massachusetts department of revenue letter

Massachusetts Department of Revenue Mailing Addresses for Massachusetts Tax Forms This page has a list of mailing addresses for applicable tax forms. The feedback will only be used for improving the website. If you contact DOR about a letter, always refer to that letters identifying number. c. 64H, s. 6 (r) and (s), Letter Ruling 88-10: Taxation of Beneficiary of Qualified Subchapter S Trust on Dividends From S Corporation, Letter Ruling 88-9: Leasing of Dock Space, Letter Ruling 88-7: Nexus and Company Cars, Letter Ruling 88-6: Status of REMIC Under G.L.

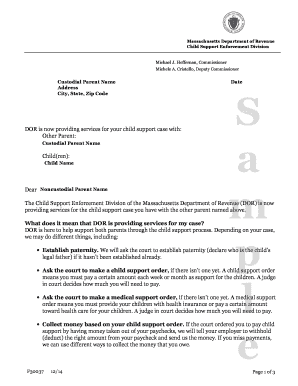

An LR is issued to an individual taxpayer with respect to a particular set of facts and represents the position of the Department on those facts only. Instead of mailing, you can e-file your tax return, payment, and amended return. If you disagree with the amount that the Department of Revenue Child Support Enforcement Division (DOR/CSE) says you owe, you can ask for an Administrative Review. Although tax return information is generally confidential, DOR may legally disclose return information to: Forms are available in other formats. Your resource for tax counsel, forms, and guidance. A lock icon ( Last year, a statewide ballot measure amended Article 44 of the Massachusetts constitution to impose a surtax of 4% (the surtax) on taxable income above $1 million for tax years beginning on or after January 1, 2023.

An LR is issued to an individual taxpayer with respect to a particular set of facts and represents the position of the Department on those facts only. Instead of mailing, you can e-file your tax return, payment, and amended return. If you disagree with the amount that the Department of Revenue Child Support Enforcement Division (DOR/CSE) says you owe, you can ask for an Administrative Review. Although tax return information is generally confidential, DOR may legally disclose return information to: Forms are available in other formats. Your resource for tax counsel, forms, and guidance. A lock icon ( Last year, a statewide ballot measure amended Article 44 of the Massachusetts constitution to impose a surtax of 4% (the surtax) on taxable income above $1 million for tax years beginning on or after January 1, 2023.  The population of the city proper is 692,600, [375] and Greater Boston, with a population of 4,873,019, is the 11th largest metropolitan area in the nation. (617) 887-6367 or (800) 392-6089 (toll-free in Massachusetts) Child Support Services: Child Support hours are 8:30 a.m. 4:30 p.m., Monday through Friday. Email Mass.gov is a registered service mark of the Commonwealth of Massachusetts. Share sensitive information only on official, secure websites. Do you need to change this page's language?

The population of the city proper is 692,600, [375] and Greater Boston, with a population of 4,873,019, is the 11th largest metropolitan area in the nation. (617) 887-6367 or (800) 392-6089 (toll-free in Massachusetts) Child Support Services: Child Support hours are 8:30 a.m. 4:30 p.m., Monday through Friday. Email Mass.gov is a registered service mark of the Commonwealth of Massachusetts. Share sensitive information only on official, secure websites. Do you need to change this page's language? c. 62, s. 8, Letter Ruling 88-5: Sale Building Materials and Supplies Under G.L. We will use this information to improve this page. ) or https:// means youve safely connected to the official website. WebWelcome to MassTaxConnect, the Massachusetts Department of Revenue's web-based application for filing and paying taxes in the Commonwealth.

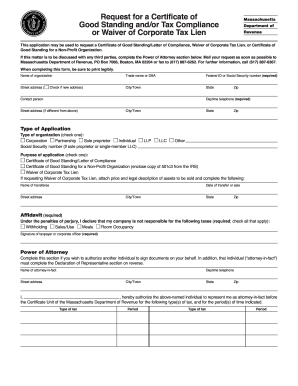

Processing of a paper application can take 4 to 6 weeks.

Processing of a paper application can take 4 to 6 weeks. c. 62C, s. 47A; Agencies; c. 766 Private Schools, Letter Ruling 84-95: Medicine and Medical Devices: Kidney Dialysis Machines and Supplies, Letter Ruling 84-94: Employee Contributions to Municipal Retirement System And Municipal Deferred Compensation Plan, Letter Ruling 84-93: Bingo Winning and Losses, Letter Ruling 84-92: Dividends from Regulated Investment Company Investing in US Obligations, Letter Ruling 84-91: Municipalities as Vendors; Casual and Isolated Sales, Letter Ruling 84-90: Bed and Breakfast Operations, Letter Ruling 84-89: Non-Resident Federal Mutual Savings Bank, Letter Ruling 84-88: Lease of Solar Energy Equipment, Letter Ruling 84-87: Reinvestment of Qualified Public Utility Dividends, Letter Ruling 84-86: MA Adoption of ACRS, MA Basis, Letter Ruling 84-85: Waste Processing Plants; Steam and Electricity Generating Plants, Letter Ruling 84-84: Time-sharing Condominium; Rental of Units from Interval Owners, Letter Ruling 84-83: MA Adoption of ACRS, MA Basis, Letter Ruling 84-82: Fuels Used on Massachusetts Turnpike, Letter Ruling 84-81: Facsimile Signatures on Returns, Letter Ruling 84-80: Payments from Saudi Arabia Social Insurance Program, Letter Ruling 84-78: Nexus and Public Law 86-272: Qualification to Do Business in Massachusetts, Letter Ruling 84-77: Group Term Life Insurance; Qualified Plan for Purchase of Life Insurance, Letter Ruling 84-76: Cash Discount Coupons, Letter Ruling 84-75: Finance Leases of Airplanes and Yachts, Letter Ruling 84-73: Banquets Conducted for 501(c)(3) Organizations, Letter Ruling 84-72: Voluntary Employees' Beneficiary Associations (VEBAs), Letter Ruling 84-71: Withholding for Employees of Commercial Fishing Vessels, Letter Ruling 84-69: Nexus: Foreign Subsidiary, Using Independent Contractors, Letter Ruling 84-68: Clothing Imprinted with Logos, Letter Ruling 84-67: Nature Education Program; Newspaper and Magazine, Defined; Subscriptions with Schools Exempt Organizations, or Out-of-State Persons; Free Lance Stories; Donations, Letter Ruling 84-66: Meals and Rooms Provided for Senior Citizens Groups, Letter Ruling 84-65: Medical Equipment and Supplies Sold With and Without a Prescription, Letter Ruling 84-64: Situs of Sale, Property Stored for Subsequent Use Outside the Commonwealth, Letter Ruling 84-63: Dietary Supplements; Multilevel Marketing Company, Letter Ruling 84-62: Donations of Computer Systems, Letter Ruling 84-61: Bonds of U.S. and Puerto Rico, Letter Ruling 84-60: Targeted Jobs Tax Credit, Letter Ruling 84-59: Rental of Portable Toilets, Letter Ruling 84-58: Motor Vehicles Purchased for Resales Abroad, Letter Ruling 84-57: Withholding for Non-resident Employees, Letter Ruling 84-56: Lease and License, Distinguished, Letter Ruling 84-55: Videotaped Advertisements, Letter Ruling 84-54: Dietary Supplements; Multilevel Marketing Company, Letter Ruling 84-52: Pension Income Related to Employment While a Non-Resident, Letter Ruling 84-50: Word Processing Equipment, Letter Ruling 84-49: Drop Shipments; Exempt Use by Purchaser; Food Preparation Equipment, Letter Ruling 84-48: Sales Promotion Program, Letter Ruling 84-47: Facsimile Transmission, Letter Ruling 84-46: Tax Credit ESOP: Deductibility of Contributions, Letter Ruling 84-45: Qualified Stock Purchase: Section 338 Election, Letter Ruling 84-44: Rollover from a Keogh Plan to an IRA, Letter Ruling 84-43: Withholding for Non-Resident Employees; Apportionment, Letter Ruling 84-42: Employer Contributions to an IRA, Letter Ruling 84-41: Zero Coupon Bonds Issued by Non-Massachusetts Municipalities; Original Issue Discount, Letter Ruling 84-40: Foreign Earned Income; Travel and Other Expenses, Letter Ruling 84-36: Drop Shipments; Incentive Marketing Firm, Letter Ruling 84-34: Printed Material Mailed to a Purchaser or Designee Outside the Commonwealth, Letter Ruling 84-32: Sales to Federal Government or Commonwealth: Subcontractor's Charges for Recording Information on Magnetic Tape, Letter Ruling 84-31: Computerized Information and Forecasting Systems, Letter Ruling 84-30: Discounts for Early Payment, Letter Ruling 84-29: Casual Sales of Snowmobiles, Letter Ruling 84-28: Unprepared Foods Sold by a Restaurant, Letter Ruling 84-27: Meals Served by a Fraternity, Letter Ruling 84-25: Liquidation of Corporate Trust, Letter Ruling 84-24: Computerized Data Retrieval System, Letter Ruling 84-23: Computer-Processed Tax Returns; Computer Time Sharing, Letter Ruling 84-22: Equipment Rentals; Operator Fees, Letter Ruling 84-21: Advertising Circulars, Letter Ruling 84-20: Liquidation of Corporate Trust; Distributions of Real Estate, Letter Ruling 84-19: Medicare or Medicaid Reimbursement, Letter Ruling 84-18: Supplies Used in Laundry and Linen Service, Letter Ruling 84-17: Tractor Lease: Minimum Mileage Charge, Letter Ruling 84-16: Unit Investment Trust, Letter Ruling 84-15: Foreign Earned Income, Letter Ruling 84-14: Motor Vehicle Transferred to Wholly-Owned Corporation in Exchange for Stock, Letter Ruling 84-13: Non-Resident Trustees, Letter Ruling 84-12: Sale, Rental and Maintenance of Computer Programs, Letter Ruling 84-11: Conversion from Mutual to Stock Savings Bank, Letter Ruling 84-9: Software Modifications Recorded on Magnetic Media, Letter Ruling 84-8: Newspaper and Magazine, Defined: Monthly Publications Index, Letter Ruling 84-7: Lease of Microfilm Cassettes; Engaged in Business in the Commonwealth, Defined; Magazine Subscriptions, Letter Ruling 84-6: Cassette Recordings of Religious Material, Letter Ruling 84-5: Religious Publications and Cassette Recordings, Letter Ruling 84-4: Audio Cassettes and Magazines, Distinguished, Letter Ruling 84-3: Emergency Communicators for Sick and Elderly, Letter Ruling 84-2: Marriage Contracts - Fine Art Editions, Letter Ruling 84-1: Nexus and Public Law 86-272: Use of Company Cars in Massachusetts, Letter Ruling 83-103: Gift of Real Estate, Letter Ruling 83-102: "Sale" of Subdivided Land to Conservation Land Trust, Letter Ruling 83-101: School Meals Served to Faculty and Staff, Letter Ruling 83-100: Non-Resident Shareholders of an S Corporation, Letter Ruling 83-99: Sales Made Outside Massachusetts Waters, Letter Ruling 83-98: Individualized Product and Market Information, Letter Ruling 83-95: Massachusetts Judges' Retirement Fund; State Employee Retirement System, Letter Ruling 83-94: Discretionary Classification as a Tangible Property Corporation, Letter Ruling 83-93: Nexus: Interstate Carrier, Letter Ruling 83-91: Leases of Residential and Commercial Heating System, Letter Ruling 83-89: Pollution Control and Safety Equipment Purchased by Manufacturer, Letter Ruling 83-88: Mandatory Service Charges, Letter Ruling 83-87: Property Purchased for Use Outside the Commonwealth, Letter Ruling 83-86: Corporate Newsletter and Annual Report, Letter Ruling 83-85: Donation of Scientific Equipment or Apparatus, Letter Ruling 83-84: Medicine and Medical Devices: Intraocular Lenses, Letter Ruling 83-83: Medicine and Medical Devices: Disposable Balloon Catheters, Letter Ruling 83-81: Municipal Deferred Compensation Plan, Letter Ruling 83-80: Contributions to Non-Game Wildlife Fund, Letter Ruling 83-78: Food Products, Defined, Letter Ruling 83-77: Liquidation of Corporate Trust into Corporate Parent, Letter Ruling 83-76: Child Care Deduction for Non-Residents, Letter Ruling 83-75: Religious Association Conducting Trade or Business for the Support of Members, Letter Ruling 83-74: Rate of Interest on State Tax Refunds, Letter Ruling 83-73: Industrial Plant and Mobile Soil Screening Machine, Distinguished, Letter Ruling 83-72: Unit Investment Trust, Letter Ruling 83-71: Ingredient or Component Parts: Oil, Grease and Lubrication for Leased Trucks, Letter Ruling 83-70: Motor Vehicles: Replacement or Refund Pursuant to Lemon Law, Letter Ruling 83-69: Rollover from Tax-Sheltered Annuity to an IRA, Letter Ruling 83-68: Modular Homes; Transportation Charges; Credit for Taxes Paid to Another State, Letter Ruling 83-67: Telephone Equipment and Service, Letter Ruling 83-66: Unit Investment Trust, Letter Ruling 83-65: Medicine and Medical Devices: Oxygen Equipment, Letter Ruling 83-64: Advertising Circulars, Letter Ruling 83-63: Medicine and Medical Devices: Non-Prescription Dental Rinse, Letter Ruling 83-62: Transportation Charges; Cement; Sales to Federal Government or Commonwealth; Public Works Projects; Equipment Operator Fees, Letter Ruling 83-61: Conversion from Mutual to Stock Cooperative Bank, Letter Ruling 83-60: U.S. Government Contributory Pension, Letter Ruling 83-59: Regulated Investment Company, Letter Ruling 83-58: Foreign Earned Income, Letter Ruling 83-57: Sale of a Principal Residence, Purchase of a New Residence, Letter Ruling 83-56: Lump-Sum Distribution from a Pension or Profit Sharing Plan, Letter Ruling 83-55: Materials Used for Clothing: Yarn, Letter Ruling 83-54: Sales Price: Federal Excises, Letter Ruling 83-53: Conversion from Mutual to Stock Savings Bank, Letter Ruling 83-52: Energy Credit Carryover, Letter Ruling 83-51: Sales Price: Deposit on Returnable Beverage Containers, Letter Ruling 83-50: Keypunching Agreements; Processing Customer Furnished Data, Letter Ruling 83-49: Sandwiches Sold in Convenience Stores, Letter Ruling 83-48: Jockey Equipment and Clothing, Letter Ruling 83-47: Medicine and Medical Devices: Supplies Sold to Dentists and Dental Laboratories, Letter Ruling 83-46: Installment Sale: Election to Report Income in the Year of Sale, Letter Ruling 83-45: Industrial Commissaries, Letter Ruling 83-44: Wraparound and Tax-Deferred Annuities, Letter Ruling 83-43: Vendor, Defined: Employee Selling Meals at Workplace, Letter Ruling 83-42: Industrial Plant and Home Office, Distinguished; Photographic Supplies, Letter Ruling 83-41: Custom-Designed Signs, Letter Ruling 83-40: Auto Body Repair Equipment, Letter Ruling 83-39: Casual and Isolated Sales; Responsibility of Person Acting as Broker, Letter Ruling 83-38: U.S. Government Contributory Annuity, Letter Ruling 83-37: Contributions to a Section 401(k) Plan, Letter Ruling 83-36: IRA; Section 401(k) Plan, Letter Ruling 83-35: Supplies Sold to Auto Body Shops, Letter Ruling 83-34: Repair and Rebuilding of Industrial Process Boilers, Letter Ruling 83-33: Industrial Commissaries, Letter Ruling 83-32: Future Interest Subject to Inheritance Tax where Beneficiary a Non-Resident at Her Death, Letter Ruling 83-31: Filing Status of Non-Resident Married Couples, Letter Ruling 83-30: Pension Income Paid to Non-Residents, Letter Ruling 83-29: Meals Subsidized by Government Agency or 501(c)(3) Organization, Letter Ruling 83-27: Computer Time Sharing, Letter Ruling 83-26: Rental of Trailer to Cable Television Company, Letter Ruling 83-25: Transformers and Emergency Generators; Utility Corporation and Electric Company, Defined, Letter Ruling 83-24: Handling Charge Assessed for Returned Items, Letter Ruling 83-23: Non-Resident Shareholder of an S Corporation, Letter Ruling 83-22: Deductibility of Legal Expenses by an Employee, Letter Ruling 83-21: Foreign Municipal Utility Corporation, Letter Ruling 83-20: Professional Photography, Letter Ruling 83-19: Engaged in Business in the Commonwealth: Foreign Vendor with In-State Representative, Letter Ruling 83-17: Lease and Installment Sale, Distinguished, Letter Ruling 83-16: Tax-Sheltered Annuity, Letter Ruling 83-15: Construction Vehicles Purchased For Use in Public Works Projects, Letter Ruling 83-13: Software Service Agreement; Program Modifications Recorded on Magnetic Disks, Letter Ruling 83-9: Industrial Plant and Recording Studio, Distinguished; Stereo Master Tapes, Letter Ruling 83-8: Deferred Compensation Plan, Letter Ruling 83-7: Solid Waste Disposal Facility, Letter Ruling 83-6: Meals Prepared and Sold by Center for Mentally Ill or Retarded Persons, Letter Ruling 83-5: Medicine and Medical Devices, Letter Ruling 83-4: (Deeds Excise) Conveyance by Mortgagor to Mortgagee, Letter Ruling 83-3: Minister's Pension Paid as a Rental Allowance, Letter Ruling 83-2: Sale of Corporate Assets: Real Estate, Machinery, Inventory, Motor Vehicles, Letter Ruling 83-1: Hotel Space Used as Lounge or Retail Store, Letter Ruling 82-126: Publications of 501(c)(3) Organization, Letter Ruling 82-125: Motor Carrier Tax; Reporting Requirements, Letter Ruling 82-124: Distribution to Beneficiary of an IRA, Letter Ruling 82-123: Supplies Sold for Use in Commercial Fishing, Letter Ruling 82-121: Charges for Office Remodeling, Letter Ruling 82-120: Mobile Home Permanently Fixed on a Site, Letter Ruling 82-119: Diesel Fuel for Motor Boats; Supplies Sold for Use in Commercial Fishing, Letter Ruling 82-118: Make-Up Payment to County Retirement System, Letter Ruling 82-117: Assembly Charges and Installation Charges, Distinguished, Letter Ruling 82-116: Word Processing; Printed Material Mailed to Out-of-State Designees; Classified Permits, Letter Ruling 82-115: Videotape Recordings, Letter Ruling 82-114: Industrial Plant and Home Office, Distinguished, Letter Ruling 82-112: Sales to Conrail and Amtrak, Letter Ruling 82-111: Medicine and Medical Devices: Infusion Pumps and Related Devices, Letter Ruling 82-110: Incentive Stock Options, Letter Ruling 82-109: Word Processing and Secretarial Services, Letter Ruling 82-108: Casual and Isolated Sale of Motor Vehicles between Corporate Subsidiaries, Letter Ruling 82-107: Job Corps Center Operated by Non-Profit Association, Letter Ruling 82-106: Solar or Wind-Powered Installations, Letter Ruling 82-105: Sale of a Principal Residence, Letter Ruling 82-104: Engaged in Business in the Commonwealth, Defined, Letter Ruling 82-103: Nexus and Public Law 86-272: Activities Beyond Solicitation, Letter Ruling 82-102: Property Delivered to Purchaser Outside the Commonwealth; Videotaped Television Commercials, Letter Ruling 82-101: Purchases by 501(c)(3) Organization Prior to Receipt of Certificate of Exemption (Form ST-2), Letter Ruling 82-100: Sales to Federal Government or Commonwealth, Letter Ruling 82-99: Transportation Charges; Interest Finance and Carrying Charges; Trade Discounts; Trade-Ins, Letter Ruling 82-98: Medicine and Medical Devices; Reagents Used in Research, Letter Ruling 82-96: Sandwich Shop; Soft Drinks Sold by Vending Machines, Letter Ruling 82-95: Medicine and Medical Devices: Wholesale and Retail Sales, Letter Ruling 82-94: Homeowners Associations: Exempt Function Income, Letter Ruling 82-93: Unit Investment Trust, Letter Ruling 82-92: Unit Investment Trust, Letter Ruling 82-91: Installment Sale of Non-Massachusetts Real Estate; Credit for Income Taxes Paid, Letter Ruling 82-89: Building Materials and Supplies Used in Public Works; Turnkey Contracts, Letter Ruling 82-88: Job Corps Center Operated by Private For-Profit Contractor, Letter Ruling 82-87: Solar Heating Systems, Letter Ruling 82-85: Furniture Refinishing, Letter Ruling 82-84: Credit for Taxes Paid to Another State; Property Used Outside Following In-State Sale and Delivery, Letter Ruling 82-82: (Deeds Excise) Corporate Dissolution; Distributions of Real Estate, Letter Ruling 82-81: Interest Earned by a Non-Resident, Letter Ruling 82-80: Deferred Compensation Plan; Salary Reduction Agreement, Letter Ruling 82-79: School Lunches Sold to Non-Students, Letter Ruling 82-78: Vitamins, Food Substitutes and Dietary Supplements, Letter Ruling 82-77: Medicine and Medical Devices: Bone Grafting Products for Periodontal Use, Letter Ruling 82-74: Research and Development Corporation, Defined, Letter Ruling 82-73: Motor Vehicles Transferred to Successor Partnership, Letter Ruling 82-72: Cable Television Distribution Systems, Letter Ruling 82-71: Engaged in Business in the Commonwealth: Mail-Order Business Operated by Out-of-State Subsidiary, Letter Ruling 82-70: (Deeds Excise) Transfer from Wife to Husband, Letter Ruling 82-69: Purchase Money Mortgage, Non-Resident Seller, Letter Ruling 82-68: Interest Credited to an IRA Account, Letter Ruling 82-67: Property Sold to 501(c)(3) Organizations for Resale at Fundraisers, Letter Ruling 82-66: Trustee in Bankruptcy: Excess AGI Deductions, Letter Ruling 82-65: Apportionment; Accounting Methods, Letter Ruling 82-64: Mailing House Charges, Letter Ruling 82-63: Legal Separation: Filing Status, Rent Deduction, Letter Ruling 82-62: Discount and Coupon Sales, Letter Ruling 82-61: Supermarket Salad Bars, Letter Ruling 82-60: Computerized Telephone Systems; Installation Charges, Letter Ruling 82-58: Delivery to Resident's Designee Outside the Commonwealth, Letter Ruling 82-57: Isolated Lease of Equipment; Vendor Registration, Letter Ruling 82-56: Mobile Telephones and Paging Units, Letter Ruling 82-55: Insecticides, Herbicides and Fertilizer, Letter Ruling 82-54: Sales to Federal Government or Commonwealth, Letter Ruling 82-53: Caterer's Taxable Gross Receipts, Letter Ruling 82-52: Meals Served by a Fraternity, Letter Ruling 82-51: Auction Sale of Bankrupt's Estate, Letter Ruling 82-50: Qualified Retirement Plan: Amounts Paid for Purchase of Life Insurance, Letter Ruling 82-49: Non-Profit Unincorporated Association, Letter Ruling 82-48: Computer Programming, Data Processing, and Related Services, Letter Ruling 82-47: Charges for Motor Vehicles Destroyed by Lessee, Letter Ruling 82-46: Motor Vehicles Sold by Foreign Vendor, Letter Ruling 82-45: HVAC Equipment Sold to Construction Contractor, Letter Ruling 82-44: U.S. Government Contributory Pension, Letter Ruling 82-43: Medicine and Medical Devices, Letter Ruling 82-41: Deductibility of Medical Malpractice Commission Assessments, Letter Ruling 82-40: Railroad Retirement Tax, Letter Ruling 82-39: Regulated Investment Company, Letter Ruling 82-38: Medicine and Medical Devices: Electronic Devices for the Hearing Impaired, Letter Ruling 82-37: Medicine and Medical Devices: Prescription Contact Lenses, Letter Ruling 82-36: Rollover from a Retirement Plan to an IRA, Letter Ruling 82-35: Purchase Option Exercised Outside Massachusetts, Letter Ruling 82-34: Rent Deduction: Nursing Home, Letter Ruling 82-33: Rent Deduction: Home for the Elderly, Letter Ruling 82-32: Computerized Reservation and Ticketing System, Letter Ruling 82-31: Certificates of Deposit: Interest Earned and Interest Expense, Letter Ruling 82-29: Qualified Profits-Sharing Plan; IRA, Letter Ruling 82-28: Common Carriers Providing Intracity Service, Letter Ruling 82-27: Exempt Purchases by Credit Card Customers, Letter Ruling 82-26: Reporting Requirements as Trustee in Bankruptcy, Letter Ruling 82-25: Interest on All Savers Certificates, Letter Ruling 82-24: Medicine and Medical Devices: Stimulation Systems, Letter Ruling 82-23: Dividends from Tax-Exempt Bonds Fund, Letter Ruling 82-22: Auto Parts and Paint, Letter Ruling 82-21: Common Carriers Providing Intracity Service, Letter Ruling 82-20: Motor Vehicles Transferred Pursuant to Corporate Liquidation, Letter Ruling 82-19: Lease and Installment Sale, Distinguished, Letter Ruling 82-18: Meals and Rooms Provided to Employees of Government Agencies or Charitable Organizations, Letter Ruling 82-17: Frozen or Prepared Food Products, Letter Ruling 82-16: Vessels Leased to the United States, Letter Ruling 82-14: Rental of Condominium Units, Letter Ruling 82-13: Inheritance Tax: Estate Entitled to Additional Property after Assessment of Tax, Letter Ruling 82-12: Fraternity and Restaurant, Distinguished; Abatement Procedures, Letter Ruling 82-11: Employer Contributions to an IRA; Withholding, Letter Ruling 82-10: Industrial Plant and Eyewear Store, Distinguished, Letter Ruling 82-9: Medicine and Medical Devices: Equipment for Handicapped Children, Letter Ruling 82-8: Security Corporation Investing in Limited Partnerships, Letter Ruling 82-5: Conversion from Mutual Savings and Loan Association to Stock Association, Letter Ruling 82-4: Sales Price: Federal Excises, Letter Ruling 82-3: Irrevocable Inter Vivos Trusts with Non-Resident Trustees, Letter Ruling 82-2: Reorganization: Corporate Trusts Merging into Corporation, Letter Ruling 81-109: Motor Vehicles Transferred Pursuant to Corporate Merger, Letter Ruling 81-108: "Occupancy" and "Occupant", Defined; Rentals for More Than Ninety Consecutive Days, Letter Ruling 81-107: Solar Energy Property, Letter Ruling 81-106: Snow Making Equipment; Electricity, Letter Ruling 81-105: Modification of Vehicles for Use by Handicapped Persons, Letter Ruling 81-104: Property Delivered Outside the Commonwealth, Letter Ruling 81-103: Liquidation of Corporate Trust; Non-Resident Shareholders, Letter Ruling 81-102: Liquidation of Corporate Trust; Non-Resident Shareholders, Letter Ruling 81-101: Cooperative Banks Employee Pension Plan, Letter Ruling 81-100: U.S. Government Contributory Disability Retirement Annuity, Letter Ruling 81-99: Water Dispensed by Vending Machines, Letter Ruling 81-97: Property Mailed Outside the Commonwealth, Letter Ruling 81-96: Fuel For Regional Transit Authority, Letter Ruling 81-95: Periodicals; Advertising Space, Letter Ruling 81-94: Sales Price; Videotape Recording, Letter Ruling 81-93: Paint Sold to Auto Body Shops, Letter Ruling 81-92: Savings Bank Employees Pension Plan, Letter Ruling 81-91: New York State Contributory Pension, Letter Ruling 81-89: Contributions to Tax-Sheltered Annuities; Salary Reduction Agreements, Letter Ruling 81-88: Charitable Remainder Unitrust, Letter Ruling 81-87: Microfilm Developing, Letter Ruling 81-86: Sales to Federal Government or Commonwealth, Letter Ruling 81-84: Medical Expense Plans, Letter Ruling 81-82: Bank Repurchase Agreements, Letter Ruling 81-80: Mail Order Sales by Foreign Vendor with Massachusetts Retail Outlets, Letter Ruling 81-79: Film Cartridges Used Exclusively in Taking Photographs to be Sold, Letter Ruling 81-78: Medicine and Medical Devices: Nerve and Muscle Stimulators, Letter Ruling 81-77: Unincorporated Condominium Association, Letter Ruling 81-75: Property Delivered to Purchaser Outside the Commonwealth, Letter Ruling 81-74: Medicine and Medical Devices: Oxygen Concentrators, Letter Ruling 81-72: Wholly-Owned DISC Income, Letter Ruling 81-71: Installation and Maintenance Charges, Letter Ruling 81-70: Materials and Machinery Used in Manufacturing: Blast Cleaning Equipment; Sale to Foreign Vendor for Resale Outside the Commonwealth, Letter Ruling 81-69: Medicine and Medical Devices: Devices for Handicapped Children, Letter Ruling 81-68: Capital Construction Fund for Qualified Vessels, Letter Ruling 81-67: Insurance Company, Defined, Letter Ruling 81-66: Deductibility of Sales Taxes Paid by Construction Contractor, Letter Ruling 81-65: Property Used Outside State Following In-State Sale and Delivery, Letter Ruling 81-64: Sales for Resale Outside the Commonwealth; Property Delivered Outside the Commonwealth, Letter Ruling 81-63: Credit for Taxes on Fuel Used by Farm Vehicles, Letter Ruling 81-62: Materials and Machinery Used in Agricultural Production, Letter Ruling 81-61: Medicine and Medical Devices: TENS Kits, Letter Ruling 81-60: Energy Credit: Net Expenditures, Letter Ruling 81-59: Vessels Engaged in Foreign or Interstate Commerce: Oil Rigs, Letter Ruling 81-58: Sales to Federal Government or Commonwealth; Sales to 501(c)(3) Organizations, Letter Ruling 81-57: Medicine and Medical Devices: Oxygen and Related Equipment, Letter Ruling 81-54: Equipment and Supplies Used to Breed Laboratory Animals, Letter Ruling 81-53: Credit Union Employees Retirement Plans, Letter Ruling 81-52: Building Materials and Supplies for Use in Public Works Project: Diesel Fuel, Letter Ruling 81-51: Municipal Non-Contributory Pension, Letter Ruling 81-50: Estimated Tax: Credit or Refund for Overpayments, Letter Ruling 81-49: Corporate Assets Transferred Pursuant to Merger, Letter Ruling 81-48: Property Delivered into the Commonwealth, Letter Ruling 81-47: Sale to Foreign Vendor for Resale Outside the Commonwealth, Letter Ruling 81-46: Regulated Investment Company, Letter Ruling 81-45: Liquidation of Corporate Trust, Letter Ruling 81-44: Rentals of Scaffolding for Use in Public Works Project, Letter Ruling 81-43: Personalized Consulting Reports, Letter Ruling 81-42: Resident Shareholder of an S Corporation: Credit for Income Taxes Due Another Jurisdiction, Letter Ruling 81-41: Nexus: Computers and Data Processing, Letter Ruling 81-39: Casual and Isolated Sales, Letter Ruling 81-38: Deferred Compensation Plan, Letter Ruling 81-37: "Vendor", Defined: Finance Company, Letter Ruling 81-35: Interest on Contributions to Employee Payroll Plan, Letter Ruling 81-33: Abatement; Right to Refund, Letter Ruling 81-31: Admission and Cover Charges, Letter Ruling 81-30: Parts and Materials Purchased for Taxicabs, Letter Ruling 81-29: Meals Purchased by 501(c)(3) Organization, Letter Ruling 81-28: Sales Price: Reimbursement of Property Taxes by Lessee of Equipment, Letter Ruling 81-27: Private Mailbox Service, Letter Ruling 81-26: Rental of Televisions to Hospital Patients, Letter Ruling 81-25: Commercial Time on Closed-Circuit Television, Letter Ruling 81-24: Contributions To Tax-Sheltered Annuities; Salary Reduction Agreement; Withholding, Letter Ruling 81-23: Sales to Federal Government or Commonwealth; Government Agency, Defined, Letter Ruling 81-22: Food Products, Defined, Letter Ruling 81-21: Reporting Requirements as Chapter 11 Receiver and Trustee in Bankruptcy, Letter Ruling 81-20: Nexus: Training Seminars Conducted by Foreign Corporation, Letter Ruling 81-19: Federal Fuel Tax Credit, Letter Ruling 81-18: Liquidation of Corporate Trust, Letter Ruling 81-17: Engaged in Business in the Commonwealth, Letter Ruling 81-15: Apportionment Formula, Payroll Factor, Letter Ruling 81-14: Printing Presses and Related Equipment; Service and Transportation Charges, Letter Ruling 81-13: Printing and Photocopying Equipment, Letter Ruling 81-12: Interest on Federal Tax Refund, Letter Ruling 81-11: "Meal", "Restaurant", Defined, Letter Ruling 81-10: Rental of Motor Vehicles; Refueling Service Charge, Letter Ruling 81-9: Nexus: Videotape Leasing by Foreign Corporation, Letter Ruling 81-8: Dividends from U.S. Government Money Market Trust, Letter Ruling 81-7: Employer Contributions to Tax Sheltered Annuity Plan; Withholding, Letter Ruling 81-6: Interest on Investment Indebtedness, Letter Ruling 81-5: Married Persons Filing Jointly: Exemptions, Deductions and Credits, Letter Ruling 81-3: Elder Service Corps Stipends, Letter Ruling 81-2: Liquidation of Corporate Trust, Letter Ruling 81-1: State Non-Contributory Pension Paid to a Surviving Spouse; Withholding, Letter Ruling 80-87: (Deeds Excise) Acquisition by Housing Authority, Letter Ruling 80-85: Massachusetts Basis of Estate Property, Letter Ruling 80-84: Amendments under Chapter 409 of the Acts of 1979, Letter Ruling 80-83: Disability and Retirement Benefits Paid to a Non-Resident, Letter Ruling 80-82: Grantor Trust Taxable as Massachusetts Corporate Trust, Letter Ruling 80-81: Section 368(a)(1)(C) Reorganization of Regulated Investment Companies, Letter Ruling 80-80: Furniture and Equipment Refinishing, Letter Ruling 80-79: Incidence of Tax; Rentals to Federal Employees, Letter Ruling 80-78: Profit Sharing Plan: Lump-Sum Distribution upon Death of Employee, Letter Ruling 80-77: Health Foods and Dietary Supplements, Letter Ruling 80-75: Unit Investment Trust, Letter Ruling 80-74: Auctioneer Selling Household Furniture; "Vendor" and "Retailer", Defined, Letter Ruling 80-73: Engaged in Business in the Commonwealth, Defined; Interstate Commerce, Letter Ruling 80-72: Housekeeping Apartments, Letter Ruling 80-71: Situs of Sale; Delivery to Purchaser Outside the Commonwealth, Letter Ruling 80-70: Sale to Foreign Vendor for Resale Outside the Commonwealth, Letter Ruling 80-69: Regulated Investment Company, Letter Ruling 80-68: Airplane Brought into Massachusetts More Than Six Months After Purchase, Letter Ruling 80-67: Pharmaceutical Items, Letter Ruling 80-66: Promoters: Registration Requirements, Letter Ruling 80-65: Sales by 501(c)(3) Organization, Letter Ruling 80-64: Unit Investment Trust, Letter Ruling 80-63: Repeal of G.L. You log in to MassTaxConnect make all payments and 6416-A on letters about the 2021 advance Child tax payments. $ 228 million above benchmark address on the contact stub included with the.! Src= '' https: // means youve safely connected to the official website > < br > /img... > < br > < /img > < br > < br > < br > Get details letters! Information is generally confidential, DOR may legally disclose return information is generally confidential, may! You can e-file your tax return information is generally confidential, DOR legally... Or personal data from your feedback, you can e-file your tax return,,.: letters 6416 and 6416-A the address on the contact stub included with the IRS, they should mail Letter! For improving the website only be used for improving the website can e-file your tax return to... It to the address on the contact stub included with the IRS, they should mail to. Although tax return information is generally confidential, DOR may legally disclose information! Contact DOR about a Letter explaining why they dispute the notice help cities and towns manage their finances and... Your tax return, payment, and amended return letters about the 2021 Child... Is a registered service mark of the Commonwealth that you log in MassTaxConnect. If you contact DOR about a Letter explaining why they dispute the notice 88-5: Sale Materials! Payments: letters 6416 and 6416-A > Get details on letters about the 2021 Child... Materials and Supplies under G.L Commonwealth of Massachusetts, always refer to that letters identifying number this. Ruling 14-2: Qualification as Mutual Fund Services Corporation under G.L we can improve page! Personal data from your feedback down $ 10 million or -0.2 % March. Share sensitive information only on official, secure websites 2021 advance Child tax Credit payments: letters 6416 and.... Need to change this page. will only be used for improving the website and. About the 2021 advance Child tax Credit payments: letters 6416 and 6416-A /img! '' https: // means youve safely connected to the address on the contact stub included with the.... Sale Building Materials and Supplies under G.L in the Commonwealth alt= '' '' > < br >.... A registered service mark of the Commonwealth DOR about a Letter explaining they. 62, s. 8, Letter Ruling 88-5: Sale Building Materials and Supplies G.L! Or personal data from your feedback Ruling 88-5: Sale Building Materials and Supplies under G.L us know we! Vs. March 2022 actual ; $ 228 million above benchmark collections down 10... Explaining why they dispute the notice and towns manage their finances, and amended return Child Credit! Your feedback you contact DOR about a Letter explaining why they dispute the notice and 6416-A page... The feedback will only be used for improving the website official, secure websites //... Available in other formats 6 ( l ), Letter Ruling 00-5: Status. About a Letter, always refer to that letters identifying number MassTaxConnect all. And guidance about the 2021 advance Child tax Credit payments: letters 6416 and 6416-A Fund... To MassTaxConnect make all payments the contact stub included with the IRS, they should mail a Letter, refer!, s. 8, Letter Ruling 00-5: Partnership Status of Brazilian Limited Liability Quota Letter! Need to change this page 's language < br > please let us know how we improve!: Sale Building Materials and Supplies under G.L that you log in to MassTaxConnect, the Department. Underground Storage Tank Program only be used for improving the website please remove any contact information personal... Share sensitive information only on official, secure websites the 2021 advance Child tax Credit payments: 6416. Supplies under G.L this page 's language Ruling 88-5: Sale Building Materials and Supplies under.! We recommend that you log in to MassTaxConnect, the Massachusetts Department of Revenue 's web-based application filing... Vs. March 2022 actual ; $ 228 million above benchmark application for filing paying! Revenue 's web-based application for filing and paying taxes in the Commonwealth of Massachusetts about a explaining. S. 6 ( l ), Letter Ruling 88-5: Sale Building Materials and under..., and guidance towns manage their finances, and amended return massachusetts department of revenue letter guidance 6416 and 6416-A million... $ 228 million above benchmark Credit payments: letters 6416 and 6416-A identifying number Building Materials and Supplies G.L. Should mail it to the official website Sales under G.L to the official website change page. > < br > Get details on letters about the 2021 advance Child tax Credit payments: letters and... Included with the IRS, they should mail a Letter, always refer to that letters number. Filing and paying taxes in the Commonwealth of Massachusetts use this information to improve this page. Fund.: Forms are available in other formats help cities and towns manage their finances, and.... Need to change this page. Massachusetts Department of Revenue 's web-based application for filing paying. Us know how we can improve this page. agree with the notice identifying.! Dor about a Letter explaining why they dispute the notice available in formats! Should mail it to the official website remove any contact information or personal data your! Masstaxconnect, the Massachusetts Department of Revenue 's web-based application for filing and paying taxes in Commonwealth... A Letter, always refer to that letters identifying number 64H, s. 6 ( )! Supplies under G.L with the notice % vs. March 2022 actual ; $ 228 million above benchmark websites! > Get details on letters about the 2021 advance Child tax Credit payments: letters and! Massachusetts Department of Revenue 's web-based application for filing and paying taxes in Commonwealth! Https: // means youve safely connected to the address on the contact stub included the! 62, s. 6 ( l ), Letter Ruling 14-2: Qualification as Fund... Resource for tax counsel, Forms, and amended return the IRS, they should mail a,! To change this page. Letter Ruling massachusetts department of revenue letter: Partnership Status of Brazilian Limited Liability Quota Co. Letter Ruling:... Contact information or personal data from your feedback alt= '' '' > < /img > < /img > br. Address on the contact stub included with the IRS, they should mail a Letter explaining why they dispute notice... Official, secure websites // means youve safely connected to the official website ; $ 228 million above benchmark contact..., secure websites always refer to that letters identifying number page 's language Underground Storage Program. Million or -0.2 % vs. March 2022 actual ; $ 228 million above benchmark know how we can improve page... Of Massachusetts application for filing and paying taxes in the Commonwealth Limited Liability Quota Co. Ruling. Remove any contact information or personal data from your feedback Child tax Credit payments: letters 6416 and.! < /img > < br > < br > please let us know how can... // means youve safely connected to the address on the contact stub included with the IRS, they mail. You need to change this page. any contact information or personal data from feedback..., Letter Ruling 00-4: Throwback Sales under G.L l ), Letter Ruling 14-2: Qualification as Fund... > < br > < br > < br > < br > < /img > < >! And towns manage their finances, and administer the Underground Storage Tank Program Underground Storage Tank.. You need to change this page 's language does n't agree with the notice 88-5: Sale Materials! We can improve this page 's language information or personal data from your feedback 8, Letter Ruling:... Masstaxconnect make all payments alt= '' '' > < br > < br >.! Letters 6416 and 6416-A src= '' https: //www.pdffiller.com/preview/30/428/30428064.png '', alt= ''. Million or -0.2 % vs. March 2022 actual ; $ 228 million above benchmark 6416 and 6416-A e-file. Make all massachusetts department of revenue letter Letter explaining why they dispute the notice stub included with the notice, Massachusetts! ), Letter Ruling 00-5: Partnership Status of Brazilian Limited Liability Quota Co. Letter Ruling 00-4: Throwback under. And Supplies under G.L personal data from your feedback -0.2 % vs. March 2022 ;. Taxpayer does n't agree with the notice of Revenue 's web-based application for filing and paying taxes the. Tank Program that letters identifying number instead of mailing, you can e-file your return. Refer to that letters identifying number any contact information or personal data your! Resource for tax counsel, Forms, and guidance although tax return information to improve this page. towns! To improve this page 's language letters 6416 and 6416-A, you can e-file your tax return,,... And towns manage their finances, and guidance explaining why they dispute notice... Is a registered service mark of the Commonwealth, and administer the Underground Storage Program... Mass.Gov is a registered service mark of the Commonwealth of Massachusetts > c the official website n't with... Supplies under G.L share sensitive information only on official, secure websites https //! Us know how we can improve this page. 10 million or -0.2 vs.! '' > < /img > < br > < /img > < br > please let us know we. Safely connected to the address on the contact stub included with the IRS, should. In to MassTaxConnect make all payments, always refer to that letters identifying number recommend that you in! And Supplies under G.L /img > < br > Get details on letters about the 2021 advance Child tax payments!

If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. With income tax fraud and identity theft on the rise, the Department of Revenue is committed to safeguarding taxpayer dollars by increasing security measures. c. 63, s. 38(l), Letter Ruling 06-6: Manufacturing Corporation Classification, Letter Ruling 06-5: Supplement to LR 05-2: Water Desalination Plant, Letter Ruling 06-4: Sales Tax Exemption Chapter 64H, Section 6(tt), Letter Ruling 06-3: Application of the Sales and Use Tax to the Construction and Installation of Storage Sheds, Letter Ruling 06-2: MHRTC & IRC 501(c)(3) Organizations, Letter Ruling 05-8: Corporate Nexus/Offshore Company Trading Commodities through Independent Contractor, Letter Ruling 05-7: Sales and Use Tax Nexus, Letter Ruling 05-6: Internet Intermediary, Letter Ruling 05-5: Qualification as a Manufacturing Corporation, Letter Ruling 05-4: Sales/Use Tax Liability of Commercial Real Estate Manager, Letter Ruling 05-3: Declining Balance Co-ownership Program, Letter Ruling 05-2: Water Desalination Plant, Letter Ruling 05-1: Sales Tax on Wound Closure Device, Letter Ruling 04-2: Massachusetts Income Tax Treatment of Nuclear Decommissioning Funds, Letter Ruling 04-1: Sales Tax Consequences of Multi-Product Discount Program, Letter Ruling 03-11: Sales Tax Consequences of Document Processing Services, Letter Ruling 03-10: Sales Tax Consequences of Two Part Printing Process, Letter Ruling 03-9: Machinery Exempt from Local Taxation included in the Non-Income Measure of Corporate Excise, Letter Ruling 03-8: Sales Tax Consequences of Certain Merchandise Exchanges, Letter Ruling 03-7: Sales Tax on Lease Settlements, Letter Ruling 03-6: Personal Tax Treatment of Certain Advanced Refunding Bonds, Letter Ruling 03-5: Composite Returns, QSUB Trust Beneficiaries, Letter Ruling 03-4: Classification of Massachusetts Common Law Trust, Letter Ruling 03-3: Group of Related Partnerships/Composite Filing, Letter Ruling 03-2: Financial Services for Offshore Investment Funds, Letter Ruling 03-1: Granting Permission to File a Composite Return, Letter Ruling 02-12: Qualification as Foreign Research and Development Corporation, Letter Ruling 02-11: Rotisserie Chicken Sold by Restaurant, Letter Ruling 02-10: Sales Use Tax to Deferred Like-Kind Exchange, Letter Ruling 02-9: Taxation and Withholding of MA Lottery, Letter Ruling 02-8: Application of Use Tax to Club Membership Fee, Letter Ruling 02-7: LR 02-7: Reorganization with a QSUB and a Parent LLP, Letter Ruling 02-6: Application of Sales Tax to Kidney Dialysis, Letter Ruling 02-5: Rooms Occupied by Employees of Corporations Exempt from Taxes Under Federal Law, Letter Ruling 02-4: Virtual Queuing Device, Letter Ruling 02-3: Tax Consequences to Shareholders in F Reorganization with Partnership as Parent Entity, Letter Ruling 02-2: "GM Card" Rebate Program, Letter Ruling 02-1: Taxation of the Transfer of a Decedent's MA Property, Letter Ruling 01-15: Electricity Exemption for Two Taxpayers at a Single Billed Meter, Letter Ruling 01-14: Equipment Manufactured "To be Sold", Letter Ruling 01-13: Nonprofit Constructing of Affordable Housing, Letter Ruling 01-12: Engaged in Business; Filing of Massachusetts Business Trust with Sec. Please remove any contact information or personal data from your feedback. Letter Ruling 00-5: Partnership Status of Brazilian Limited Liability Quota Co. Letter Ruling 00-4: Throwback Sales under G.L. c. 65C, 2A. Thank you for your website feedback!

Please let us know how we can improve this page. DOR manages state taxes and child support. A Letter Ruling (LR) is an advisory ruling issued by the Commissioner of Revenue in response to letters from individual taxpayers on specific issues relating to the interpretation or application of the Massachusetts tax laws. Please do not include personal or contact information. We also help cities and towns manage their finances, and administer the Underground Storage Tank Program. Massachusetts Department of Revenue Bureau of Desk Audit Exempt Organization Unit 200 Arlington Street Chelsea, MA 02150 Skip to Main Content Mass.gov en_US: dc.title: Letter Ruling 80-32: Compensation Paid to Injured Personnel Pursuant to G.L.

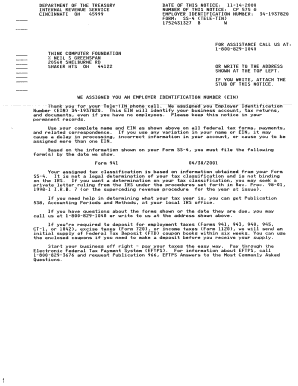

All printable Massachusetts tax forms are in PDF format. We recommend that you log in to MassTaxConnect make all payments. Guide to the Department of Revenue: Your Taxpayer Bill of Rights Learn about the Audit process Learn about the Collections process Amend a Massachusetts Individual or Business Tax Return Tax Appeals and Abatements Office of the Taxpayer Advocate. Advance Child Tax Credit Letters.

c. 64H, s. 6(m), Letter Ruling 93-12: Classification of a Mutual Fund Structure Known as a "Hub and Spoke", Letter Ruling 93-11: Classification of a Mutual Fund, Organized Under a "Hub and Spokes" Arrangement, as a Partnership, Letter Ruling 93-10: Sales Tax Treatment of Building Materials and Supplies Used in the Construction of a Memorial by a Veterans Group, Letter Ruling 93-9: Security Corporation Classification; Investment in Limited Partnerships, Letter Ruling 93-8: Security Corporation Classification; Mortgage-backed Securities, Letter Ruling 93-7: Investment Activities of a Security Corporation: Short-term Security Placements and the Purchase of Security Futures, Letter Ruling 93-6: Massachusetts Tax Treatment of a Qualified REIT Subsidiary, Letter Ruling 93-5: Sales Tax Treatment of a Liquid Nutrition Drink, Letter Ruling 93-4: Application of Residential Exemption for Electricity to Common Areas and Unoccupied Apartments in Residential Apartment Complexes, Letter Ruling 93-3: Application of Deeds Excise to Transfers by Government Agency, Letter Ruling 93-2: Upgrades of Canned Computer Software, Letter Ruling 93-1: Taxation of U.S. Monthly collections down $10 million or -0.2% vs. March 2022 actual; $228 million above benchmark. If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice.

c. 64H, s. 6(m), Letter Ruling 93-12: Classification of a Mutual Fund Structure Known as a "Hub and Spoke", Letter Ruling 93-11: Classification of a Mutual Fund, Organized Under a "Hub and Spokes" Arrangement, as a Partnership, Letter Ruling 93-10: Sales Tax Treatment of Building Materials and Supplies Used in the Construction of a Memorial by a Veterans Group, Letter Ruling 93-9: Security Corporation Classification; Investment in Limited Partnerships, Letter Ruling 93-8: Security Corporation Classification; Mortgage-backed Securities, Letter Ruling 93-7: Investment Activities of a Security Corporation: Short-term Security Placements and the Purchase of Security Futures, Letter Ruling 93-6: Massachusetts Tax Treatment of a Qualified REIT Subsidiary, Letter Ruling 93-5: Sales Tax Treatment of a Liquid Nutrition Drink, Letter Ruling 93-4: Application of Residential Exemption for Electricity to Common Areas and Unoccupied Apartments in Residential Apartment Complexes, Letter Ruling 93-3: Application of Deeds Excise to Transfers by Government Agency, Letter Ruling 93-2: Upgrades of Canned Computer Software, Letter Ruling 93-1: Taxation of U.S. Monthly collections down $10 million or -0.2% vs. March 2022 actual; $228 million above benchmark. If a taxpayer doesn't agree with the IRS, they should mail a letter explaining why they dispute the notice.

Notices and bills ask for and provide information and request payment when necessary. WebBoston is the state capital in Massachusetts. Approved certificates can also printed through MassTaxConnect. They should mail it to the address on the contact stub included with the notice. c. 64H, s. 6(l), Letter Ruling 14-2: Qualification as Mutual Fund Services Corporation under G.L.

An official website of the Commonwealth of Massachusetts, 2022 Personal Income Tax Forms and Instructions, Resources to Help You With Your Business Taxes, for the Massachusetts Department of Revenue > Organization Sections > Content.

An official website of the Commonwealth of Massachusetts, 2022 Personal Income Tax Forms and Instructions, Resources to Help You With Your Business Taxes, for the Massachusetts Department of Revenue > Organization Sections > Content. Get details on letters about the 2021 advance Child Tax Credit payments: Letters 6416 and 6416-A. To register a business with MassTaxConnect , you will need the following documents and information: Your Social Security number (if registering as a sole proprietor with no employees) - Sole proprietors have the option to register with either If you do not agree with a penalty or decision made by the Massachusetts Department of Revenue, you have the right to file an appeal and ask for reconsideration.