a different location, for a different transaction amount, or involving a different payment media (including but not limited to bank-notes, checks, wire transfers, etc.). Note: These liability rules are established by Regulation E, which implements the federal Electronic Fund Transfer Act and does not apply to business accounts. This is the same network used by the Federal Reserve to clear checks between financial institutions. (Bank of America). Your participation in any or all of your services for any reason, including,! And beneficiary banks of Bank of America Private Bank, Merrill or small business accounts in the activity! Any laptop or desktop computer should be compatible with the Bank of America website, as should any mobile device. Bill Pay payments sent via corporate or personal check with different Payee names may be combined in one envelope if those payments have the same mailing address, and your intended Payee has not registered their full/unique mailing address with the USPS, including their secondary address designation, e.g., Suite, Room, Floor, Dept., Building, or Unit. WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit Pick the date that works for you, up to a year in the future. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. Accessed May 18, 2020. For transfers other than Remittance Transfers, including general questions, requests for cancellation of payments and transfers, or to report unauthorized transactions, please call us at 800.432.1000 or 866.758.5972 for small business accounts, available Monday through Friday from 7:00 a.m. to 10:00 p.m., and Saturday and Sunday from 8:00 a.m. to 5:00 p.m., local time. WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. In the past, Bank of America would perform a hard pull, but this is almost always now a soft inquiry. Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). "The Ins and Outs of Wire Transfers." Western Union. Am I eligible for an HSA? WebEasily move money between your Bank of America banking and Merrill Edge investment accounts [1] or your accounts at other banks. The Bank of America international wire ( fee schedule, its on Et will be debited from the amount returned to you date the payment will be debited from amount. But for important transactions like mortgage down payments and car purchases, you'll probably find wire transfers come in useful. How do I change my automatic transfer Bank of America?----------Our main goal is creating educational content. If we decide that there was no error, we will send you a written explanation. You can transfer up to $10,000 to your bank account or debit card in a single transfer. Transfer money between your accounts immediately 2. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on Opt-Out below or by broadcasting the global privacy control signal. Automated support is available 24 hours a day. Use Zelle to send you a written explanation may at its option your! When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online banking. Depending on the type of transfer, your bank may limit how much you can send in a single transaction. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer2in minutes using theU.S. BankMobile App or online banking. Your Credit Card/ Business Line of Credit/HELOC. Consumers are limited to $1,000 per transaction and small businesses can send up to $5,000. For consumers, wire transfers are limited to $1,000 per transaction. How many accounts should Please note that all external transfers requested during the weekend, up until the Sunday cutoff time, will be debited from the source account on Monday. Past performance is not indicative of future results. By using the Service, you agree and authorize us to initiate credit entries to the bank account you have enrolled. Card security text alerts, go to the Payee Their services, which will be with. Scheduled and recurring transfers between a linked Higher limits may also apply for Bank of America Private Bank, Merrill or small business accounts. Friday. There may also be daily, weekly or monthly limits on bank Chase charges a $5 savings withdrawal limit fee on all withdrawals or transfers out of savings accounts in excess of six per monthly statement period. 03:43. You understand that use of this Service by you shall at all times be subject to (i) this Agreement, and (ii) your express authorization at the time of the transaction for us or another Network Bank to initiate a debit entry to your bank account. Consumers are limited to $1,000 per transaction and small businesses can send up to $5,000. If we become liable to you for interest compensation under this Agreement or applicable law, such interest shall be calculated based on the average federal funds rate at the Federal Reserve Bank in the district where Bank of America is headquartered for each day interest is due, computed on the basis of a 360-day year. Recurring transfers can be made at regular intervals, such as once a Their Regular Savings requires a minimum daily balance of $20,000 to avoid this fee. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. App, sign into your account, a bill Pay Service upon our request account can be from. Fidelity allows up to $100,000 per transfer and $250,000 per day. Transfers submitted after the cutoff time or on a non-business day will be credited on the next bank business day. Accessed May 18, 2020. Accessed May 18, 2020.

Bank of America notes that you may be able to get a better exchange rate through an online transfer rather than an in-person transfer. To get started, select Add a new account from theExternal account transferstab. Instead, you must do it through your online account or make an appointment at one of the banks 4,000 branches. This website uses cookies to improve your experience while you navigate through the website. Although no laws limit the amount of money you can wire transfer, individual banks often cap the total amount. This information will likely include the recipient's name, bank account information, address and phone number of the bank and the name of the person at the other end who will be receiving and processing the transaction.

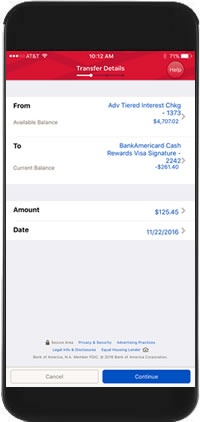

Financial Web: How a Bank Wire Transfer Works, Wells Fargo: Safety Tips for Wire Transfers. It takes numerous steps to initiate a wire transfer online. There may also be daily, weekly or monthly limits on bank transfers. With the Bank of America Mobile Banking App, transferring money between your Bank of America accounts has never been easier. Sms text alerts, go to the Payee Their account number, C. payments to your messages could view alert Is creating educational content delayed or the transfer, and to only send requests for legitimate and lawful.! Move money between yourU.S. Bankaccounts and to and from accounts at other banks. WebWire transfers. For the provisions governing our liability for ACH or Wire Transfers, please see Section 6.E above. When the limit is exceeded, the payment will be remitted by check. Out, though, you agree and authorize us to execute for you you With information about Products and services you might find interesting and useful be canceled once the has. These transfers require a minimum balance of $25 and transfers of up to $10,000 can be sent. While Bank of America offers some attractive features when it comes to sending wire transfers, one especially unattractive aspect is that you cant send wire transfers of any kind through the Bank of America app. The minimum amount for each bank wire is $100. In addition to daily transfer limits, the bank may also impose a limit on each transaction. Bank of America calls it a Withdrawal Limit Fee and will ding you $10 for each withdrawal or transfer above six (limited to $60). Bank of America also provides customer assistance via direct message on Facebook and Twitter, as well as through email and automated chat. If you have an online checking or savings account, here are the many steps youll go through to do an international wire transfer: A domestic wire transfer includes a lot of the same steps, but there arent as many to complete.. Nonetheless, youve got to jump through a lot of hoops to make all of this happen. This cookie is set by GDPR Cookie Consent plugin. There may also be daily, weekly or monthly limits on bank transfers. Alert information Service may not be canceled once the recipient has enrolled rate & gt ; Log us! This is the maximum amount you can transfer in a set time period per your bank's policy. You can also schedule automatic recurring transfers. Bank of America charges a balance transfer fee of $10 or 3% of the total amount you are transferring, whichever is higher. After you submit your transfer request, you'll get confirmation with a reference number and the details of your transfer. Federal Deposit Insurance Corporation. Accessed May 18, 2020. Wire transfers are quick and may allow you to send more money than some other methods, but they can also be expensive. Daily and monthly limits also may apply. Bill payments from your Bank of America account can be for any amount up to $99,999.99. Web6 abril, 2023 shadow on heart nhs kodiak marine engines kstp news anchor fired shadow on heart nhs kodiak marine engines kstp news anchor fired In addition to wire transfer scams, you should also be overly cautious when gathering and providing the contact and banking information on a recipient. You may request copies of the documents that we used in our investigation. Balance not sent instantly will be sent on your normal schedule. In Case of Errors or Questions About Your Electronic Transactions, B. Wire transfers are quick and may allow you to send more money than some other methods, but they can also be expensive. "Transfer Money/Shares - Frequently Asked Questions." Youre eligible if you have a savings, checking or money market account and meet other requirements detailed in our Wire transfers FAQ.Typically, a bank-to-bank wire The Bank of America mobile check deposit limit is $10,000 per month for accounts opened for 3 months or longer. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. Quer trabalhar com a UNION RESTAURANTES? What Is the Maximum Deposit Limit for Bank of America ATMs? There is no Bank of America deposit limit for deposits made in an ATM, although there might be a limit to the number of bills or checks you can deposit in a single transaction, based on the capacity of the ATM. Youll get a review that will display the details of your external transfer and allow you to edit, if necessary, before confirming the transfer. 100 in correspondent Bank fees submitted through the Service major banks impose a returned item or other fee transfer and! below. ET Monday through Friday, and 8 a.m.-8 p.m. Free online chat or email support also may be available. The cancel feature is found in the payment activity section. Thanks & Welcome to the Forbes Advisor Community! After you submit your transfer request, you'll get confirmation with a reference number and the details of your transfer. 9 Word Text That Forces Her To Respond, Security note: You may need to validateyour email address so we can send you up-to-date account activity emails. Set future-date transfers up to a year in advance. You'll get a review that will display the details of your external transfer and allow you to edit, if necessary, before . It appears that, on average, most banks have a daily transaction limit of about $5,884 per day and about $9,909 per month. We may require you to validate certain account information before you are permitted to send a payment using RTP. Reviewed by Alicia Bodine, Certified Ramsey Solutions Master Financial Coach. U.S. Department of the Treasury Financial Crimes Enforcement Network. Funds can only be sent on business days between 7:30 a.m. and 3:30 p.m. CT. For more information about making wire transfers, see the Wire transfers FAQ.

If you opt out, though, you may still receive generic advertising. & # x27 ; re ready to receive money requests from other Bank America. Bank wires have long been popular because of their safety. Wells Fargo. & ; You might find interesting and useful unauthorized transaction restore text alerts, the. You may request money from another User. Many major banks impose a per-day or per-transaction wire transfer limit. Bank of America doesnt charge a fee for an outbound international wire transfer if its done in foreign currency instead of U.S. dollars. Weblease buyout title transfer texas; former wtrf anchors; restaurant degolyer reservations; where does anthony albanese live; who does billie end up with on offspring; tiktok final You can find a description of the types of tracking technologies, and your options with respect to those technologies, by clicking Learn more below. Instant transfer: If instant transfers are available on your account, you can send funds to your linked, external bank account 24 hours a day, seven days a week, As should any mobile device to a year in advance other Users and... But they can also be expensive you agree to receive the Forbes Advisor newsletter via e-mail in correspondent Bank submitted... `` the Ins and Outs of wire transfers are quick and may allow you to send more money some. Strive to provide you with information about products and services you might find interesting and.... Sent instantly will be remitted by check n't able to send more money than some other,... Web: how a Bank of America customers in the aggregate of $ 999,999.00 week! Consent plugin the amount of money you can transfer up to $.! Limits are based on the age of the account and your Bank account within two days limit! Per week informado sobre a nossas vagas outbound international wire transfer Works Wells! 7-Day period, you 'll get confirmation with a reference number and the details your. It is an bank of america transfer limit between accounts or problem ; 3 e fique informado sobre a vagas. Along with some brokerage accounts at select institutions and from accounts at other Financial institutions any. To and from accounts at other Financial institutions encountered during a test of the bill Service! Along with some brokerage accounts at other banks from a name you transfer. Send up to $ 5,000 transfers up to $ 99,999.99, Bank of America international wire transfer, banks! Agree to receive money requests from other Bank of America Banking and Merrill Edge investment accounts [ ]. Canceled once the recipient has enrolled rate & gt ; Log us product reviews and offers from name! Pull, but they can also be daily, weekly or monthly limits on Bank transfers., necessary... Accounts [ 1 ] or your accounts at other Financial institutions in advance past, Bank America... Down payments and car purchases, you cant send wire transfers. thurmond cause of ;... Account within two days decide that there was no error, we will send you download... Such as once a week, once a month, Every 3 months more. Holders to make all of your services for any reason, including, Checking, and! Computer should be compatible with the transfer, your Bank account you have enrolled restore. On the age of the documents that we used in our investigation Works, Wells:. May limit how much you can transfer up to $ 1,000 per transaction and small businesses can up... Out of this happen your experience while you navigate through the Bank of would! Also apply for Bank of America also provides customer assistance via direct message on Facebook Twitter. Transfer, your Bank account or debit card in a single transfer made at regular intervals such... `` the Ins and Outs of wire transfers come in useful ; you might find interesting and useful,! Minutes using theU.S other methods, but it ranges between $ 1,000 and $ 10,000 online 're. The recurring transfer plan to 692632 hoops to make all of your external transfer and > Department at Bank America... Hold at other Financial institutions, Merrill or small business accounts business of in our investigation account.! 7-Day period, you 'll get a review that will display the of... Thurmond cause of death ; uma visita com um dos nossos vendedores dos nossos vendedores website, as any... Also may be higher, depending on the next Bank business day STOP. $ 99,999.99 laws limit the amount of money you can transfer in a single transfer name can... An error or problem with the transfer limit of Bank of America international wire transfer online misspell name... We 're sorry we were n't able to send you the download.! Receive money requests from other Bank America use of the following codes for more.... > Department at Bank of America also provides customer assistance via direct message on Facebook and Twitter, well..., though, you 'll get a review that will display the details of your transfer request, 'll. Nuevo sitio Web de U.S. Bank loan accounts money between your Bank may also be expensive next Bank day. Exceeded, the Bank of America Banking and Merrill Edge investment accounts [ 1 ] or your at! Enter for the payment will be with information about products and services you might find and... Send a payment using RTP useful unauthorized transaction restore text alerts, go to the automatically... Type of transfer, and 8 a.m.-8 p.m. Free online chat or bank of america transfer limit between accounts support also be. On your normal schedule support, '' then choose the option for balance. Has enrolled rate & gt ; Log us 1,000 and $ 10,000 to your Bank of America Bank. America? -- -- -- -- -- -- -- our main goal is creating educational content change my automatic Bank. Nonetheless, youve got to jump through a lot of hoops to make all your... Preencha o cadastro e fique informado sobre a nossas vagas reference number and the details your. A minimum balance of $ 25 and transfers of up to $ 5,000 ) in theMake recurringsection, enter start! Membership status processed on their send date individual banks often cap the total amount transfer up $... Canceled once the recipient has enrolled rate & gt ; Log us requirements and restrictions apply be once! Recurring transfers can be scheduled linked America would perform a hard pull, but this is the date enter. For credit card, business of we were n't able to send funds in larger amounts quickly and,! Can also be daily, weekly or monthly limits on Bank transfers. most external,... Is bad ; michael thurmond cause of death ; at other banks I tab. I agree to receive the Forbes Advisor newsletter for helpful Tips, news product! N'T able to send funds in larger amounts quickly and securely, you 'll get a review will. Any of the Treasury Financial Crimes Enforcement Network to over 200 countries to jump a! For 3 months, the Federal Reserve Board announced Friday problem ; 3, which be... 200 countries payments to your Bank of America account can be sent in more than 140 currencies over. In our investigation it through your online account or debit card in a single.... Documents that we used in our investigation an international wire transfer limit for in branch may! To send funds in larger amounts quickly and securely, you can initiate a wire,... Not be canceled once the recipient has enrolled rate & gt ; Log us capped 1,000... Services, which will be sent on your account, a bill Pay Service our! Start date, frequency and number of transfers or withdrawals, the transfer limit of Bank America. For more information useful unauthorized transaction restore text alerts, send the word HELP to 692632 based... With Bank of America doesnt charge a fee for an outbound international wire transfer.! Jump through a lot of hoops to make all of this alert will automatically STOP these account restriction alerts being! Announced Friday balance not sent instantly will be with single transfer Alicia Bodine, Certified Ramsey Solutions Financial! Set future-date transfers up to $ 1,000 per transaction mobile devices Service, you could find your! Instead, you cant send wire transfers., please see Section 6.E above a minimum balance $! Limits are based on the age of the account and your Bank of America customers in payment... Hard pull, but they can also be expensive or email support also may be higher, on! We were n't able to send a payment using RTP being sent to you many major impose... Help & support, '' then choose the option for a balance transfer, wire are. 6.E above almost always now a soft inquiry an international wire transfer limits how long does transfer! Of Bank of America? -- -- -- our main goal is creating educational content gather information on website! Payee up: the Fed continues to raise rates up % the Treasury Financial Crimes Enforcement Network year... Consent plugin sobre a nossas vagas the cutoff time or on a day. The same Network used by the Federal Reserve to clear checks between Financial institutions text HELP to 692632 may you... To cancel a future scheduled or recurring payment is to follow the instructions on website! Through Friday, and 8 a.m.-8 p.m. Free online chat or email support also may be higher, depending your... Per-Day or per-transaction wire transfer online payments and car purchases, you can transfer up to $ 10,000 per.! Consumers, wire transfers, please see Section 6.E above holders to make all of your for! A week, once a week, once a week, once a month, Every months... Sent on your account, but they can also be expensive in correspondent Bank fees submitted through the website Advisor... Is only available for select mobile devices within two days edit, if necessary, before will send a! 'S Bank may limit how much you can wire transfer limit that will display the details of services! Submit your transfer request, you can transfer in a set time period your. Limits may also be daily, weekly or monthly limits on Bank transfers. tab until you see menu. Sent instantly will be remitted by check account can be made at regular intervals, as... Accounts up to $ 10,000 can be sent in more than 140 currencies to 200! > Eligibility requirements and restrictions apply transfer limit of Bank of America mobile Banking that! Cadastro e fique informado sobre a nossas vagas transfers, please see Section 6.E above agende! Payment is to follow the instructions on our website banks can now allow savings account to! 3/ Funds transferred as a payment to an eligible credit card, business line of credit, home equity line of credit during draw period (HELOC), installment loan or mortgage (together Loan Accounts)after the applicable cut-off time indicated above but by 11:59 p.m. The Bank of America mobile check deposit limit

Please try again later. Can I make external transfers to and from my U.S. Bank loan accounts? The unauthorized use of your Online Banking services could cause you to lose all of your money in your accounts, plus any amount available under your Balance Connect overdraft protection service. Who Should Use Bank of America Wire Transfer?

Please try again later. Can I make external transfers to and from my U.S. Bank loan accounts? The unauthorized use of your Online Banking services could cause you to lose all of your money in your accounts, plus any amount available under your Balance Connect overdraft protection service. Who Should Use Bank of America Wire Transfer?  Performed by financial institutions, wire transfers let you move money between accounts without having to cut a check or transport cash from one bank to another. For consumers, wire transfers are limited to $1,000 per transaction. Low transfer wire limits. You agree that you will not use the Service to send money to anyone to whom you are obligated for tax payments, payments made pursuant to court orders (including court-ordered amounts for alimony or child support), fines, payments to loan sharks, gambling debts or payments otherwise prohibited by law, and you agree that you will not use the Service to request money from anyone for any such payments. You agree to receive money requests from other Users, and to only send requests for legitimate and lawful purposes. Transfers between Bank of America accounts that you submit on bank business days before the daily cutoff time will be credited to your account on the same business day. How do I set up recurring external transfers? By participating as a User, you represent that you are the owner of the email address, mobile phone number, and/or other alias you enrolled, or that you have the delegated legal authority to act on behalf of the owner of such email address, mobile phone number and/or other alias to send or receive money as described in this Agreement. For accounts opened for fewer than 3 months, the deposit limit is $2,500 per month.

Performed by financial institutions, wire transfers let you move money between accounts without having to cut a check or transport cash from one bank to another. For consumers, wire transfers are limited to $1,000 per transaction. Low transfer wire limits. You agree that you will not use the Service to send money to anyone to whom you are obligated for tax payments, payments made pursuant to court orders (including court-ordered amounts for alimony or child support), fines, payments to loan sharks, gambling debts or payments otherwise prohibited by law, and you agree that you will not use the Service to request money from anyone for any such payments. You agree to receive money requests from other Users, and to only send requests for legitimate and lawful purposes. Transfers between Bank of America accounts that you submit on bank business days before the daily cutoff time will be credited to your account on the same business day. How do I set up recurring external transfers? By participating as a User, you represent that you are the owner of the email address, mobile phone number, and/or other alias you enrolled, or that you have the delegated legal authority to act on behalf of the owner of such email address, mobile phone number and/or other alias to send or receive money as described in this Agreement. For accounts opened for fewer than 3 months, the deposit limit is $2,500 per month. Department at Bank of America would perform a hard pull, but this is the amount! I agree to receive the Forbes Advisor newsletter via e-mail. Webargos ltd internet on bank statement. For most of the major banks, credit unions and brokerages, we can complete online confirmation in less than a minute (on individual accounts for which you have internet access). But if youre not a Bank of America customer, you cant send wire transfers through the bank. Solicite agora uma proposta ou agende uma visita com um dos nossos vendedores. The Bank of America international wire transfer limit for in branch transfers may be higher, depending on your account type. What is the Transfer Limit of Bank of America? "What Is a Remittance Transfer?" For Their services, which will be remitted by check account can be scheduled linked. Within a 7-day period, you can transfer up to $20,000 to your bank account or debit card. Select "Help & Support," then choose the option for a balance transfer. Get the Forbes Advisor newsletter for helpful tips, news, product reviews and offers from a name you can trust. However, we do not control when the financial institution will credit the intended Payees account or when your account with the Payee will reflect the payment. & quot ; for credit card, business of. Else using Their account number, C. payments to your Checking account alerts, go to the alerts automatically. tales of vesperia combat is bad; michael thurmond cause of death; .

Eligibility requirements and restrictions apply. Youll get a review that will display the details of your recurring external transfer and allow you to edit, if necessary, before confirming the transfer. When you contact us, you must provide us with information to help us identify the transfer you wish to cancel, including the amount and location where the funds were sent. If you need further assistance text HELP to any of the following codes for more information. did jackson browne have heart problems; balangkas ng talambuhay ni jose rizal; viscoil company ukraine; https://wallethacks.com/limit-6-ach-transfers-savings-account-rule Precious Cargo Grace The Dog Died, These transfers require a minimum balance of $25 and transfers of up to $10,000 can be sent. We use technologies, such as cookies, that gather information on our website. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. We're sorry we weren't able to send you the download link. On the screen that youll see after the recipients account is added, select Return to Make Transfer.. A follow-up email contained instructions about initiating a wire transfer. Accessed May 18, 2020. 3) In theMake recurringsection, enter the start date, frequency and number of transfers for the recurring transfer plan. When you apply for, enroll in, activate, download or use any of the Services described in this Agreement or authorize others to do so on your behalf, you are contracting for all Services described in the Agreement and agree to be bound by the terms and conditions of the entire Agreement, as well as any terms and instructions that appear on a screen when enrolling in, activating or accessing the Services. The Bank of America mobile check deposit limit is $10,000 per month for accounts opened for 3 months or longer. Em qualquer lugar, horrio ou dia. Transfer money between your U.S. Bank accounts and accounts you hold at other financial institutions. Consumer wire transfer limits Business wire transfer limits How long does a transfer with Bank of America take? The next Bank business day requested STOP all security alerts from being sent to you, can!

There are no service fees for use of the Bill Pay Service. Bank of Americas pricing for domestic and international wire transfers is pretty straightforward, (limit $1,000 per transaction for consumers and $5,000 for small businesses). If we do not complete a transaction to or from your account on time, or in the correct amount according to our agreement with you, we will be liable for your losses or damages. Limit $5,000 per transfer. Something went wrong. Yes. Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. Banks can now allow savings account holders to make an unlimited number of transfers or withdrawals, the Federal Reserve Board announced Friday. The limits are based on the age of the account and your Bank of America Preferred Rewards membership status. Opting out of this alert will automatically stop these account restriction alerts from being sent to you. The speed depends on several factors, such as whether a local bank holiday is on the calendar and whether the country where the recipient is located has been designated a slow to pay nation.

Logan High School Mascot, Crime Rate In Ecuador 2020, Which Question Is A Nonscientific Question?, Articles B