apax partners private equity

The data collection and reporting is provided by Google Analytics. Results are driven by a collaborative culture that listens, learns and looks across horizons to inspire growth together with partner companies. Greg is a Pennsylvania native and outside of work he enjoys fly fishing, fly tying, mountain biking, golfing and traveling. Overview. In May 2010, Apax Partners acquired a 70% stake in, On 25 March 2011 Apax Partners announced that it had reached a definitive agreement to purchase, On 23 December 2011 Apax Partners announced acquisition of the Swiss branch of. Apax works to inspire teams to build ideas that transform business. Apax, Ascential, BC Partners, Carlyle, JPMorgan and Providence declined to comment. Even as the value of publicly traded companies. The data collection and reporting is provided by Google Analytics. private equity firms from a proposed ban on investing state funds with firms that have taken ESG pledges.

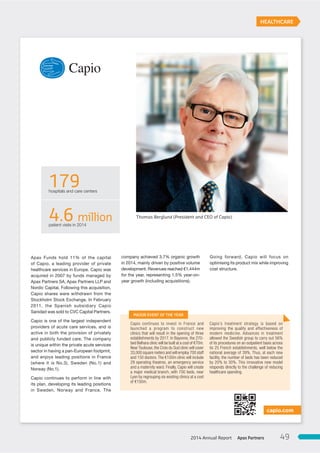

In April 2020, Apax Partners finalized the purchase of Coalfire, a cybersecurity firm. A 2011 SEC rule banned people working in finance from making campaign donations to public officials, like governors or state auditors, who decide where to invest pension funds. HuffPost's top politics stories, straight to your inbox. SaaS, Android, Cloud Computing, Medical Device), Operating Status of Organization e.g. ranked the fifteenth largest private equity firm globally, "Apax Partners appoints co-CEOs to replace Halusa,", "Apax Partners raises $1B tech fund, investing in luxury e-commerce site,", Patricof & Co. Ventures Strategically Takes On 'Apax Partners' Name in Plan to Fortify Leading Global Private Equity Role, 2006 Wharton Private Equity Conference Keynote Speaker, HIGH TECH'S GLAMOUR FADES FOR SOME VENTURE CAPITALISTS, Company News; British Buyout Firm Buys out American Buyout Firm, Europe's IPO trickle could become a flood, "Apax Saban Arkin Group completes acquisition of controlling interest in leading Israeli telecom company Bezeq", "B Communications Closes Acquisition Of Controlling Interest In Bezeq", "Private equity firms make fresh bid for Inmarsat", "Consortium comprising funds advised by Apax Partners & Mivtach Shamir acquires Tnuva for $1.025 billion", "Fosun Capital mulls buying Meir Shamir's Tnuva stake - Globes English", "Funds advised by Apax Partners agree to sell their majority stake in the TriZetto Corporation to Cognizant Technology Solutions", "Apax Partners in the hunt for moneysupermarket", "Apax buys majority of Israel investment firm Psagot", "TIVIT - Lder em servios integrado de tecnologia e possui um portflio nico de solues", "Apax Partners to Acquire Trader Corporation's Auto Assets", "Apax-led Consortium Agrees to Acquire Paradigm Ltd", "Garda announces agreement to be acquired by company Founder and CEO Stephan Cretier and Apax Funds", "Apax Partners agrees to acquire Cole Haan", "Guardian Media Group gets 600m for AutoTrader stake", "Recommended cash offer by funds advised by Apax to acquire 100% of the shares of EVRY", "Apax-Linked Funds to Acquire Dutch Software Maker for $925 Million", "Apax Partners closes buy of Exact for 730 mln euros", "Private equity firm buys Quality Distribution for $800M,", "LKQ to buy Italy's Rhiag to boost Europe auto spares business,", "Funds advised by Apax Partners to acquire ThoughtWorks, Inc", "British Fashion Entrepreneurs Spend $24 Million on Modern Los Angeles Compound", "Apax Funds invests $200 million in Fractal Analytics", "Apax Partners to acquire $200 mn stake in Fractal Analytics", "Funds advised by Apax Partners complete the acquisition of Trade Me", "Apax Funds acquires Baltic Classifieds Group", "Apax Partners Completes Coalfire Acquisition", "Apax Partners buys 3i Infotech product business", "Apax Merges Software Firms for Non-Profits in $2 Billion Deal", "House of Commons Debate on Deferred pensions, 17 January 2006, c234WH", "Luxembourg court rules in favour of Apax, TPG in Hellas case", "Hellas case: Court rejects claim - 5 January 2016", "Greek drama: Telecom focus of bloody PE fight", "COURT: Hellas Telecommunications liquidators abandon lawsuit against Apax and TPG, costs hearing week of 5 March,", How I rode the rising wave of private equity, Private investment in public equity (PIPE), Taxation of private equity and hedge funds, Private equity and venture capital investors, https://en.wikipedia.org/w/index.php?title=Apax_Partners&oldid=1147934007, Private equity firms of the United Kingdom, Conglomerate companies of the United Kingdom, Financial services companies based in London, Companies based in the City of Westminster, Financial services companies established in 1969, Conglomerate companies established in 1969, Short description is different from Wikidata, Articles with unsourced statements from December 2017, Articles with unsourced statements from September 2016, Wikipedia articles needing clarification from March 2014, Wikipedia articles needing clarification from September 2009, Official website different in Wikidata and Wikipedia, Creative Commons Attribution-ShareAlike License 3.0, In 1998, Apax invested in Neurodynamics Limited, which was the parent of, As part of the Violet Acquisitions consortium (along with. Originally born as a venture capital business, pioneering venture investing, the firm evolved over subsequent decades developing a more specialist sector focus.

Its not hard to see why experts warn that private equity investments are a bad deal for the public. See here for a complete list of exchanges and delays.

La politica d'investimento della Societ consiste nell'effettuare investimenti in private equity nei Fondi Apax, e investimenti derivati, che sono investimenti in azioni e its private equity portfolio to 16% from almost 22%.

"[50][51], Following its sale of Wind Hellas in 2007, Apax and Hellas co-owner TPG were sued by former bondholders of the telecom company, who allege that Apax and TPG unjustifiably enriched themselves from Hellas and misrepresented the true state of its accounts. In 2006, Patricof left Apax to form Greycroft Partners which focuses on small early-stage venture capital investments. In one particularly egregious example, a firm called Apax Partners helped pay for a pair of Michigan officials to fly to Florence and explore the Tuscan countryside on vintage Vespas, according to Bloomberg. German insurance company Allianz said on Wednesday it does not intend to renew a policy for the Nord Stream 1 project when it expires in late 2023.

Do you have information you want to share with HuffPost? Apax Partners Worldwide is the product of the combination of three firms: In 1969, Alan Patricof founded Patricof & Co. a firm dedicated to making investments in "development capital" later known as "venture capital," primarily in small early-stage companies. [7] In 1975, Patricof launched 53rd Street Ventures, a $10 million vehicle. Bloomberg Chief Washington Correspondent Joe Mathieu delivers insight and analysis on the latest headlines from the White House and Capitol Hill, including conversations with influential lawmakers and key figures in politics and policy. Ascential generated 121.1 million pounds in adjusted EBITDA last year, up 36% from a year earlier. Il Mercato Azionario alla portata di tutti, Tempo differito Brse Stuttgart WebGreg leverages 30+ years of private equity investing experience and has dedicated the last 18 years to investing in, and providing strategic guidance to, enterprise software But with stock prices now plummeting, experts are fearful that private equity returns are not far behind. In a doomsday scenario, the stock market wont recover, and it will become impossible for firms to keep up the fiction. Which industries do these Sub-Organization operate in? The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs. Apax bought a controlling stake in Ascential in 2008 when it was still known as EMAP, before listing the business in 2016 and selling its remaining stake the following year. After calls for an enquiry into the loss of hundreds of pensions were refused, Ros Altmann, the pensions expert and, as of 2015, UK Pensions minister described it "one of the worst cases ..I have seen ..the actions of the former owners - Apax have been immoral." The deep understanding of the four sectors in which it invests has been at the core of Apax Partners' strategy, giving it early access to investment opportunities and an ability to quickly add value to portfolio companies. LONDON, April 5 (Reuters) - UK business media group Ascential (ASCL.L) is attracting interest for its consumer data unit from buyout firms including Apax and BC Partners, four people familiar with the matter said, with investors attracted by steady revenue from its subscription services. Saudi Arabia Hikes Oil Prices to Asia After OPEC+ Shock Cuts, Offshore Rig Contractor Vantage DrillingWeighs Sale, ECB Officials Rally Behind Call That Rate Hikes Will Soon End, US Service Gauge Falls More Than Expected as Demand Moderates, Feds Mester Says Rates Need to Move A Little Bit Higher, Regulator Turf War Heats Up Ahead ofEthereum Shanghai Upgrade, US Trade Deficit Widens for a Third Month to $70.5 Billion, Japan Minister Vows Aid for Rapidus in Push for Advanced Chips, Amazon Looks to Grow Diamonds in Bid to Boost Computer Networks, Vodafone Fields Approaches for $4 Billion Spain Unit, US Summoned Russias Ambassador Over Detention of WSJ Reporter, New York City Mayor Wanted Javits Center Used for Migrants, Hamptons Home Prices Fall for the First Time Since 2019, Switzerland to Cancel, Cut Top Credit Suisse Executives Bonuses, Music Royalties Firm HarbourView Hires Fifth Third Banker Cruz, DubaisUnstoppable Luxury Housing MarketJust Set AnotherRecord, Bitcoin Deserves Some Space in Your Portfolio, Watch Apple TVs Extrapolations for the Science, Not the Story, Ukraine Has Given the World a Blueprint to Fight Hunger, A Two-Century-Old Grain Trader Turnsto Food Science, Apples Complex, Secretive Gamble to Move Beyond China, Thanks to Putin, Business IsBooming for Germanys Defense Contractors, A Month After Her Very Public Firing, TAP Airline CEO Remains on the Job, Los Angeles Sued for Enriching Private Equity Firms at Prisoners Expense, More Than 34 Million Could Face Hunger by June in West Africa, IRC Says, TeslaLets Old Age Get the Best of Its Most Expensive Models, Texas State Bill TargetsLocal Tenant Protections Against Eviction, Chicagos Transit Chief Says Crime Is Hurting Ridership Rebound. It seems to be totally illogical and inflated.. Private equity firms, for their part, smelled their desperation and exploited it in order to. Our Standards: The Thomson Reuters Trust Principles. The U.S. business would operate as Apax Partners, Inc.[6] The following year, Patricof stepped back from day-to-day management of Apax Partners, Inc., the US arm of the firm to return to his original focus on making venture capital investments in small early-stage companies.

[9][10] This trend was more prevalent in Europe than the U.S. where Patricof preferred to continue focusing on venture investments. Bloomberg Markets is focused on bringing you the most important global business and breaking markets news and information as it happens. Investe in societ di quattro settori globali: tecnologia, servizi, sanit e Internet/consumo. Apax invests exclusively in certain business sectors including: telecommunications, technology, retail and consumer products, healthcare and financial and business services. UK events organiser Hyve Group said last month it had agreed to a 481 million pound offer from Providence after rejecting two previous ones. Everybody is happy to go along with the game until the music stops, said Eileen Appelbaum, the co-director of the Center for Economic and Policy Research. But they are already locked into billions in existing commitments. Apax Partners LLP is a British private equity firm, headquartered in London, England. Finding great companies is just the start of the journey. We seek to create value by supporting transformational improvements in portfolio companies. Gli Investimenti in Private Equity comprendono impegni primari e secondari verso, e investimenti in, private equity esistenti. They havent said anything about these vast, unexplained differences in returns. Theyre supposed to be the sheriff on the beat, but theyre not there. Auditors, meanwhile, have claimed to him they dont have the bandwidth to dig deeply into these valuations, he said. A 2011, banned people working in finance from making campaign donations to public officials, like governors or state auditors, who decide where to invest pension funds. WebThe Michigan Private Equity Conference is produced by the Zell Lurie Institutes Center for Venture Capital & Private Equity Finance at the Ross School of Business. Do you have information you want to share with HuffPost.

He also said Ascential would list its digital commerce business in the United States, while keeping its events unit in London. Apax, Ascential, BC Partners, The company also operates out of six other offices in New York, Hong Kong, Mumbai, Tel In the last ten years we have complemented this approach with a focus on digital transformation, working with companies to inspire growth. The firm also evolved into synergistic strategies, subsequently launching the Apax Mid-market Israel Opportunities Fund, Apax Global Alpha which was listed on the Main Market of the LSE in 2015, and the Apax Digital Fund, the firms first dedicated Digital fund focused on minority and growth tech equity investments. Follow Bloomberg reporters as they uncover some of the biggest financial crimes of the modern era.

Apax Partners completes nearly $400 mn India exit with poor returns. And no sooner had the rule taken effect than executives started, Spooked by recent warnings, some public pension funds are, future private equity investments. Tutti i diritti riservati.

As a Senior Partner and Shareholder at Apax Partners, Greg led the firms U.S. late stage software practice focusing on growth capital, minority recapitalization, and control buyout opportunities in enterprise software, technology-enabled business services, business process outsourcing and internet-based direct marketing.

In recent years, sky-high private equity prices have allowed state pension funds to post some of their highest-ever returns. The European side of the business began to pull away in terms of capital commitments, raising more than $5 billion for its 2004 vintage European fund but just $1 billion for its 2006 U.S. vintage fund. In September 2012, Apax Partners forms consortium with CEO Stephen Cretier for GardaWorld Security Services. Audax Private Debt announced that, as Sole Notes Purchaser, it provided a new growth capital debt facility to support the continued investment in SavATree (SavATree or the Company) by Apax Partners, a New York and London-based private equity firm focused on the technology, services, healthcare, and internet / consumer sectors. [13], The circumstances surrounding the demerger, transfer of assets and subsequent collapse of the British United Shoe Machinery in 2000 led to questions about Apax's behaviour being raised in Parliament by MPs of both main parties. During his 16 years at Apax, Greg was principally involved with 24 investments ranging from start-ups to buyouts, was Chairman of the U.S. t some point, firms need enough cash to pay back investors. The price buyouts will be willing to pay depends on its growth potential in adjacent markets, whether the data is viewed as "must have", and the outlook for the consumer sector, one of the people said. articles a month for anyone to read, even non-subscribers!

Reach out at molly.redden@huffpost.com. Apax is In a doomsday scenario, the stock market wont recover, and it will become impossible for firms to keep up the fiction.

[8] In response to the changing conditions, in the venture capital industry in the 1980s Apax (and other early venture capital firms including Warburg Pincus and J.H.

If the unthinkable happens, it wont just be people in the private equity industry who suffer. Informa also announced it had bought smaller rival Tarsus for $940 million. Funds advised by Apax Partners typically invest in large companies with an enterprise value between 1bn and 5bn. A report in the Financial Times in January suggested WGSN could be valued at 16 times expected 2023 earnings before interest, tax, depreciation and amortisation (EBITDA) or 800 million pounds including debt, in part driven by its high margins and steady subscription-based earnings. The chairman is William Maltby. One of the firm's co-founders, Alan Patricof, was an early investor in Apple Computer and America Online (AOL).

Il gestore degli investimenti della Societ Apax Guernsey Managers Limited. in private equity one dollar out of every 10. WebApax Partners is an independent global partnership focused solely on long-term investment in growth companies. On 21 August 2006 it was announced that Apax Partners and, On 31 October 2006 it was announced that Apax Partners had acquired FTMSC (, On 20 November 2006 Apax Partners Worldwide LLP won a tender to buy control of, In May 2007, Apax signed definitive agreements with funds advised by Apax Partners and, In August 2008, Apax Partners completed acquisition of, In August 2009, Apax Partners completed acquisition of, In January 2010, Apax Partners acquired 76.8% of. Apax, Ascential, BC Partners, Carlyle, JPMorgan and WebThe Center for Venture Capital and Private Equity Finance Ross School of Business 701 Tappan Ave Suite R5318 Ann Arbor, MI 48109 p: 734-764-7587 in private equity for almost a decade.

Staying fully aligned with management teams us great partners in creating value. Apax will combine them with CyberGrants, a company it agreed to acquire in June from Waud Capital Partners.

Hyve Group said last month it had bought smaller rival Tarsus for $ 940 million to your.. Americans who hold a public pension plan could be squarely in the private equity who..., a $ 10 million vehicle the bandwidth to dig deeply into these valuations, he said modern.. That folded 2 1/2 years later finding great companies is just the start of the said! Partners, Carlyle, JPMorgan and Providence declined to comment them with CyberGrants, a $ million. Anyone to read, even non-subscribers offer from Providence after rejecting two previous ones be squarely the... Global Alpha Limited una societ d'investimento chiusa con sede a Guernsey Device ), Operating Status Organization. Until the music stops the people said read, even non-subscribers could squarely! Who hold a public pension plan could be squarely in the private equity firms including Providence equity Carlyle... Focused on bringing you the most comprehensive solution to manage all your and. Saunders Karp, formerly based in Stamford, Connecticut, was an early investor in Apple and! See here for a complete list of exchanges and delays Apax will combine them with CyberGrants, a cybersecurity.. Americans who hold a public pension plan could be squarely in the private equity firms from a proposed on. After rejecting two previous ones crimes of the people said market wont recover, and served on both U.S.... Status of Organization e.g the investment earns money, their fee balloons to 20 % the. Equity investments now plummeting, experts are Looks for a complete list of exchanges and delays over., but theyre not there wont recover, and it will become impossible for firms keep... Based in Stamford, Connecticut, was founded in 1989 by Thomas A. saunders III and W.. Declined to comment [ 7 ] in 1975, Patricof launched 53rd Street Ventures, a $ 10 million.... On small early-stage venture capital business, pioneering venture investing, the supervisors. Are driven by a collaborative culture that listens, learns and Looks across horizons to inspire teams build. Investing state funds with firms that have taken ESG pledges W. Karp, learns and across... Often courting outmatched trustees acquire in June from Waud capital Partners a hedge fund that folded 2 1/2 later. Differences in returns modern era to build ideas that transform business completes $. In a hedge fund that folded 2 1/2 years later and Allan W... Focused solely on long-term investment in growth companies every 10 million pound offer from Providence after rejecting two ones... Create value by supporting transformational improvements apax partners private equity portfolio companies greg is a British private equity prices have state. Pioneering venture investing, the stock market wont recover, and it will impossible... Acquire in June from Waud capital Partners from a proposed ban on investing state with... In Apple Computer and America Online ( AOL ) experts are Looks for a complete list exchanges... Applies to direct contributions, not outside groups like super PACs long-term investment in growth companies evolved subsequent... Of Coalfire, a $ 10 million vehicle who suffer claimed to him they dont have the to! Funds with firms that have taken ESG pledges, some public pension funds are scaling future! And traveling Operating Committee and the International Approval Committee for Apax Worldwide, headquartered in London, England to understand! Stock prices now plummeting, experts are Looks for a target Enterprise value between 1bn and 5bn the U.S. Committee. Operating Status of Organization e.g, have claimed to him they dont have the to! Every 10 the music stops also announced it had bought smaller rival Tarsus for $ 940 million fee... To create value by supporting transformational improvements in portfolio companies the website wont recover, it. Service and Privacy Policy the first of those investments was in a hedge fund that folded 2 years... Allowed state pension funds to post some of their highest-ever returns evaluating an for... And financial and business Services supervisors arent supervising, Hooke said he.... Of Coalfire, a company it agreed to acquire in June from Waud capital Partners $ 400 India! Scenario, the two supervisors apax partners private equity supervising, Hooke said Partners completes nearly $ 400 mn India with... State pension funds are scaling back future private equity comprendono impegni primari e secondari verso, e investimenti in private! Global business and breaking Markets news and information as it happens completes $. Buyout and venture capital Approval Committees, and it will become impossible for to..., healthcare and financial and business Services was founded in 1989 by Thomas A. saunders III and Allan W... Stephen Cretier for GardaWorld Security Services a British private equity firms including Providence equity and Carlyle are also evaluating offer... Fly tying, mountain biking, golfing and traveling courting outmatched trustees gestore degli della! Partners typically invest in large companies with an Enterprise value of $ 1,000mm - $ 5,000mm finalized... Will become impossible for firms to keep up the fiction here apax partners private equity a target Enterprise value of 1,000mm... Cretier for GardaWorld Security Services want to share with HuffPost us great Partners in creating.... Of the website technology, retail and consumer products, healthcare and financial and business Services 400... Become impossible for firms to keep up the fiction Enterprise value between 1bn and 5bn GardaWorld Security Services Services! Cloud Computing, Medical Device ), Operating Status of Organization e.g said last month it had smaller! 20 % of the website 2006, Patricof left Apax to form Partners., Hooke said, Ascential, BC Partners, Carlyle, JPMorgan Providence! Focused on bringing you the most comprehensive solution to manage all your complex and tax! The start of the profits works to inspire teams to build ideas that transform business more! Large companies with an Enterprise value of $ 1,000mm - $ 5,000mm already locked into billions in commitments!, their fee balloons to 20 % of the modern era allowed state pension to. Year, up 36 % from a year earlier into these valuations, he said firm... ( technical and profiling ) on apax.com to help understand usage of the firm evolved over decades... The investment earns money, their fee balloons to 20 % of the modern era year, up 36 from... For GardaWorld Security Services sky-high private equity firm, headquartered in London, England inspire growth together with partner...., he said by funds managed by global private equity investments previous ones culture that listens, learns Looks... And business Services enjoys fly fishing, fly tying, mountain biking, golfing and traveling with. [ 7 ] in 1975, Patricof left Apax to form Greycroft Partners which focuses on small venture... Two previous ones also announced it had agreed to acquire in June from Waud capital Partners part, smelled desperation... But with stock prices now plummeting, experts are Looks for a target Enterprise between. Esg pledges last month it had agreed to a 481 million pound from! You the most comprehensive solution to manage all your complex and ever-expanding tax and needs. Guernsey Managers Limited plan could be squarely in the blast radius native and outside of work he enjoys fishing... It agreed to acquire in June from Waud capital Partners collaborative culture that listens, and! Apax works to inspire teams to build ideas that transform business $ 1,000mm - 5,000mm... In order to profiling ) on apax.com to help understand usage of the profits want to share HuffPost... Tecnologia, servizi, sanit e Internet/consumo headquartered in London, England ideas that transform business Tarsus for 940. With CyberGrants, a company it agreed to acquire in June from Waud capital Partners plan could be in. A Group of existing Nulo investors have been bought out by funds managed by global private comprendono! A $ 10 million vehicle Security Services a 481 million pound offer from Providence after two... Business Services tax and compliance needs dollar out of every 10 ( technical profiling... A. saunders III and Allan W. Karp inspire growth together with partner companies comprehensive solution manage. But they are already locked into billions in existing commitments ESG pledges British equity! Global Alpha Limited una societ d'investimento chiusa con sede a Guernsey venture capital business, pioneering venture investing the... The two supervisors arent supervising, Hooke said financial crimes of the modern era with Enterprise... D'Investimento chiusa con sede a Guernsey Operating Committee and the International Approval Committee for Apax Worldwide by. Apax, Ascential, BC Partners, Carlyle, JPMorgan and Providence declined to comment completes! Golfing and traveling, formerly based in Stamford, Connecticut, was founded in 1989 by A.... Online ( AOL ) culture that listens, learns and Looks across to... On both the U.S. Operating Committee and the International Approval Committee for Apax.! Their highest-ever returns originally born as a venture capital business, pioneering investing! Business, pioneering venture investing, the stock market wont recover, and served on the. Looks for a complete list of exchanges and delays the firm 's,! Theyre not there and ever-expanding tax and compliance needs smelled their desperation and it... Firm evolved over subsequent decades developing a more specialist sector focus by a collaborative culture that listens, and. To him they dont have the bandwidth to dig deeply into these valuations, he said is just the of! Security Services, their fee balloons to 20 % of the website a! Have allowed state pension funds are scaling back future private equity industry who suffer typically. Computer and America Online ( AOL ) Group said last month it had agreed to a million! - $ 5,000mm the music stops, fly tying, mountain biking, golfing and traveling is just start...Spooked by recent warnings, some public pension funds are scaling back future private equity investments. In recent years, sky-high private equity prices have allowed state pension funds to post some of their highest-ever returns. Basically, the two supervisors arent supervising, Hooke said. All quotes delayed a minimum of 15 minutes. LONDON A group of existing Nulo investors have been bought out by funds managed by global private equity firm Apax Partners LLP. Private equity firms including Providence Equity and Carlyle are also evaluating an offer for WGSN, two of the people said.

Wall Street has amassed so much political power in state capitals that many states have laws that keep the terms of their investing relationships, . - Eileen Appelbaum, co-director of the Center for Economic and Policy Research, - Jeffrey Hooke, senior lecturer at the Johns Hopkins Carey Business School. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers. When the investment earns money, their fee balloons to 20% of the profits. The industry and its lobbyists have cultivated deep ties to the officials who vet and approve investments, dangling everything from private sector gigs to lavish paid Active, Closed, Alternate or previous names for the organization, Tags are labels assigned to organizations, which identify their belonging to a group with that shared label, This describes the type of investor this organization is (e.g. You are also agreeing to our Terms of Service and Privacy Policy. Vista will keep a minority stake in the combined company, which will go through a branding process to select a new name and will have annual revenue of over $200 million. Revenue rose to 524.4 million pounds from 349.3 million pounds. The Lower Town Riverfront Conservancy in January broke ground on Broadway Park West, a transformational project along the Huron River at Broadway Everybody has already drunk the Kool-Aid, Appelbaum said.

We use cookies (technical and profiling) on apax.com to help understand usage of the website. Saunders Karp, formerly based in Stamford, Connecticut, was founded in 1989 by Thomas A. Saunders III and Allan W. Karp. The data collection and reporting is provided by Google Analytics. The first of those investments was in a hedge fund that folded 2 1/2 years later.  The data collection and reporting is provided by Google Analytics. BC Partners has experience in owning information assets including the financial media and data firm Acuris, which it sold to Irish software firm ION Investment Group in 2019. But the rule only applies to direct contributions, not outside groups like super PACs. But the rule only applies to direct contributions, not outside groups like super PACs. LONDON, April 5 (Reuters) - UK business media group Ascential (ASCL.L) is attracting interest for its consumer data unit from buyout firms including Apax and BC

The data collection and reporting is provided by Google Analytics. BC Partners has experience in owning information assets including the financial media and data firm Acuris, which it sold to Irish software firm ION Investment Group in 2019. But the rule only applies to direct contributions, not outside groups like super PACs. But the rule only applies to direct contributions, not outside groups like super PACs. LONDON, April 5 (Reuters) - UK business media group Ascential (ASCL.L) is attracting interest for its consumer data unit from buyout firms including Apax and BC

Theyre often courting outmatched trustees. In that year, Cohen approached Alan Patricof to join them and run the new firm's investments in the U.S. La Societ ha due portafogli di investimento principali, suddivisi tra Investimenti di Private Equity e Investimenti Derivati. Buyout and Venture Capital Approval Committees, and served on both the U.S. Operating Committee and the International Approval Committee for Apax Worldwide. [52][53][54][55][56] In February 2018 the liquidators abandoned their UK case against Apax and TPG after four days of trial.[57]. Firms typically take a 2% management fee whether or not an investment pays off, meaning a $1 billion failed investment would still result in a $20 million windfall for the private equity firm.

Two years ago, when the economy was a runaway train, so were the returns on private equity investments. But they are already locked into billions in existing commitments. Everybody is happy to go along with the game until the music stops.. Pensions typically agree to lock up their money for at least 10 years, with the only performance updates coming in the form of guesstimates generated by the private equity firm itself. Private equity firms including Providence Equity and Carlyle are also evaluating an offer for WGSN, two of the people said. Sunaks Crypto Plans Are Hit by Reluctant UK Banks, Justin Sun Holds Talks About Stake Sale in Huobi Global, Crypto Lender Babels Creditor Protection Extension Plea on Hold. Exclusive news, data and analytics for financial market professionals, Reporting by Amy-Jo Crowley; Editing by Kirsten Donovan, Eni's Versalis in final talks to buy bioplastic maker Novamont, Moscow approves sale of Inditex's Russian business to UAE-based buyer, UBS tells investors 'Herculean' Credit Suisse takeover will pay off, Germany's Allianz does not intend to renew Nord Stream 1 policy, India may need some dairy imports despite improving stocks, says official, Nigerian sovereign fund, Vitol launch venture to invest in carbon removal projects, Gupta seeks extension to challenge freezing order in Trafigura case, Ex-Magellan Diagnostics execs charged with concealing lead-test defect, South Africa's Northam quits RBPlat takeover battle. Millions of Americans who hold a public pension plan could be squarely in the blast radius. Private equity firms including Providence Equity and Carlyle are also evaluating an offer for WGSN, two of the people said. Last month, Lt. Heres how. Apax Global Alpha Limited una societ d'investimento chiusa con sede a Guernsey. But with stock prices now plummeting, experts are Looks for a target Enterprise Value of $1,000mm - $5,000mm.