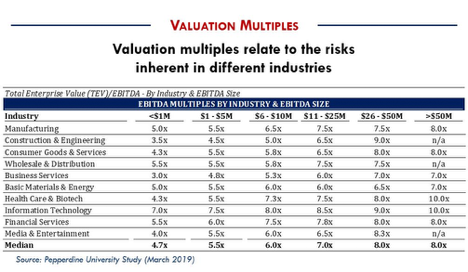

marketplace valuation multiples 2022

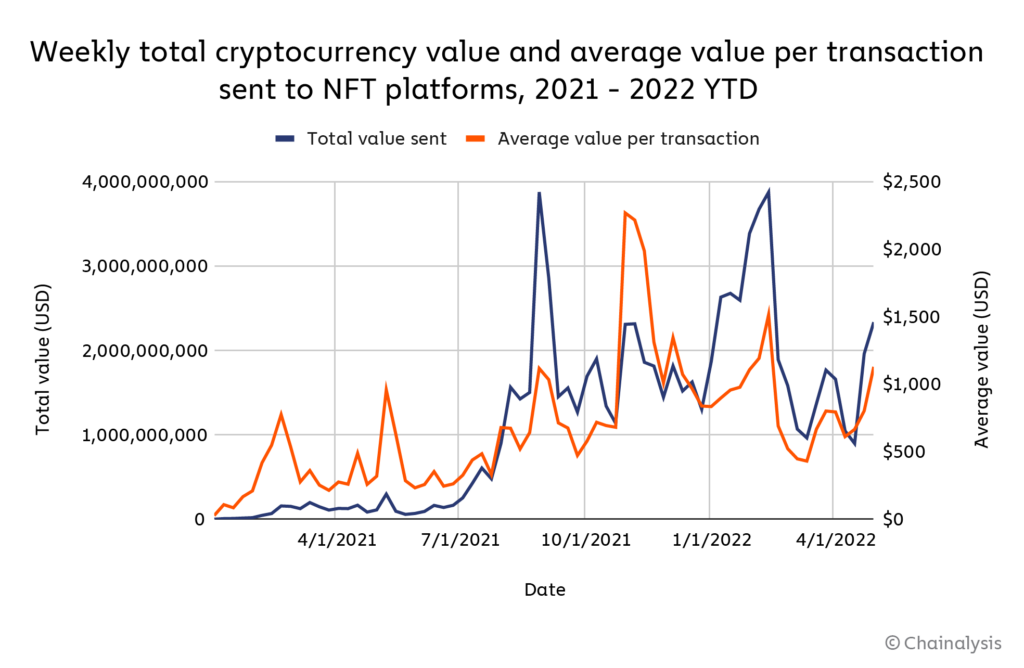

Q1, 2021 institutional buyers pursued businesses with >$1 million revenue; by Q4, 2021 this increased to >$3million. Number of coronavirus (COVID-19) cases in Hungary 2023, Share of Hungarians vaccinated against COVID-19 2020-2022, Coronavirus (COVID-19) confirmed cases in Hungary 2022, by county, Number of coronavirus (COVID-19) tests conducted in Hungary 2020-2022, To download this statistic in XLS format you need a Statista Account, To download this statistic in PNG format you need a Statista Account, To download this statistic in PDF format you need a Statista Account. Buyers are performing more detailed analysis of local market labor supply / demand dynamics. In Q4 2022, FinTech companies in the SEG Index recorded a median EV/Revenue multiple of 5.4x, less than half compared to pre-pandemic levels. U.S. Valuation Multiples by Industry Jul 2021 2021 U.S. Valuation Multiples by Industry  Use Ask Statista Research Service. Business Solutions including all features. They were also the stocks to see the greatest decline post-peak Snowflake from 133x to 62x, Zoom from 54x to 11x, Coupa from 43x to 13x, and Fastly from 37x to 10x. In the fourth quarter of 2022, all Mid-Atlantic metro markets surveyed by Newmark experienced a reduction in net demand and therefore downward pressure on occupancy. After a decade-long increase in SaaS valuation multiples, the upwards trend has reversed course. WebPrices of Reported Business Sales. Retaining talent is a critical success factor for many deals, especially for capability deals.

Use Ask Statista Research Service. Business Solutions including all features. They were also the stocks to see the greatest decline post-peak Snowflake from 133x to 62x, Zoom from 54x to 11x, Coupa from 43x to 13x, and Fastly from 37x to 10x. In the fourth quarter of 2022, all Mid-Atlantic metro markets surveyed by Newmark experienced a reduction in net demand and therefore downward pressure on occupancy. After a decade-long increase in SaaS valuation multiples, the upwards trend has reversed course. WebPrices of Reported Business Sales. Retaining talent is a critical success factor for many deals, especially for capability deals.  The recent decline in public stock prices is not an indication of any current systemic weakness in the SaaS industry or business model. Wages are up and continuing to rise. In order to receive the same valuation as one would have received at the peak, a company must increase its total EBITDA and, in all likelihood, revenue. The economic waves created by geopolitical realignments and the ongoing COVID-19 crisis will likely have lasting impacts on many aspects of peoples lives. ABC Wholesale Corp has a Market Cap of $69.3B as of March 1, 2018, a cash balance of $0.3B, and debt of $1.4B as of December 31, 2017. As a Premium user you get access to the detailed source references and background information about this statistic. Revenue multiples represent gross revenue or gross sales reported, divided by reported sales price. Another observation in this chart is that the variance in valuations dropped considerably in the last six months the blue dots are more tightly packed together than the green dots. Required fields are marked with an asterisk(*). Please do not hesitate to contact me. These trends challenge strategic buyers to identify, size, and underwrite synergies, including revenue synergies, to ensure competitiveness against alternative sources of capital.

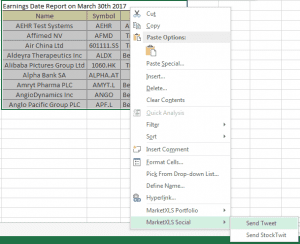

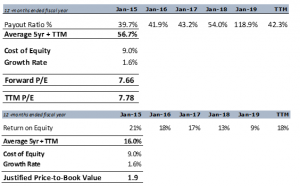

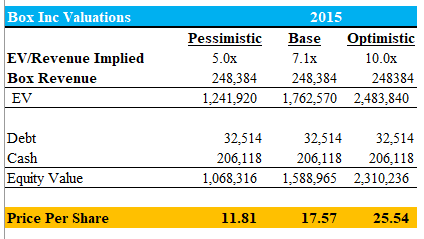

The recent decline in public stock prices is not an indication of any current systemic weakness in the SaaS industry or business model. Wages are up and continuing to rise. In order to receive the same valuation as one would have received at the peak, a company must increase its total EBITDA and, in all likelihood, revenue. The economic waves created by geopolitical realignments and the ongoing COVID-19 crisis will likely have lasting impacts on many aspects of peoples lives. ABC Wholesale Corp has a Market Cap of $69.3B as of March 1, 2018, a cash balance of $0.3B, and debt of $1.4B as of December 31, 2017. As a Premium user you get access to the detailed source references and background information about this statistic. Revenue multiples represent gross revenue or gross sales reported, divided by reported sales price. Another observation in this chart is that the variance in valuations dropped considerably in the last six months the blue dots are more tightly packed together than the green dots. Required fields are marked with an asterisk(*). Please do not hesitate to contact me. These trends challenge strategic buyers to identify, size, and underwrite synergies, including revenue synergies, to ensure competitiveness against alternative sources of capital.  Assuming a 20% EBITDA margin, this equates to more than $13 million in additional revenue. 2022 started with a 40% fall compared to Q4 of the previous year, and continued on a negative trend, although less abrupt. Interestingly, despite losing nearly 40% of their value, operationally, public SaaS companies continue to perform along historical trend lines. Please see Reimagining Talent in M&A for our take on how successful companies are reimagining their hiring due diligence, reading the talent landscape, and using employee insights to inform their integrations. Below we discuss the current and recent public B2B SaaS market and its impact on private valuations. Nonetheless, its important to acknowledge several risk factors that could complicate this positive outlook. Home health agencies are turning away referrals because they dont have enough labor to meet demand. This is a BETA experience. Moreover, as public market valuations outpaced deal multiples, financial investors increasingly chose equity market alternatives such as initial public offerings and SPACs over exits to strategics. "Average EV/EBITDA multiples in the health & pharmaceuticals sector worldwide from 2019 to 2022, by industry." In short, the 2021 rebound in strategic dealmaking took place in an evolving market. We watch for risk factors that could change this outlook but do not yet see overarching signals of a slowdown. Meanwhile, CVC volume grew at a nearly 7% annual rate between 2017 and 2020, and the value of those investments increased by 24% annually over the same time period; 2021 further accelerated this growth trend. Increasing Revenues/Sales To Achieve The Same Valuation At The Peak. The recent market tumble is a valuation reset driven out of fear of future operational challenges. Given this gap in valuations, companies should be able to capture returns from buying and integrating assets at lower multiples. Kroll is not affiliated with Kroll Bond Rating Agency, Growing economic headwinds are beginning to impact the multifamily investment markets. The Centers for Medicare and Medicaid Services (CMS) reimbursements are slated to generally increase across the board; however, physicians face a looming ~4.5% rate cut absent congressional action. The ideal entry-level account for individual users. The COVID-crash was significant, but short, and recovery for all industries has been faster than in the years following the GFC. There has not been a SaaS IPO so far in 2022, and venture financings, both the number and dollar value, fell in Q1 2022 on a quarter-over-quarter basis for the first time in years. Buyers face macroeconomic complications, including supply chain disruptions, inflation, labor shortages/greater competition for talent, and rising wages. While the February CPI increase was 7.9% year-over-year, it was only a 4.5% annualized increase when compared to February. 2017

PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network.

Assuming a 20% EBITDA margin, this equates to more than $13 million in additional revenue. 2022 started with a 40% fall compared to Q4 of the previous year, and continued on a negative trend, although less abrupt. Interestingly, despite losing nearly 40% of their value, operationally, public SaaS companies continue to perform along historical trend lines. Please see Reimagining Talent in M&A for our take on how successful companies are reimagining their hiring due diligence, reading the talent landscape, and using employee insights to inform their integrations. Below we discuss the current and recent public B2B SaaS market and its impact on private valuations. Nonetheless, its important to acknowledge several risk factors that could complicate this positive outlook. Home health agencies are turning away referrals because they dont have enough labor to meet demand. This is a BETA experience. Moreover, as public market valuations outpaced deal multiples, financial investors increasingly chose equity market alternatives such as initial public offerings and SPACs over exits to strategics. "Average EV/EBITDA multiples in the health & pharmaceuticals sector worldwide from 2019 to 2022, by industry." In short, the 2021 rebound in strategic dealmaking took place in an evolving market. We watch for risk factors that could change this outlook but do not yet see overarching signals of a slowdown. Meanwhile, CVC volume grew at a nearly 7% annual rate between 2017 and 2020, and the value of those investments increased by 24% annually over the same time period; 2021 further accelerated this growth trend. Increasing Revenues/Sales To Achieve The Same Valuation At The Peak. The recent market tumble is a valuation reset driven out of fear of future operational challenges. Given this gap in valuations, companies should be able to capture returns from buying and integrating assets at lower multiples. Kroll is not affiliated with Kroll Bond Rating Agency, Growing economic headwinds are beginning to impact the multifamily investment markets. The Centers for Medicare and Medicaid Services (CMS) reimbursements are slated to generally increase across the board; however, physicians face a looming ~4.5% rate cut absent congressional action. The ideal entry-level account for individual users. The COVID-crash was significant, but short, and recovery for all industries has been faster than in the years following the GFC. There has not been a SaaS IPO so far in 2022, and venture financings, both the number and dollar value, fell in Q1 2022 on a quarter-over-quarter basis for the first time in years. Buyers face macroeconomic complications, including supply chain disruptions, inflation, labor shortages/greater competition for talent, and rising wages. While the February CPI increase was 7.9% year-over-year, it was only a 4.5% annualized increase when compared to February. 2017

PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network.

In addition, annual legislation is required to prevent further cuts promulgated by pay-as-you-go (PAYGO) rules and renew the annual Extenders for hospitals. That said, private capital providers like venture capital and private equity funds are sitting on mountains of dry powder, and still need to deploy it. Public SaaS valuations are down nearly 40% from their highs in mid-2021, and the private markets are a mix of concern and restraint, with huge piles of dry capital needing to be deployed. While traditional buy-side activity comprised a portion of this volume, an upcoming PwC study has identified the role divestitures can play in creating value in the healthcare sector. This figure is based on the financial firms 2022 earnings of $5.06 per share, not on estimated earnings for 2023. Alternative deal types, such as partnerships (joint ventures, alliances) and CVC are often proving an appealing investment opportunity, but they require distinct strategic approaches. We heard of 100x ARR valuations more than a few times but on the whole, private valuations did not rise to the same degree as public valuations.  We may be seeing a similar dynamic happening now as we exit the COVID-19-caused deep, but short, recession. So, absent significant shifts in business strategy, which we do not anticipate, it is unlikely that there would be a significant change in the relevance of M&A as a growth driver. A far more typical scenario would be a seller pays the broker a retainer after being told the broker will get them 3.5 X profit for the business. To achieve the prior $64 million valuationwhile taking into account the drop in the valuation multiplethis same company would need to have an EBITDA of $10.67 million. 9x revenue. A business with a higher EBITDA and/or higher peak valuation multiple will require a different amount of growth to counteract a drop in multiples. Do I qualify? Jack Chang, Managing Director - DGP Capital. By the end of 2032, the market is expected to reach US$ 2.6 Billion.. After a down year in 2020, value rebounded to an all-time high, with soaring valuations and accommodating deal financing. Table: Lowest valuations from all-time highs to today. But if there is a contraction in valuation multiples across the board due to rising interest rates or other macro factors, it goes without saying that there would be a direct impact on valuation.

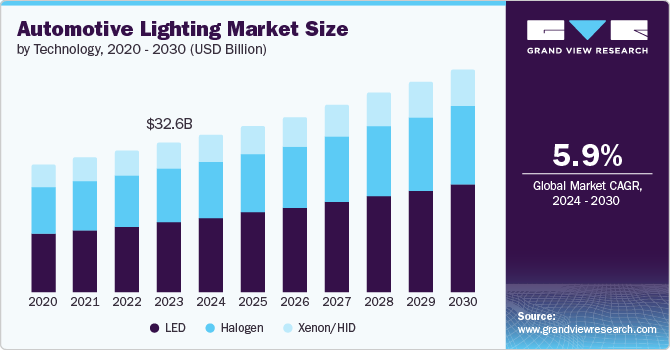

We may be seeing a similar dynamic happening now as we exit the COVID-19-caused deep, but short, recession. So, absent significant shifts in business strategy, which we do not anticipate, it is unlikely that there would be a significant change in the relevance of M&A as a growth driver. A far more typical scenario would be a seller pays the broker a retainer after being told the broker will get them 3.5 X profit for the business. To achieve the prior $64 million valuationwhile taking into account the drop in the valuation multiplethis same company would need to have an EBITDA of $10.67 million. 9x revenue. A business with a higher EBITDA and/or higher peak valuation multiple will require a different amount of growth to counteract a drop in multiples. Do I qualify? Jack Chang, Managing Director - DGP Capital. By the end of 2032, the market is expected to reach US$ 2.6 Billion.. After a down year in 2020, value rebounded to an all-time high, with soaring valuations and accommodating deal financing. Table: Lowest valuations from all-time highs to today. But if there is a contraction in valuation multiples across the board due to rising interest rates or other macro factors, it goes without saying that there would be a direct impact on valuation.  2022 M&A should fall short of a record-breaking 2021, but it will likely still be one of the strongest markets of the past 20 years. This scrutiny has two components: Even if deals are not ultimately blocked, the need to build more time and resources into M&A processes to navigate regulatory review may slow dealmaking. This can help you determine when might be an appropriate time to contemplate either a complete or partial exit in order to maximize the valuation received for your business. Some buyers were motivated by the plethora of available assets and low cost of capital; others jumped into the fray to stay competitive as their peers did deals. If an unlevered company can grow at 50% for five years, our analysis suggests the investment can withstand 60% valuation multiple compression without degrading the return; whereas at 30% annual growth, the investment only has an 18% multiple compression cushion, but if the investment is held for an additional year at 30% WebPrice multiples are ratios of a stocks market price to some measure of fundamental value per share. In, Leonard N. Stern School of Business. You need at least a Starter Account to use this feature. Combined, joint venture and strategic alliance volume grew by nearly 4.6% between 2017 and 2020 (driven predominantly by strategic alliances), reaching a 20-year high in 2020. Industry-wide enterprise value (EV) to EBITDA multiples have also declined from heightened levels seen at the end of 2021. Subscribe to Bain Insights, our monthly look at the critical issues facing global businesses. Charles Schwab has seen an acceleration of money inflows which came in at twice the rate as the FY 2022 weekly average. Targets more highly-susceptible to wage pressures have been prime candidates for earn-out based deal structures, allowing buyers to mitigate the potential risk of continued elevation of wage levels. I would like to receive the latest updates from Newmark. You can see the raw Index datahere. In this case, an EBITDA multiple that declines from eight to seven would result in a $56 million valuation. $10 million.

2022 M&A should fall short of a record-breaking 2021, but it will likely still be one of the strongest markets of the past 20 years. This scrutiny has two components: Even if deals are not ultimately blocked, the need to build more time and resources into M&A processes to navigate regulatory review may slow dealmaking. This can help you determine when might be an appropriate time to contemplate either a complete or partial exit in order to maximize the valuation received for your business. Some buyers were motivated by the plethora of available assets and low cost of capital; others jumped into the fray to stay competitive as their peers did deals. If an unlevered company can grow at 50% for five years, our analysis suggests the investment can withstand 60% valuation multiple compression without degrading the return; whereas at 30% annual growth, the investment only has an 18% multiple compression cushion, but if the investment is held for an additional year at 30% WebPrice multiples are ratios of a stocks market price to some measure of fundamental value per share. In, Leonard N. Stern School of Business. You need at least a Starter Account to use this feature. Combined, joint venture and strategic alliance volume grew by nearly 4.6% between 2017 and 2020 (driven predominantly by strategic alliances), reaching a 20-year high in 2020. Industry-wide enterprise value (EV) to EBITDA multiples have also declined from heightened levels seen at the end of 2021. Subscribe to Bain Insights, our monthly look at the critical issues facing global businesses. Charles Schwab has seen an acceleration of money inflows which came in at twice the rate as the FY 2022 weekly average. Targets more highly-susceptible to wage pressures have been prime candidates for earn-out based deal structures, allowing buyers to mitigate the potential risk of continued elevation of wage levels. I would like to receive the latest updates from Newmark. You can see the raw Index datahere. In this case, an EBITDA multiple that declines from eight to seven would result in a $56 million valuation. $10 million.  The higher cost of capital is a challenge to larger, platform-sized deals, and is driving more club deals and non-controlling investments. Bains outlook remains optimistic, as many of the fundamentals for dealmaking remain attractive for buyers. https://multiples.kroll.com Kroll is headquartered in New York with offices around the world. The majority of businesses in the data set sold for $100,000 to $1,000,000 - falling squarely in the "main street" segment of small businesses. EBITDA is an acronym that stands for earnings before interest, tax, depreciation, and amortization. Within several quarters they had mostly made up the lost revenue from the slower growth rate during 2009. But how does a business make up for this drop in multiple and still receive the same valuation from a raw dollar point of view? Value-based care provider models, and the enabling technologies and services that accommodate them, continue to be prime targets for investors that want to ride the sectors volume tailwinds while minimizing reimbursement and other regulatory risks. The typical time from first hello to funding is just 5 weeks. Cyber concerns are being addressed through increased efforts on network penetration testing and broader cyber-security diligence, along with enhanced focus on the broader information technology strategy, reliance on vendors, and leveraging of the cloud. Valuation multiples could see a contraction from peak levels if the supply of actionable deals begins to outstrip demand. Revenue multiples range from 0.4 to just over 1.1, with the average across all businesses at 0.62. Note that between August and February a number of B2B SaaS companies IPOed, but they are not included in this calculation. They will be more cautious, which will take the shape of longer review and diligence periods, but they still need to do deals and will be looking to put a lot of money into good opportunities. Then you can access your favorite statistics via the star in the header. Strategic buyers need an expanded set of skills to compete in todays competitive market. LevinPro HC and LevinPro LTC: The merger and acquisition data contained in various charts and tables in this report have been included only with the permission of the publisher, Irving Levin Associates LLC. By David Harding, Andrei Vorobyov, Suzanne Kumar, and Siobhan Galligan. Please see www.pwc.com/structure for further details. The remote work movement is a double-edged sword, allowing you to recruit across the globe, but it also opens opportunities around the world to your employees. $18 billion merger between two healthcare real estate investment trusts (REITs) and an $8.9B acquisition of Summit Health-City MD, a provider of primary, specialty and urgent care services, by Village MD (a Walgreens subsidiary). Show publisher information S&P Capital IQ: Information provided by or through third parties is provided as is, without any representations or warranties by PwC or such third party. Sorry, something went wrong. The median valuation multiple of the 81 B2B SaaS companies we track now stands at 10.6x, and the distribution of multiples has tightened back around that median to the same degree as it was in 2019 and prior. For more information on the business valuation process, see our resources on valuing a business. If these factors intensify, that could create an environment in which companies become less expensive to acquire, even as potential buyers come under financial pressures of their own.

The higher cost of capital is a challenge to larger, platform-sized deals, and is driving more club deals and non-controlling investments. Bains outlook remains optimistic, as many of the fundamentals for dealmaking remain attractive for buyers. https://multiples.kroll.com Kroll is headquartered in New York with offices around the world. The majority of businesses in the data set sold for $100,000 to $1,000,000 - falling squarely in the "main street" segment of small businesses. EBITDA is an acronym that stands for earnings before interest, tax, depreciation, and amortization. Within several quarters they had mostly made up the lost revenue from the slower growth rate during 2009. But how does a business make up for this drop in multiple and still receive the same valuation from a raw dollar point of view? Value-based care provider models, and the enabling technologies and services that accommodate them, continue to be prime targets for investors that want to ride the sectors volume tailwinds while minimizing reimbursement and other regulatory risks. The typical time from first hello to funding is just 5 weeks. Cyber concerns are being addressed through increased efforts on network penetration testing and broader cyber-security diligence, along with enhanced focus on the broader information technology strategy, reliance on vendors, and leveraging of the cloud. Valuation multiples could see a contraction from peak levels if the supply of actionable deals begins to outstrip demand. Revenue multiples range from 0.4 to just over 1.1, with the average across all businesses at 0.62. Note that between August and February a number of B2B SaaS companies IPOed, but they are not included in this calculation. They will be more cautious, which will take the shape of longer review and diligence periods, but they still need to do deals and will be looking to put a lot of money into good opportunities. Then you can access your favorite statistics via the star in the header. Strategic buyers need an expanded set of skills to compete in todays competitive market. LevinPro HC and LevinPro LTC: The merger and acquisition data contained in various charts and tables in this report have been included only with the permission of the publisher, Irving Levin Associates LLC. By David Harding, Andrei Vorobyov, Suzanne Kumar, and Siobhan Galligan. Please see www.pwc.com/structure for further details. The remote work movement is a double-edged sword, allowing you to recruit across the globe, but it also opens opportunities around the world to your employees. $18 billion merger between two healthcare real estate investment trusts (REITs) and an $8.9B acquisition of Summit Health-City MD, a provider of primary, specialty and urgent care services, by Village MD (a Walgreens subsidiary). Show publisher information S&P Capital IQ: Information provided by or through third parties is provided as is, without any representations or warranties by PwC or such third party. Sorry, something went wrong. The median valuation multiple of the 81 B2B SaaS companies we track now stands at 10.6x, and the distribution of multiples has tightened back around that median to the same degree as it was in 2019 and prior. For more information on the business valuation process, see our resources on valuing a business. If these factors intensify, that could create an environment in which companies become less expensive to acquire, even as potential buyers come under financial pressures of their own.  Our assumptions for this valuation: Scale: > $1b GMV YoY growth of at least 30% Take rate of about 10-15% Taking Etsy as an example

Our assumptions for this valuation: Scale: > $1b GMV YoY growth of at least 30% Take rate of about 10-15% Taking Etsy as an example

Does not include real estate value. The Mid-Atlantic multifamily market exhibited modest softening in the fourth quarter of 2022. For these strategic buyers, 2021 brought a nuanced and evolving marketone that demanded an expanded set of skills and a deep understanding of the deal landscape. Lastly, health services has benefitted from a disproportionate share of capital, particularly from PE, over the last few years. Scale deals accounted for more than half of large deals (those valued at more than $1 billion) throughout the first three quarters of 2021. Some of this decline in variance is attributable to a rash of new SaaS IPOs in 2021 with valuations close to the median.

Strategic buyers across industries cited pain from these record deal prices. Through 2020 and 2021 all SaaS valuations rose, but the highest valuations increased the most. While it was anticipated that multifamily growth would slow, economic uncertainty from rising interest rates and unsteady financial market conditions have brought a more sudden stop to the markets momentum. This post explores those alternative financing methods and when they might be a good fit (versus a line of credit or loan from a specialty lender like SaaS Capital). The Mid-Atlantic multifamily market exhibited modest softening in the fourth quarter of 2022. $100 million. We work with ambitious leaders who want to define the future, not hide from it. Leadership Lessons To Draw From In A Tight Market, How To Transition To Integrated Business Planning For Enhanced Performance, Why Attention To Detail Makes Brand Experiences Better, Reducing Energy Waste: Why Its Urgent And How It Can Be Achieved, Future Mobility: The Significant Yet Unrecognized Risk Of Fraudulent Parts, The New Rules For B2B Go-To-Market Strategies, The Pairing Of Old Wine And New Markets: Trends In The Wine Industry, A Guide To International Relocation For Startup Leaders.

The linear regression estimates for each data set corroborate the fact that the market has revalued growth. In particular, demand for new technological capabilities and underlying innovation will continue to grow. This figure is based on the financial firms 2022 earnings of $5.06 per share, not on estimated earnings for 2023. Meanwhile, non-tech and non-healthcare assets were also up vs. prior years, although median multiples of 14 times were well below the extremes seen in the other two industries. The above table shows the five companies with the lowest valuation multiples in August, and their valuation multiple at the end of February and the respective growth rates. Much of the near-term reimbursement ambiguity will be put to rest before the end of the year, but longer-term uncertainty and potential variability is likely to remain without a collaborative legislative focus. Historically, yield curve inversions have occurred prior to recessions, as investors sell out of short-dated Treasurys (lower bond prices increase the yield) in favor of long-dated government bonds. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe.  Industry Market Multiples are available online. To continue learning more about other valuation multiples, please see these additional resources: Valuation At present, total Debt-to-EBITDA multiples are averaging roughly 4-4.5x for deals under $250 million in enterprise value (EV) and 7x for larger buyout transactions. The number of new marketplaces, from B2B to B2C, have been exploding recently. The bottom line is that it adds to the uncertainty. The best commercial real estate investors have honed their gut instincts around finding the most attractive deals and the most effective valuation methods for each particular type of transaction. Bridge rounds and short runway were relatively easily solved in recent times, but we think those situations will become much more difficult this year. Again, this results in a $64 million valuation. New York NY 10055. Profit from the additional features of your individual account. Leonard N. Stern School of Business. If this response is overly aggressive, it could tip the economy into a recession, albeit likely a mild one. This is covered in greater detail in Delivering Results in Joint Ventures and Alliances Requires a New Playbook and Harnessing the True Value of Corporate Venture Capital.. Strategic deals (including both corporate deals and add-ons) saw value reach $3.8 trillion, an increase of 47% over 2020, fueled by record valuations. Companies that make more acquisitions are more often likely to identify the right targets, develop the capabilities required to vet deals better and faster, and form the organizational muscles to more effectively integrate acquisitions. Now in 2022, a new series of dramatic world events are causing business valuations to drop. However, its full-year revenue outlook came in below Streets estimates. A new governments policies and the worlds reaction will define Brazils M&A environment in 2023. As the boom in buy now, pay later deals ended, the bulk of dealmaking shifted to other areas. Getting The Same Valuation When Multiples Drop. EBITDA multiples are one of the most commonly used business valuation indicators that is often used by investors or potential buyers to assess a companys financial performance. Nursing and other clinical labor wages continue to increase.

Industry Market Multiples are available online. To continue learning more about other valuation multiples, please see these additional resources: Valuation At present, total Debt-to-EBITDA multiples are averaging roughly 4-4.5x for deals under $250 million in enterprise value (EV) and 7x for larger buyout transactions. The number of new marketplaces, from B2B to B2C, have been exploding recently. The bottom line is that it adds to the uncertainty. The best commercial real estate investors have honed their gut instincts around finding the most attractive deals and the most effective valuation methods for each particular type of transaction. Bridge rounds and short runway were relatively easily solved in recent times, but we think those situations will become much more difficult this year. Again, this results in a $64 million valuation. New York NY 10055. Profit from the additional features of your individual account. Leonard N. Stern School of Business. If this response is overly aggressive, it could tip the economy into a recession, albeit likely a mild one. This is covered in greater detail in Delivering Results in Joint Ventures and Alliances Requires a New Playbook and Harnessing the True Value of Corporate Venture Capital.. Strategic deals (including both corporate deals and add-ons) saw value reach $3.8 trillion, an increase of 47% over 2020, fueled by record valuations. Companies that make more acquisitions are more often likely to identify the right targets, develop the capabilities required to vet deals better and faster, and form the organizational muscles to more effectively integrate acquisitions. Now in 2022, a new series of dramatic world events are causing business valuations to drop. However, its full-year revenue outlook came in below Streets estimates. A new governments policies and the worlds reaction will define Brazils M&A environment in 2023. As the boom in buy now, pay later deals ended, the bulk of dealmaking shifted to other areas. Getting The Same Valuation When Multiples Drop. EBITDA multiples are one of the most commonly used business valuation indicators that is often used by investors or potential buyers to assess a companys financial performance. Nursing and other clinical labor wages continue to increase.  The number of technology company IPOs were down 92% in the first quarter of 2022 compared to 2021, and the amount of capital raised was down even more. WebMay 25, 2022 European Industry Market Multiples (As of March 31, 2022) May 25, 2022 Industry Market Multiples are available online. Enterprise value multiples, by contrast, relate the total market value of all sources of a companys capital to a measure of fundamental value for the entire company. A confirmation email has been sent to you. Companies sought to use M&A to keep pace with the trends transforming their industries (many of which were accelerated by Covid-19) while also navigating high prices and intense competition for deals. (You can figure this by calculating the difference between the original EBITDA and the new EBITDA, divided by the 20% EBITDA margin.) With a drop in valuation multiple, your business will have to increase its EBITDA by a meaningful amount so that you are able to achieve the same valuation you would have received at the peak.

The number of technology company IPOs were down 92% in the first quarter of 2022 compared to 2021, and the amount of capital raised was down even more. WebMay 25, 2022 European Industry Market Multiples (As of March 31, 2022) May 25, 2022 Industry Market Multiples are available online. Enterprise value multiples, by contrast, relate the total market value of all sources of a companys capital to a measure of fundamental value for the entire company. A confirmation email has been sent to you. Companies sought to use M&A to keep pace with the trends transforming their industries (many of which were accelerated by Covid-19) while also navigating high prices and intense competition for deals. (You can figure this by calculating the difference between the original EBITDA and the new EBITDA, divided by the 20% EBITDA margin.) With a drop in valuation multiple, your business will have to increase its EBITDA by a meaningful amount so that you are able to achieve the same valuation you would have received at the peak.

Cash flow and earnings multiples represent Sellers Discretionary Earnings (SDE) as reported by the business owners or business brokers closing the sale listing, divided by reported sales price. This is partially explained by the broad applicability of digital capabilities required to remain competitive across sectors. Simply put, EBITDA is multiplied by a factor, commonly referred to as the "EBITDA multiple." WebA valuation multiple is simply an expression of market value relative to a key statistic that is assumed to relate to that value. for profit, not for profit and PE, etc. Outliers to the high side and low side have certainly existed throughout time, and there were many more (mostly to the high side) over the last two years, but the bulk of valuation events have remained in this range. This year and possibly 2023 will not be as smooth as most of the 2010s. The median valuation of early-stage deals reached a record $67 million in Q1representing 112% year-over-year growth. Two market dynamics now, in retrospect, signaled a market peak at the end of 2021. Generally, the decline in multiples was equal to or lesser here than the five most highly valued companies. - 2023 PwC. Other megadeals include Quidel Corporations acquisition of Ortho Clinical Diagnostics ($8.0B), Mediclinic Internationals acquisition by a consortium of investors ($7.4B) and Chubbs acquisition of Cigna's life, accident and supplemental benefits businesses ($5.4B). statistic alerts) please log in with your personal account. The median sale price of the data set is $269,000, rising to $315,000 for the full year of 2022. >94% of firms will complete 20 or less deals in 2022. The majority of businesses in the data set sold for $100,000 to $1,000,000 - falling squarely in the "main street" segment of small businesses. Growth cures many wounds. WebThe UK video game market was valued at 5.3 billion in 2019, which is 6.03 billion when adjusted for inflation.

Cash flow and earnings multiples represent Sellers Discretionary Earnings (SDE) as reported by the business owners or business brokers closing the sale listing, divided by reported sales price. This is partially explained by the broad applicability of digital capabilities required to remain competitive across sectors. Simply put, EBITDA is multiplied by a factor, commonly referred to as the "EBITDA multiple." WebA valuation multiple is simply an expression of market value relative to a key statistic that is assumed to relate to that value. for profit, not for profit and PE, etc. Outliers to the high side and low side have certainly existed throughout time, and there were many more (mostly to the high side) over the last two years, but the bulk of valuation events have remained in this range. This year and possibly 2023 will not be as smooth as most of the 2010s. The median valuation of early-stage deals reached a record $67 million in Q1representing 112% year-over-year growth. Two market dynamics now, in retrospect, signaled a market peak at the end of 2021. Generally, the decline in multiples was equal to or lesser here than the five most highly valued companies. - 2023 PwC. Other megadeals include Quidel Corporations acquisition of Ortho Clinical Diagnostics ($8.0B), Mediclinic Internationals acquisition by a consortium of investors ($7.4B) and Chubbs acquisition of Cigna's life, accident and supplemental benefits businesses ($5.4B). statistic alerts) please log in with your personal account. The median sale price of the data set is $269,000, rising to $315,000 for the full year of 2022. >94% of firms will complete 20 or less deals in 2022. The majority of businesses in the data set sold for $100,000 to $1,000,000 - falling squarely in the "main street" segment of small businesses. Growth cures many wounds. WebThe UK video game market was valued at 5.3 billion in 2019, which is 6.03 billion when adjusted for inflation.

But heres the issue with that line of thinking: If you wait long enough in a peak mergers-and-acquisitions market, youll likely see valuation multiples drop, especially in a situation where interest rates are rising. (For small business valuation purposes, cash flow to the owner (earnings) is a more reliable indicator than revenue.).

But heres the issue with that line of thinking: If you wait long enough in a peak mergers-and-acquisitions market, youll likely see valuation multiples drop, especially in a situation where interest rates are rising. (For small business valuation purposes, cash flow to the owner (earnings) is a more reliable indicator than revenue.).  SaaS Capital is the leading provider of long-term Credit Facilities to SaaS companies. One question that team members at my company, a boutique investment bank that provides merger-and-acquisition and capital-advisory services, have been fielding lately from both current and prospective clients is how interest rates can impact the valuations of privately held businesses. As soon as this statistic is updated, you will immediately be notified via e-mail. BBAI recently reported in-line sales and EBITDA for Q4. Chart. Read More: 9 Bills You Should Never Put on Autopay. We are optimistic about the outlook for strategic deal activity in 2022, though there are several risks to watch. Insights to the typical margin and leverage profile of middle market target companies in 2022. This report provides valuable insights into trading multiples for various key industries in Europe as of June 30, 2022. The large-scale enterprise category led the global SaaS industry in 2022 and is projected to continue throughout the forecast period. Focus on the business for 2022 and revisit fundraising when the markets stabilize later this year or in 2023. The opposite is also true. Regarding risk of a worsening economy, from prior research into how SaaS companies perform in a recession, we know that growth rates will slow, and companies will drive towards profitability, but will otherwise survive an economic downturn fairly unscathed. But the narrower distribution is predominately due to the most highly valued companies losing the most value. Assume, for example, that your companys trailing-12-months EBITDA is $8 million. Payer-provider convergence and headline-grabbing investments from non-traditional players underlie the broader evolutionary theme of the sector fee-for-service focused models are in the rear-view mirror and players are diving in and embracing value-based care throughout the ecosystem. This is a year for operating and growing, and only raising minimally dilutive capital, if any at all. Should you need to refer back to this submission in the future, please use reference number "refID" . We see from the r-squared values of the two best-fit lines that growth rate alone predicts about 60% of a companys valuation! This statistic is not included in your account. Opinions expressed are those of the author. In August 2021, the median public B2B SaaS company hit a record high value at 16.9x its current run-rate annual recurring revenue (ARR). About 44% of executives report that they already are seeing or expect to see greater scrutiny from regulators. Video: Bain's Suzanne Kumar and Andrei Vorobyov discuss the complex trends of the past yearand how business leaders can compete in 2022. Unlike the comparatively simple deal market of 20 years ago, which predominately comprised corporate buyers and some financial investor activity, todays M&A landscape includes significant participation not only from corporate buyers but also greater value from add-on deals (in which investors buy and combine multiple platform assets to create scale), financial investors, special purpose acquisition companies (SPACs), and venture capital (VC)/corporate venture capital (CVC). These are for marketplaces that are growing fast and are category leaders. A total of 4,579 companies were included in the calculation for 2022, 4,326 for 2021, 4,023 for 2020 and 3,779 for 2019. For the most part, suburban markets continue to outperform the urban core. Leonard N. Stern School of Business. However, deal volume was most significant in the first half of the year and began to cool in the later half of the year, particularly in the fourth quarter. However, its full-year revenue outlook came in below Streets estimates. Below are some important updates to the public SaaS market, private SaaS market, and our own data and analysis around the SCI.

SaaS Capital is the leading provider of long-term Credit Facilities to SaaS companies. One question that team members at my company, a boutique investment bank that provides merger-and-acquisition and capital-advisory services, have been fielding lately from both current and prospective clients is how interest rates can impact the valuations of privately held businesses. As soon as this statistic is updated, you will immediately be notified via e-mail. BBAI recently reported in-line sales and EBITDA for Q4. Chart. Read More: 9 Bills You Should Never Put on Autopay. We are optimistic about the outlook for strategic deal activity in 2022, though there are several risks to watch. Insights to the typical margin and leverage profile of middle market target companies in 2022. This report provides valuable insights into trading multiples for various key industries in Europe as of June 30, 2022. The large-scale enterprise category led the global SaaS industry in 2022 and is projected to continue throughout the forecast period. Focus on the business for 2022 and revisit fundraising when the markets stabilize later this year or in 2023. The opposite is also true. Regarding risk of a worsening economy, from prior research into how SaaS companies perform in a recession, we know that growth rates will slow, and companies will drive towards profitability, but will otherwise survive an economic downturn fairly unscathed. But the narrower distribution is predominately due to the most highly valued companies losing the most value. Assume, for example, that your companys trailing-12-months EBITDA is $8 million. Payer-provider convergence and headline-grabbing investments from non-traditional players underlie the broader evolutionary theme of the sector fee-for-service focused models are in the rear-view mirror and players are diving in and embracing value-based care throughout the ecosystem. This is a year for operating and growing, and only raising minimally dilutive capital, if any at all. Should you need to refer back to this submission in the future, please use reference number "refID" . We see from the r-squared values of the two best-fit lines that growth rate alone predicts about 60% of a companys valuation! This statistic is not included in your account. Opinions expressed are those of the author. In August 2021, the median public B2B SaaS company hit a record high value at 16.9x its current run-rate annual recurring revenue (ARR). About 44% of executives report that they already are seeing or expect to see greater scrutiny from regulators. Video: Bain's Suzanne Kumar and Andrei Vorobyov discuss the complex trends of the past yearand how business leaders can compete in 2022. Unlike the comparatively simple deal market of 20 years ago, which predominately comprised corporate buyers and some financial investor activity, todays M&A landscape includes significant participation not only from corporate buyers but also greater value from add-on deals (in which investors buy and combine multiple platform assets to create scale), financial investors, special purpose acquisition companies (SPACs), and venture capital (VC)/corporate venture capital (CVC). These are for marketplaces that are growing fast and are category leaders. A total of 4,579 companies were included in the calculation for 2022, 4,326 for 2021, 4,023 for 2020 and 3,779 for 2019. For the most part, suburban markets continue to outperform the urban core. Leonard N. Stern School of Business. However, deal volume was most significant in the first half of the year and began to cool in the later half of the year, particularly in the fourth quarter. However, its full-year revenue outlook came in below Streets estimates. Below are some important updates to the public SaaS market, private SaaS market, and our own data and analysis around the SCI.